Here’s Why IPOs Will Likely Dwindle to Near Zero

“The IPO market is fizzling”

Financial activity is usually abuzz during times of financial optimism, such as the issuance of initial public offerings (IPOs).

An IPO means that a company is transitioning from private to public ownership. The process involves selling shares to the public for the first time.

As recently as 2021, a Dec. 2 Nasdaq.com headline said:

A Record Year for IPOs

The attached article mentioned that close to a thousand companies had gone public last year, handily surpassing the record set in the 1990s.

As you know, the S&P 500 index was still climbing throughout 2021.

However, history shows that when the ebullient psychology which drives stock prices higher wanes, so does the IPO market.

Indeed, at the onset of the worst part of the 2007-2009 bear market, the May 2008 Elliott Wave Financial Forecast, a monthly publication which provides analysis of major U.S. financial markets, said:

IPOs are being cancelled at a record rate as “concerns about a recession sapped demand for new shares.”

Of course, the “Great Recession” of about 15 years ago turned out to be the worst economic downturn since the Great Depression of the early 1930s.

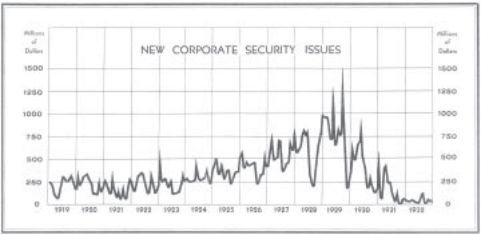

Speaking of which, you may be interested in seeing a chart from Bradstreet’s Weekly when the business digest was doing a 1932 year in review (data is through mid-1932). A classic Elliott Wave Theorist, a monthly publication which provides analysis of financial markets and cultural trends, re-published the chart and said:

Wall Street was in manic mode in 1929, giving the public what it wanted: more stock. By late 1931, new issues had reached nearly zero.

Now back to present day: The “manic” psychology of 2021 drove the S&P 500 index to a record high in the first few trading days of 2022. As stock prices tumbled thereafter, the June Elliott Wave Financial Forecast noted:

The IPO market is fizzling. According to Renaissance Capital, of eight IPOs that began trading in May, just one logged a gain: Bright Green Corporation, a cannabis company. From its offering price of $8, the shares jumped 625% to $58 on its second day of trading, which was May 18. After that, however, it fell more than 85% and is now trading at $7.89 as we go to press, below its initial offering.

As of this writing intraday on June 22, Bright Green Corporation was trading at $2.77.

Is the stock market destined to repeat the 2007-2009 bear market, or even worse, the historic financial downturn from 1929 to 1933?

The stock market’s Elliott wave pattern offers a big clue.

If you’d like to learn how the Elliott wave model can help you analyze the stock market, you are encouraged to read Frost & Prechter’s Wall Street classic, Elliott Wave Principle: Key to Market Behavior. Here’s a quote from the book:

In markets, progress ultimately takes the form of five waves of a specific structure. Three of these waves, which are labeled 1, 3 and 5, actually effect the directional movement. They are separated by two countertrend interruptions, which are labeled 2 and 4, as shown in Figure 1-1. The two interruptions are apparently a requisite for overall directional movement to occur.

[R.N.] Elliott noted three consistent aspects of the five-wave form. They are: Wave 2 never moves beyond the start of wave 1; wave 3 is never the shortest wave; wave 4 never enters the price territory of wave 1.

Get more insights into the Wave Principle by reading the entire online version of the book for free.

All that’s required for free access is a Club EWI membership, which is also free.

Club EWI is the world’s largest Elliott wave educational community, and members enjoy complimentary access to a wealth of Elliott wave resources on financial markets, investing and trading.

Just follow the link and you can have the Wall Street classic on your computer screen in moments: Elliott Wave Principle: Key to Market Behavior — free and instant access.