Sometimes you know that a company earnings will be good. You buy the stock and you wait for the earnings announcement. Stock goes up until the good news are out. And then it sells off and you are frustrated. Sometimes you see the market crashing in the morning, the media says “home builders are in trouble”. You should the builders. Then in the afternoon market rallies and the news headline reads “FED optimism rallies stocks, traders shrugged home builder news”. Why does this keep happening in our day to day trading?

How News Are Interpreted by the Markets:

Same Day. Same Event. Same Market. Different Story!

“There is no group more subjective than conventional analysts.” — Robert Prechter.

Elliott wavers sometimes hear the criticism that patterns in market charts can be “open to interpretation.” For example, what looks like a finished 1-2-3 correction to one analyst, another analyst may interpret as 1-2-3 of a developing impulse, with waves 4 and 5 on the way.

Does this happen? Absolutely. (Although, there are always tools an Elliottician can employ to firm up the wave count.) But here’s the real question: What’s the alternative?

Typical alternatives amount to analysis of the “fundamentals”: Jobs, interest rates, CPI, PPI, what Ben Bernanke said on Tuesday — it all goes into the pot. Result? Well, if you think it’s clear and unambiguous, guess again. Here’s a fresh example.

Find out what really moves markets — download the free 118-page Independent Investor eBook. The Independent Investor eBook shows you exactly what moves markets and what doesn’t. You might be surprised to discover it’s not the Fed or “surprise” news events. Learn more, and download your free ebook here.

On the evening of February 18, in a surprise move, the Federal Reserve raised its discount rate — the interest rate at which it lends money to banks. The next morning the S&P futures were pointing lower; everyone was bracing for a weak day — because, as conventional thinking goes, higher interest rates are bad for business, the economy, and ultimately for the stock market. Friday morning, stocks indeed opened lower and major news headlines confirmed:

- Wall St opens weaker after Fed move

- … Investors Wary After Fed Move

- Stocks Open Lower After Surprise Fed Move

But around 11am that same morning, the DJIA turned around and moved higher. Now look at what the headlines from major sources were saying after lunch on February 19:

- US stocks bounce back; Fed move viewed in positive light

- US Stocks Up A Bit On Fed Discount Rate Increase

- Stocks Higher After Fed Move

What was a “bearish move” by the Fed in the morning morphed into a “bullish” one by the afternoon! Same event. Same market. Same day. Completely opposite interpretation!

This brings to mind the answer EWI’s President Robert Prechter once gave when asked about the objectivity of Elliott wave analysis. Bob said:

“I always ask, ‘compared to what?’ There is no group more subjective than conventional analysts who look at the same ‘fundamental’ news event — a war, the level of interest rates, the P/E ratio, GDP reports, you name it — and come up with countless opposing conclusions. They generally don’t even bother to study the data. Show me a forecasting method that is totally objective or contains no human interpretation. There is no such thing, even in a black box. To answer your question more specifically, though, properly there should be no subjectivity in interpreting Elliott waves patterns. There is a set of rules and guidelines for that interpretation. Interpretation gives you only the most probable scenario(s), not a sure one. But people mislabel probabilistic forecasting as subjectivity. And subjectivity or bias can ruin that value, just as in any other approach. Sometimes we screw up. But in contrast to the outrageously improbable (if not downright false) wave interpretations or other types of forecasts we often see from others, we are as close to an objective service as you’re going to find. We hire analysts who know the rules of Elliott cold.”

Find out what really moves markets — download the free 118-page Independent Investor eBook. The Independent Investor eBook shows you exactly what moves markets and what doesn’t. You might be surprised to discover it’s not the Fed or “surprise” news events. Learn more, and download your free ebook here.

Vadim Pokhlebkin joined Robert Prechter’s Elliott Wave International in 1998. A Moscow, Russia, native, Vadim has a Bachelor’s in Business from Bryan College, where he got his first introduction to the ideas of free market and investors’ irrational collective behavior. Vadim’s articles focus on the application of the Wave Principle in real-time market trading, as well as on dispersing investment myths through understanding of what really drives people’s collective investment decisions.

Earnings: Is That REALLY What’s Driving The DJIA Higher?

The idea of earnings driving the broad stock market is a myth.

It’s corporate earnings season again, and everywhere you turn, analysts talk about the influence of earnings on the broad stock market:

- · US Stocks Surge On Data, 3Q Earnings From JPMorgan, Intel (Wall Street Journal)

- · Stocks Open Down on J&J Earnings (Washington Post)

- · European Stocks Surge; US Earnings Lift Mood (Wall Street Journal)

With so much emphasis on earnings, this may come as a shock: The idea of earnings driving the broad stock market is a myth.

When making a statement like that, you’d better have proof. Robert Prechter, EWI’s founder and CEO, presented some of it in his 1999 Wave Principle of Human Social Behavior (excerpt; italics added):

- Are stocks driven by corporate earnings? In June 1991, The Wall Street Journal reported on a study by Goldman Sachs’s Barrie Wigmore, who found that “only 35% of stock price growth [in the 1980s] can be attributed to earnings and interest rates.” Wigmore concludes that all the rest is due simply to changing social attitudes toward holding stocks. Says the Journal, “[This] may have just blown a hole through this most cherished of Wall Street convictions.”

- What about simply the trend of earnings vs. the stock market? Well, since 1932, corporate profits have been down in 19 years. The Dow rose in 14 of those years. In 1973-74, the Dow fell 46% while earnings rose 47%. 12-month earnings peaked at the bear market low. Earnings do not drive stocks.

And in 2004, EWI’s monthly Elliott Wave Financial Forecast added this chart and comment:

|

Earnings don’t drive stock prices. We’ve said it a thousand times and showed the history that proves the point time and again. But that’s not to say earnings don’t matter. When earnings give investors a rising sense of confidence, they can be a powerful backdrop for a downturn in stock prices. This was certainly true in 2000, as the chart shows. Peak earnings coincided with the stock market’s all-time high and stayed strong right through the third quarter before finally succumbing to the bear market in stock prices. Investors who bought stocks based on strong earnings (and the trend of higher earnings) got killed.

So if earnings don’t drive the stock market’s broad trend, what does? The Elliott Wave Principle says that what shapes stock market trends is how investors collectively feel about the future. Investors’ mood — or social mood — changes before “the fundamentals” reflect that change, which is why trying to predict the markets by following the earnings reports and other “fundamentals” will often leave you puzzled. The chart above makes that clear.

Get Your FREE 8-Lesson “Conquer the Crash Collection” Now! You’ll get valuable lessons on what to do with your pension plan, what to do if you run a business, how to handle calling in loans and paying off debt and so much more. Learn more and get your free 8 lessons here.

Robert Prechter, Chartered Market Technician, is the world’s foremost expert on and proponent of the deflationary scenario. Prechter is the founder and CEO of Elliott Wave International, author of Wall Street best-sellers Conquer the Crash and Elliott Wave Principle and editor of The Elliott Wave Theoristmonthly market letter since 1979.

Earnings Do Not Drive Stock Prices – See The Proof in This Chart

A free Club EWI report exposes the TEN most misleading myths of Wall Street, including this one: “Earnings drive the stock market.”

Since the time of buttonwood trees, Wall Street has had its own version of the Ten Commandments – the cornerstone principles of conventional economic wisdom. The first of these writ-in-stone notions is the widespread belief that earnings drive the stock market.

By this line of reasoning, knowing where a market’s prices will trend next is simply a matter of knowing how the companies that comprise said market are expected to perform. On this, the recent news items below capture the public’s devoted following of earnings data:

- “Stocks Rebound As Investors Await Earnings.” (Associated Press)

- “US Stocks Drop As Earnings Data Fall Short” (MarketWatch)

- “Sideways Market Looks For Direction: Earnings Could Point The Way” (MarketWatch)

In reality, though, much of this belief is based on faith, not facts. While earnings may play a role in the price of an individual stock, the stock market as a whole marches to a different drummer.

You get this ground-breaking revelation in the FREE report from Club Elliott Wave International (Club EWI, for short) titled “Market Myths Exposed”. In Chapter One, our editors shatter the smoke-screen surrounding the widespread notion that “Earnings Drive Stock Prices” with these enlightening insights:

“Quarterly earnings reports announce a company’s achievements from the previous quarter. Trying to predict futures prices movements based on what happened three months ago is akin to driving down the highway looking only in the rearview mirror. It leaves investors eating the markets dust when the trend changes.”

And — There is no consistent correlation between upbeat earnings and an uptrend in stock prices; or vice a versa, downbeat earnings and a decline in stocks. Case in point: During the 1973-4 bear market, the S&P 500 plummeted 50% while S&P earnings rose every quarter over that period. Here, “Market Myths Exposed” provides the following, visual reinforcement: A chart of the S&P 500 versus S&P 500 Quarterly Earnings since 1998.

|

As you can see, the market enjoyed record quarterly earnings right alongside the historic, bear market turn in stocks in 2000. Then again, the first negative quarter ever in 2009 preceded the March 2009 bottom in stocks.

“Market Myths Exposed” dispels the top TEN fallacies of mainstream economic thought. The misconception that “Earnings Drive the Stock Market” is number one. The remaining nine are equally capable of knocking your socks off and most importantly, helping you protect your financial future.

Get the free 33-page Market Myths Exposed eBook now Learn why you should think independently rather than relying on misleading investment commentary and advice that passes as common wisdom. Just like the myth that government intervention can stop a stock market crash, Market Myths Exposed uncovers other important myths about diversifying your portfolio, the safety of your bank deposits, earnings reports, inflation and deflation, and more! Protect your financial future and change the way you view your investments forever!

EUR/USD: What Moves You?

It’s not the news that creates forex market trends –

it’s how traders interpret the news.

Today, the EUR/USD stands well below its November peak of $1.51. Find out what Elliott wave patterns are suggesting for the trend ahead now — FREE. You can access EWI’s intraday and end-of-day Forex forecasts right now through next Wednesday, February 10. This unique free opportunity only lasts a short time, so don’t delay! Learn more about EWIs FreeWeek here.

What moves currency markets? “The news” is how most forex traders would undoubtedly answer. Economic, political, you name it — events around the world are almost universally believed to shape trends in currencies.

A January 14 news story, for example, was high up on the roster of events that supposedly have a major impact on the euro-dollar exchange rate. That morning, the European Central Bank announced it was leaving the “interest rate unchanged at the record low of 1% for an eighth successive month.” (FT.com)

The euro fell against the U.S. dollar after the news. But could it have rallied instead? You bet. In fact, traditional forex analysis says it should have. Here’s why.

Analysts always say that the higher a country’s interest rates, the more attractive its assets are to foreign investors — and, in turn, the stronger its currency. Well, U.S. interest rates are now at 0-.25% and in Europe, at 1%, they are 3 to 4 times higher. Isn’t that wildly bullish for the EUR? Apparently not, and wait till you hear why — because in today’s announcement ECB president Jean-Claude Trichet warned that European recovery would be “bumpy.” Ha!

By no means is this the first time a supposedly bullish event failed to lift the market. On June 6, 2007, for example, the ECB raised interest rates. Bullish, right? But the euro didn’t gain that day, either — the U.S. dollar did.

Watch forex markets with these “inconsistencies” in mind and you’ll see them often. In time you realize that it’s not news that creates market trends — it’s how traders interpret the news. That’s a subtle — but hugely important — distinction.

So the real question becomes: What determines how traders interpret the news? The Elliott Wave Principle answers that question head-on: social mood — i.e., how they collectively feel. Currency traders in a bullish mood disregard bad news and buy, leaving it to analysts to “explain” why. Bearishly-biased traders find “reasons” to sell even after the rosiest of economic reports.

If you know traders’ bias, you know the trend. How do you know? Watch Elliott wave patterns in forex charts – it’s reflected in there, on all time frames.

Today, the EUR/USD stands well below its November peak of $1.51. Find out what Elliott wave patterns are suggesting for the trend ahead now — FREE. You can access EWI’s intraday and end-of-day Forex forecasts right now through next Wednesday, February 10. This unique free opportunity only lasts a short time, so don’t delay! Learn more about EWIs FreeWeek here.

Vadim Pokhlebkin joined Robert Prechter’s Elliott Wave International in 1998. A Moscow, Russia, native, Vadim has a Bachelor’s in Business from Bryan College, where he got his first introduction to the ideas of free market and investors’ irrational collective behavior. Vadim’s articles focus on the application of the Wave Principle in real-time market trading, as well as on dispersing investment myths through understanding of what really drives people’s collective investment decisions.

EUR/USD: Often, Basic Elliott Wave Analysis Is All You Need

Watch this classic video from Elliott Wave International’s Chief Currency Strategist, Jim Martens, to see how useful the basics of Elliott wave analysis can be. Jim explains how the same basic pattern that R.N. Elliott discovered back in the 1930s is often all you need to make informed market forecasts.

Then access Jim Marten’s intraday and end-of-day Forex forecasts, completely free from Elliott Wave International. The independent market forecasting firm is offering free access (a $199 value) through February 10. Get your free Forex forecasts now.

|

Bin Laden is dead, but stock market is down. Why?

Interest rates, oil prices, trade balances, corporate earnings and GDP: None of them seem to be important, or even relevant, to explaining stock price changes

May 3, 2011

By Elliott Wave International

On the morning of May 2, the financial headlines were abuzz with the news of Osama Bin Laden’s death and its positive impact on the stock market:

“Stock Market Celebrates Killing of Bin Laden” (The Wall Street Journal)

But despite a positive open, stocks closed lower on May 2. Undoubtedly, in the days ahead we’ll hear analysts explaining how Bin Laden’s death is not that “bullish” of an event, after all.

On that same note, MarketWatch.com ran an interesting story on May 2 that quoted from a research paper which found “little evidence that non-economics events have a big effect on the stock market.”

Here at EWI, we go one step further and say the following: Economic events have little impact on the stock market, too.

Don’t believe us? Read this excerpt from a free Club EWI resource, the 50-page 2011 Independent Investor eBook, and judge for yourself.

The Independent Investor eBook, 2011 Edition

(Excerpt; full report here)

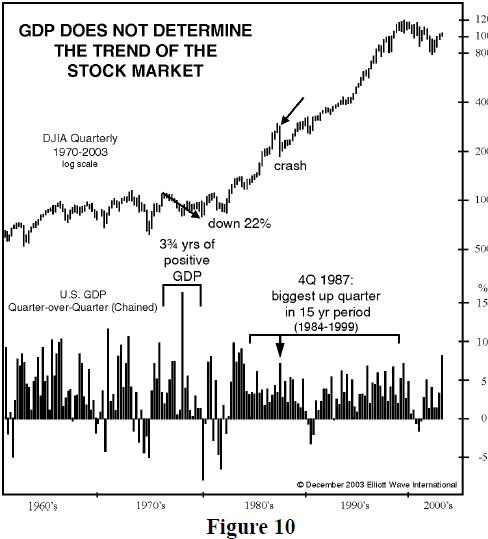

…Economists’ Claim #5: “GDP drives stock prices.”

Suppose that you had perfect foreknowledge that over the next 3¾ years GDP would be positive every single quarter and that one of those quarters would surprise economists in being the strongest quarterly rise in a half-century span. Would you buy stocks?

If you had acted on such knowledge in March 1976, you would have owned stocks for four years in which the DJIA fell 22%. If at the end of Q1 1980 you figured out that the quarter would be negative and would be followed by yet another negative quarter, you would have sold out at the bottom.

Suppose you were to possess perfect knowledge that next quarter’s GDP will be the strongest rising quarter for a span of 15 years, guaranteed. Would you buy stocks?

Had you anticipated precisely this event for 4Q 1987, you would have owned stocks for the biggest stock market crash since 1929. GDP was positive every quarter for 20 straight quarters before the crash and for 10 quarters thereafter. But the market crashed anyway. Three years after the start of 4Q 1987, stock prices were still below their level of that time despite 30 uninterrupted quarters of rising GDP.

These two events are shown in the figure below:

|

It seems that there is something wrong with the idea that investors rationally value stocks according to growth or contraction in GDP. …

Claim #6: “Wars are bullish/bearish for stock prices.” … (continued)

Keep reading the 50-page Independent Investor eBook now, free — all you need is a free Club EWI password. Get yours now to gain independent perspective to the financial markets.