The Great Depression was a worldwide economic downturn starting in most places in 1929 and ending at different times in the 1930s or early 1940s for different countries. It was the largest and most severe economic depression in the 20th century, and is used in the 21st century as an example of how far the world’s economy can decline. The Great Depression originated in the United States; historians most often use a starting date of when the stock market crashed of October 29, 1929, known as Black Tuesday.

The depression had devastating effects in virtually every country, rich and poor. International trade plunged by half to two-thirds, as did personal income, tax revenue, prices and profits. Cities all around the world were hit hard, especially those dependent on heavy industry. Construction was virtually halted in many countries. Farming and rural areas suffered as crop prices fell by approximately 60 percent. Facing plummeting demand with few alternate sources of jobs, areas dependent on primary sector industries such as farming, mining and logging suffered the most. However, even shortly after the Wall Street Crash of 1929, optimism persisted; John D. Rockefeller said that “These are days when many are discouraged. In the 93 years of my life, depressions have come and gone. Prosperity has always returned and will again.”

The Great Depression ended at different times in different countries; for subsequent history see Home front during World War II. America’s Great Depression ended in 1941 with America’s entry into World War II. The majority of countries set up relief programs, and most underwent some sort of political upheaval, pushing them to the left or right. In some states, the desperate citizens turned toward nationalist demagogues—the most infamous being Adolf Hitler—setting the stage for World War II in 1939.

The Great Depression was triggered by a sudden, total collapse in the stock market. The stock market turned upward in early 1930, returning to early 1929 levels by April, though still almost 30 percent below the peak of September 1929. Together, government and business actually spent more in the first half of 1930 than in the corresponding period of the previous year. But consumers, many of whom had suffered severe losses in the stock market the previous year, cut back their expenditures by ten percent, and a severe drought ravaged the agricultural heartland of the USA beginning in the summer of 1930.

In early 1930, credit was ample and available at low rates, but people were reluctant to add new debt by borrowing. By May 1930, auto sales had declined to below the levels of 1928. Prices in general began to decline, but wages held steady in 1930, then began to drop in 1931. [Read about what to before, during and after a deflationary crash] Conditions were worse in farming areas, where commodity prices plunged, and in mining and logging areas, where unemployment was high and there were few other jobs. The decline in the US economy was the factor that pulled down most other countries at first, then internal weaknesses or strengths in each country made conditions worse or better. Frantic attempts to shore up the economies of individual nations through protectionist policies, such as the 1930 U.S. Smoot-Hawley Tariff Act and retaliatory tariffs in other countries, exacerbated the collapse in global trade. By late in 1930, a steady decline set in which reached bottom by March 1933.

Great Depression on YouTube

Part 1:

Part 2:

Stock Market Crash Chart of Great Depression

Collective investor psychology: an insight from the long forgotten Mr. Gates

July 16, 2012

Can an investor ever know enough about financial markets to make a truly informed decision?

Around the turn of the last century, Elmer Gates also observed how people take cues from others. He once ran the largest private non-commercial laboratory in the United States and obtained more invention patents than Thomas Edison. Remarkably, he worked on his inventions only during his spare time. His regular working hours were devoted to the study of the mind. Gates noted:

A companion, helper, associate, co-worker, influences one’s mental functioning by every gesture, tone, look, suggestion, opinion, approval or disapproval, argument, and mood. Minds interact consciously and subconsciously especially during quiescence, dirigation, introspection, and awareness; by their congeniality, presence and other ways.

Elmer Gates and the Art of Mind-Using (p. 246)

Even professionals must cope with imperfect knowledge, and the constant uncertainty that comes with it. That’s why every investor looks to others for signals about what to do.

- Have you ever watched a dog interact with its owner? The dog repeatedly looks at the owner, taking cues constantly. The owner is the leader, and the dog is a pack animal alert for every cue of what the owner wants it to do.

- Participants in the stock market are doing something similar. They constantly watch their fellows, alert for every clue of what they will do next. The difference is that there is no leader. The crowd is the perceived leader, but it comprises nothing but followers. When there is no leader to set the course, the herd cues only off itself, making the mood of the herd the only factor directing its actions.

The Elliott Wave Theorist, May 2009

Investors take their cues from others then rationally justify their buy or sell decisions

Most market observers believe that investors respond logically to the latest news and buy or sell based on objective valuations.

Nothing could be further from the truth.

If investor behavior was rational, price charts would be linear and without sharp rises or declines. But that is not the case. The market’s price charts do show sharp price rises and steep declines, often when the market’s fundamentals offer no explanation to justify such a move. In a word, those near-vertical price moves are irrational. They’re not driven by logic, but by hope or fear.

- People have no idea where prices are going, so to satisfy the reasoning portions of their brains, they make up reasons to justify their buying and selling actions….Investors are not reasoning but unconsciously herding, and unconscious processes aren’t random; they proceed according to mental constructs. That’s why financial markets display patterns such as persistent trends, head and shoulders formations, trend channels, Elliott waves, and so on. [emphasis added]

The Elliott Wave Theorist, January 2008

These price patterns occur at all degrees of trend. That means collective investor psychology is evident in 5-minute, hourly, daily, weekly, monthly, quarterly and yearly charts.

Investor hope is even on display during major market downtrends

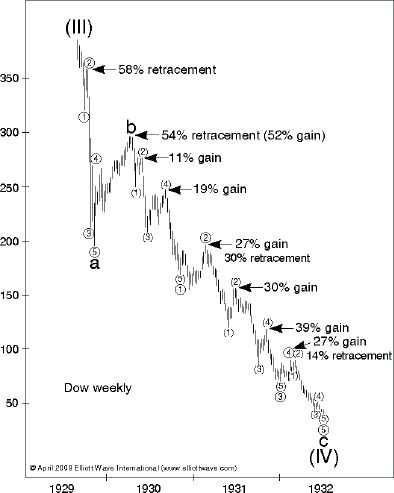

Notice how the Dow Industrials rebounded after the 1929 crash but before the worst part of the price decline of 1930-32 (see wave b in the chart below).

|

In the chart, you’ll notice that bursts of “hope” even occurred several times during the worst part of the decline itself. Memories of the Roaring ‘Twenties bull market still lingered.

More recently, investor hope lasted over three years after U.S. markets bottomed in March 2009.

Today’s market is a full degree of trend larger than even 1929-1932

After the market declined in May and the start of June, yet another burst of hope started on June 4. But brace yourself.

Get ready for a psychological change that will be reflected in the price patterns of U.S. markets

Causes of Great Depression

There were multiple causes for the first downturn in 1929, including the structural weaknesses and specific events that turned it into a major depression and the way in which the downturn spread from country to country. In relation to the 1929 downturn, historians emphasize structural factors like massive bank failures and the stock market crash, while economists (such as Peter Temin and Barry Eichengreen) point to Britain’s decision to return to the Gold Standard at pre-World War I parities (US$4.86:£1).

Recession cycles are thought to be a normal part of living in a world of inexact balances between supply and demand. What turns a usually mild and short recession or “ordinary” business cycle into a great depression is a subject of debate and concern. Scholars have not agreed on the exact causes and their relative importance. The search for causes is closely connected to the question of how to avoid a future depression, and so the political and policy viewpoints of scholars are mixed into the analysis of historic events eight decades ago. The even larger question is whether it was largely a failure on the part of free markets or largely a failure on the part of government efforts to regulate interest rates, curtail widespread bank failures, and control the money supply. Those who believe in a large role for the state in the economy believe it was mostly a failure of the free markets and those who believe in free markets believe it was mostly a failure of government that compounded the problem.

Current theories may be broadly classified into three main points of view. First, there is orthodox classical economics: monetarist, Austrian Economics and neoclassical economic theory, which focus on the macro economic effects of money supply, how central banking decisions lead to overinvestment (economic bubble), or the supply of gold which backed many currencies before the Great Depression, including production and consumption.

Second, there are structural theories, most importantly Keynesian, but also including those of institutional economics, that point to underconsumption and overinvestment (economic bubble), malfeasance by bankers and industrialists, or incompetence by government officials. The only consensus viewpoint is that there was a large-scale lack of confidence. Unfortunately, once panic and deflation set in, many people believed they could make more money by keeping clear of the markets as prices got lower and lower and a given amount of money bought ever more goods.

Third, there is the Marxist critique of political economy. This emphasizes the tendency of capitalism to create unbalanced accumulations of wealth, leading to overaccumulations of capital and a repeating cycle of devaluations through economic crises. Marx saw recession and depression as unavoidable under free-market capitalism as there are no restrictions on accumulations of capital other than the market itself.

Keynesian models

British economist John Maynard Keynes argued in General Theory of Employment Interest and Money that lower aggregate expenditures in the economy contributed to a massive decline in income and to employment that was well below the average. In this situation, the economy might have reached a perfect balance, at a cost of high unemployment. Although Keynes never mentions fiscal policy in The General Theory, and instead advocates the need to socialize investments, Keynes ushered in more of a theoretical revolution than a policy one. His basic idea was simple: to keep people fully employed, governments have to run deficits when the economy is slowing because the private sector will not invest enough to increase production and reverse the recession. Keynesian economists called on governments during times of economic crisis to pick up the slack by increasing government spending and/or cutting taxes.

As the Depression wore on, Roosevelt tried public works, farm subsidies, and other devices to restart the economy, but never completely gave up trying to balance the budget.According to the Keynesians, he needed to spend much more money; they were unable to say how much more. With fiscal policy, however, government could provide the needed Keynesian spending by decreasing taxes, increasing government spending, and increasing individuals’ incomes. As incomes increased, they would spend more. As they spent more, the multiplier effect would take over and expand the effect on the initial spending. The Keynesians did not estimate what the size of the multiplier was.Keynesian economists assumed poor people would spend new incomes; however, they saved much of the new money; that is, they paid back debts owed to landlords, grocers and family. Keynesian ideas of the consumption function were upset in the 1950s by Milton Friedman and Franco Modigliani.

Monetarist explanations

Monetarists, including Milton Friedman and current Federal Reserve System chairman Ben Bernanke, argue that the Great Depression was caused by monetary contraction, the consequence of poor policymaking by the American Federal Reserve System and continuous crisis in the banking system. In this view, the Federal Reserve, by not acting, allowed the money supply as measured by the M2 to shrink by one-third from 1929 to 1933. Friedman argued that the downward turn in the economy, starting with the stock market crash, would have been just another recession. The problem was that some large, public bank failures, particularly that of the New York Bank of the United States, produced panic and widespread runs on local banks, and that the Federal Reserve sat idly by while banks fell. He claimed that, if the Fed had provided emergency lending to these key banks, or simply bought government bonds on the open market to provide liquidity and increase the quantity of money after the key banks fell, all the rest of the banks would not have fallen after the large ones did, and the money supply would not have fallen as far and as fast as it did. With significantly less money to go around, businessmen could not get new loans and could not even get their old loans renewed, forcing many to stop investing. This interpretation blames the Federal Reserve for inaction, especially the New York branch.

One reason why the Federal Reserve did not act to limit the decline of the money supply was regulation. At that time the amount of credit the Federal Reserve could issue was limited by laws which required partial gold backing of that credit. By the late 1920s the Federal Reserve had almost hit the limit of allowable credit that could be backed by the gold in its possession. This credit was in the form of Federal Reserve demand notes. Since a “promise of gold” is not as good as “gold in the hand”, during the bank panics a portion of those demand notes were redeemed for Federal Reserve gold. Since the Federal Reserve had hit its limit on allowable credit, any reduction in gold in its vaults had to be accompanied by a greater reduction in credit. On April 5, 1933 President Roosevelt signed Executive Order 6102 making the private ownership of gold certificates, coins and bullion illegal, reducing the pressure on Federal Reserve gold.

Neoclassical approach

Recent work from a neoclassical perspective focuses on the decline in productivity that caused the initial decline in output and a prolonged recovery due to policies that affected the labor market. This work, collected by Kehoe and Prescott, decomposes the economic decline into a decline in the labor force, capital stock, and the productivity with which these inputs are used. This study suggests that theories of the Great Depression have to explain an initial severe decline but rapid recovery in productivity, relatively little change in the capital stock, and a prolonged depression in the labor force. This analysis rejects theories that focus on the role of savings and posit a decline in the capital stock.

Austrian School of Economics

Another explanation comes from the Austrian School of economics. Theorists of the “Austrian School” who wrote about the Depression include Austrian economist Friedrich Hayek and American economist Murray Rothbard, who wrote America’s Great Depression (1963). In their view and like the monetarists, the Federal Reserve, which was created in 1913, shoulders much of the blame; but in opposition to the monetarists, they argue that the key cause of the Depression was the expansion of the money supply in the 1920s that led to an unsustainable credit-driven boom.

One reason for the monetary inflation was to help Great Britain, which, in the 1920s, was struggling with its plans to return to the gold standard at pre-war (World War I) parity. Returning to the gold standard at this rate meant that the British economy was facing deflationary pressure. According to Rothbard, the lack of price flexibility in Britain meant that unemployment shot up, and the American government was asked to help. The United States was receiving a net inflow of gold, and inflated further in order to help Britain return to the gold standard. Montagu Norman, head of the Bank of England, had an especially good relationship with Benjamin Strong, the de facto head of the Federal Reserve. Norman pressured the heads of the central banks of France and Germany to inflate as well, but unlike Strong, they refused. Rothbard says American inflation was meant to allow Britain to inflate as well, because under the gold standard, Britain could not inflate on its own.

In the Austrian view it was this inflation of the money supply that led to an unsustainable boom in both asset prices (stocks and bonds) and capital goods. By the time the Fed belatedly tightened in 1928, it was far too late and, in the Austrian view, a depression was inevitable.

According to the Austrians, the artificial interference in the economy was a disaster prior to the Depression, and government efforts to prop up the economy after the crash of 1929 only made things worse. According to Rothbard, government intervention delayed the market’s adjustment and made the road to complete recovery more difficult.

Furthermore, Rothbard criticizes Milton Friedman’s assertion that the central bank failed to inflate the supply of money. Rothbard asserts that the Federal Reserve bought $1.1 billion of government securities from February to July 1932, raising its total holding to $1.8 billion. Total bank reserves rose by only $212 million, but Rothbard argues that this was because the American populace lost faith in the banking system and began hoarding more cash, a factor quite beyond the control of the Central Bank. The potential for a run on the banks caused local bankers to be more conservative in lending out their reserves, and this, Rothbard argues, was the cause of the Federal Reserve’s inability to inflate.

Inequality of wealth and income

Two economists of the 1920s, Waddill Catchings and William Trufant Foster, popularized a theory that influenced many policy makers, including Herbert Hoover, Henry A. Wallace, Paul Douglas, and Marriner Eccles. It held the economy produced more than it consumed, because the consumers did not have enough income. Thus the unequal distribution of wealth throughout the 1920s caused the Great Depression.

According to this view, wages increased at a rate lower than productivity increases. Most of the benefit of the increased productivity went into profits, which went into the stock market bubble rather than into consumer purchases. Say’s law no longer operated in this model (an idea picked up by Keynes).

As long as corporations had continued to expand their capital facilities (their factories, warehouses, heavy equipment, and other investments), the economy had flourished. Under pressure from the Coolidge administration and from business, the Federal Reserve Board kept the discount rate low, encouraging high (and excessive) investment. By the end of the 1920s, however, capital investments had created more plant space than could be profitably used, and factories were producing more than consumers could purchase.

According to this view, the root cause of the Great Depression was a global overinvestment in heavy industry capacity compared to wages and earnings from independent businesses, such as farms. The solution was the government must pump money into consumers’ pockets. That is, it must redistribute purchasing power, maintain the industrial base, but reinflate prices and wages to force as much of the inflationary increase in purchasing power into consumer spending. The economy was overbuilt, and new factories were not needed. Foster and Catchings recommended federal and state governments start large construction projects, a program followed by Hoover and Roosevelt.

Franklin D. Roosevelt, elected in 1932 and inaugurated March 4, 1933, blamed the excesses of big business for causing an unstable bubble-like economy. Democrats believed the problem was that business had too much money, and the New Deal was intended as a remedy, by empowering labor unions and farmers and by raising taxes on corporate profits. In addition, excess price and entry competition, integrated banking, and the sheer size of corporations were viewed as contributing factors. Regulation of the economy was a favorite remedy to this problem.

Debt deflation

Irving Fisher argued that the predominant factor leading to the Great Depression was overindebtedness and deflation. Fisher tied loose credit to over-indebtedness, which fueled speculation and asset bubbles. He then outlined 9 factors interacting with one another under conditions of debt and deflation to create the mechanics of boom to bust.

The chain of events proceeded as follows:

- Debt liquidation and distress selling

- Contraction of the money supply as bank loans are paid off

- A fall in the level of asset prices

- A still greater fall in the net worths of business, precipitating bankruptcies

- A fall in profits

- A reduction in output, in trade and in employment.

- Pessimism and loss of confidence

- Hoarding of money

- A fall in nominal interest rates and a rise in deflation adjusted interest rates.

During the Crash of 1929 preceding the Great Depression, margin requirements were only 10%. Brokerage firms, in other words, would lend $9 for every $1 an investor had deposited. When the market fell, brokers called in these loans, which could not be paid back. Banks began to fail as debtors defaulted on debt and depositors attempted to withdraw their deposits en masse, triggering multiple bank runs. Government guarantees and Federal Reserve banking regulations to prevent such panics were ineffective or not used. Bank failures led to the loss of billions of dollars in assets. Outstanding debts became heavier, because prices and incomes fell by 20–50% but the debts remained at the same dollar amount. After the panic of 1929, and during the first 10 months of 1930, 744 US banks failed. (In all, 9,000 banks failed during the 1930s). By April 1933, around $7 billion in deposits had been frozen in failed banks or those left unlicensed after the March Bank Holiday.

Bank failures snowballed as desperate bankers called in loans which the borrowers did not have time or money to repay. With future profits looking poor, capital investment and construction slowed or completely ceased. In the face of bad loans and worsening future prospects, the surviving banks became even more conservative in their lending. Banks built up their capital reserves and made fewer loans, which intensified deflationary pressures. A vicious cycle developed and the downward spiral accelerated.

The liquidation of debt could not keep up with the fall of prices which it caused. The mass effect of the stampede to liquidate increased the value of each dollar owed, relative to the value of declining asset holdings. The very effort of individuals to lessen their burden of debt effectively increased it. Paradoxically, the more the debtors paid, the more they owed. This self-aggravating process turned a 1930 recession into a 1933 great depression.

Macroeconomists including Ben Bernanke, the current chairman of the U.S. Federal Reserve Bank, have revived the debt-deflation view of the Great Depression originated by Fisher.

Breakdown of international trade

Many economists have argued that the sharp decline in international trade after 1930 helped to worsen the depression, especially for countries significantly dependent on foreign trade. Most historians and economists partly blame the American Smoot-Hawley Tariff Act (enacted June 17, 1930) for worsening the depression by seriously reducing international trade and causing retaliatory tariffs in other countries. Foreign trade was a small part of overall economic activity in the United States and was concentrated in a few businesses like farming; it was a much larger factor in many other countries. The average ad valorem rate of duties on dutiable imports for 1921–1925 was 25.9% but under the new tariff it jumped to 50% in 1931–1935.

In dollar terms, American exports declined from about $5.2 billion in 1929 to $1.7 billion in 1933; but prices also fell, so the physical volume of exports only fell by half. Hardest hit were farm commodities such as wheat, cotton, tobacco, and lumber. According to this theory, the collapse of farm exports caused many American farmers to default on their loans, leading to the bank runs on small rural banks that characterized the early years of the Great Depression.

Turning point and recovery

In most countries of the world recovery from the Great Depression began between late 1931 and early 1933. Economic studies have indicated that just as the downturn was spread worldwide by the rigidities of the Gold Standard, it was suspending gold convertibility (or devaluing the currency in gold terms) that did most to make recovery possible. What policies countries followed after casting off gold and what results they got varied widely.

In the United States recovery began in the spring of 1933. There is no consensus among economists regarding the motive force for the U.S. economic expansion that continued through most of the Roosevelt years (and the sharp contraction of the 1937 recession that interrupted it). According to Christina Romer, the money supply growth caused by huge gold inflows was a crucial source of the recovery of the United States economy, and fiscal policy and World War II were of little help. The gold inflows were partly due to devaluation of the U.S. dollar and partly due to deterioration of the political situation in Europe. In their book, A Monetary History of the United States, Milton Friedman and Anna J. Schwartz also attributed the recovery to monetary factors, and contended that it was much slowed by poor management of money by the Federal Reserve System. Current Chairman of the Federal Reserve Ben Bernanke agrees that monetary factors played important role both in the worldwide economic decline and eventual recovery. Bernanke, also sees a strong role for institutional factors, particularly the rebuilding and restructuring of the financial system, and points out that the Depression needs to be examined in international perspective. Two economists, Harold L. Cole and Lee E. Ohanian, believe that the economy should have returned to normal after four years of depression except for continued depressing influences, and point the finger to the lack of downward flexibility in prices and wages, encouraged by Roosevelt Administration policies such as the National Industrial Recovery Act. Another economist has called attention to the expectations of reflation and rising nominal interest rates that Roosevelt’s words and actions portended.

Gold standard

Every major currency left the gold standard during the Great Depression. Great Britain was the first to do so. Facing speculative attacks on the pound and depleting gold reserves, in September 1931 the Bank of England ceased exchanging pound notes for gold and the pound was floated on foreign exchange markets.

Great Britain, Japan, and the Scandinavian countries left the gold standard in 1931. Other countries, such as Italy and the United States, remained on the gold standard into 1932 or 1933, while a few countries in the so-called “gold bloc”, led by France and including Poland, Belgium and Switzerland, stayed on the standard until 1935-1936.

According to later analysis, the earliness with which a country left the gold standard reliably predicted its economic recovery. For example, Great Britain and Scandinavia, which left the gold standard in 1931, recovered much earlier than France and Belgium, which remained on gold much longer. Countries such as China, which had a silver standard, almost avoided the depression entirely. The connection between leaving the gold standard as a strong predictor of that country’s severity of its depression and the length of time of its recovery has been shown to be consistent for dozens of countries, including developing countries. This partly explains why the experience and length of the depression differed between national economies.

Read about the performance of Gold and Silver during recessions and depressions.

Can the Government Stop Another Great Depression?

The following article is excerpted from a recent issue Elliott Wave International’s Financial Forecast.

Elliott Wave International (EWI) is offering the full 10-page issue, entitled “The Most Important Investment Report You’ll Read in 2009,” free for a limited time. In addition to the following market commentary, it includes independent forecasts of stocks, bonds, metals, the U.S. dollar and economic trends.

Visit EWI to download the full report, free.

By Steve Hochberg and Pete Kendall

Editors of The Elliott Wave Financial Forecast

As Conquer the Crash so boldly counseled, prosperity entails managing one’s finances and livelihood so as to be in tune with a 1930s’ style deflationary depression. But conventional wisdom disagrees. “There’s no comparison” to the Great Depression, says the world’s leading financial authority, U.S. Federal Reserve Chairman Ben Bernanke: “I’ve written books about the Depression. We didn’t have the social safety net that we have today. So let’s put that out of our minds.” He cites as evidence a 25% unemployment rate, a one-third decline in U.S. GDP and a 90% decline in stock prices, all of which occurred during the 1930s’ depression.

Unfortunately, what Bernanke’s managed to do is put one important word out of his mind—yet. Like the rest of the “this is no depression” camp, he fails to note that his cited figures are the extreme readings of that era. Bernanke also ignores the critical fact that today’s bear market is actually ahead of where the stock market was at the same point during the 1929-1932 decline and that the economy is lurching lower in a manner suggesting strongly that it will have little trouble keeping pace with the economic contraction of the 1930s (see Economy & Deflation section below).

Another common refrain is that, in contrast to the early 1930s, there are now competent financial authorities doing everything in their power to unlock the credit markets and reignite the bull market in equities. It’s certainly true that the Fed is doing everything in its power, and even some things that aren’t, to reel in the crisis. The U.S. Treasury is doing likewise. By Bianco Research’s tally, the potential total of U.S. bailouts is closing in on $9 trillion. But these efforts are every bit as impotent as Conquer the Crash and the September issue of The Elliott Wave Financial Forecast suggested that they would be. Here’s the key quote from the September EWFF: “The bailouts keep coming at lower lows, signaling further declines ahead.” Incredibly to most people, since this quote appeared the Dow has declined by another 30% and various government financial wizards have put forward even bolder yet more haphazard “rescue” initiatives.

The ballooning bailout makes us more convinced than ever that it will fail. The whole “Keystone Cops” approach to “the rescue” strengthens our conviction. One day the bailout is aimed at jacking up asset prices; the next it is buying mortgages; the next it is rescuing the consumer; and the next it’s all-hands-on-deck to prop up whoever it is that happens to be failing on that day. The alphabet soup of rescue programs now includes ABCPMMMFLF (no, we didn’t make this up), which is supposed to “shore up” the $1 trillion asset-backed commercial paper markets. And still, credit spreads shoot higher.

Another program, the “systematically significant failing institutions program” (SSFIP), was established in November to deliver a $40 billion “equity injection” into AIG. The problem, which will probably become the focus of intense Congressional scrutiny at some later point, is that the injection was made in October, before the program even existed. The Wall Street Journal puts it this way: “Practically every day the government launches a massively expensive new initiative to solve the problems that the last day’s initiative did not.” At the latest economic summit in mid-November, the U.S. and other nations were reputedly “close to a deal to create a new ‘early warning system’ to detect weaknesses in the global financial system before they reach epic proportions.” Among the stated objectives: greater transparency. Of course, “sources spoke on the condition of anonymity because plans are still being worked out.” The real reason that these people want to remain anonymous is that like everyone else, they recognize the proportions of the unfolding epic and thus the futility of the bailout effort.

For more information on navigating the current market turmoil, including forecasts of stocks, bonds, metals, the U.S. dollar and economic trends, download Elliott Wave International’s free 10-page report, The Most Important Investment Report You’ll Read in 2009.

Robert Prechter, Chartered Market Technician, is the world’s foremost expert on and proponent of the deflationary scenario. Prechter is the founder and CEO of Elliott Wave International, author of Wall Street best-sellers Conquer the Crash and Elliott Wave Principle.

Copyright (c) 2006 TradingStocks.NET Permission is granted to copy, distribute and/or modify this document under the terms of the GNU Free Documentation License, Version 1.2 or any later version published by the Free Software Foundation; with no Invariant Sections, no Front-Cover Texts, and no Back-Cover Texts. A copy of the license is included in the section entitled “GNU Free Documentation License”.