Why risk in the rebalanced portfolio is getting bigger

Surprisingly, after the great stock market run of 1980s and 1990s, a decade of ups and downs in stocks left bonds ahead. Yes, bonds have outperformed stocks for the last 30 years. But how long can the bond miracle last? Bonds are deemed to be stable investments that are not as volatile as stocks. Most people think bonds are boring. But if we look at a bond chart for the last few decades, a bond bubble seems to have completed 5 waves according to Elliott Wave Theory.

During market pullbacks, financial advisors use a boilerplate response: “Let’s rebalance the portfolio.” Investors have heard that one for years. You are supposed to diversify and you will be safe. If stocks go down, bonds will be up, right? Or if bonds go down, you will make it up in stocks. So they say. What if it is not true? Did that equation work out during 2008-2009 crash? For some bonds maybe, but junk bonds were at least devastated.

The recommended allocation varies depending on a client’s age and risk tolerance, but it typically involves shifting funds from stocks to bond holdings.

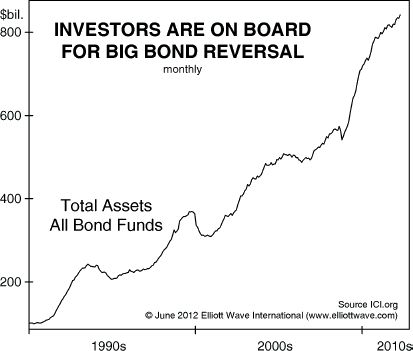

The evidence shows that many investors did just that in response to the 2007-2009 financial crisis – at the fastest rate in decades. Bond fund assets have risen eight-foldover the past 22 years.

Investors now hold more than $800 billion in bond funds. Just take a look at this chart from a June 6, Elliott Wave Theorist Special Report.

|

Investors who increased their bond allocation probably feel financially safer.

After all, bond funds have been more stable than stock funds, and they provided higher returns than money market funds.

Yet extrapolating the past into the future is often a major mistake. Very often we end up losing when we feel safe and secure in our illusions.

- During the coming collapse in the value of debt, investors’ interest in diversified funds of all stripes-debt, equity and commodity-will fall precipitously. The drop will come as a shock, especially to those who “rebalanced” from stocks and commodities to bonds after the markets panicked in 2008.

The Elliott Wave Theorist, Special Report, June 2012

What should safety-conscious investors do?

The Theorist Special Report offers a clear answer, one that’s just as relevant now as when it was published in June.

You will also learn about a striking parallel between the bond market of 1929-1932 and today and what to expect next.