Europe On Sale: Get It While U Can

On July 13 and 14, the euro and the U.S. dollar briefly traded at parity — for the first time in 20 years.

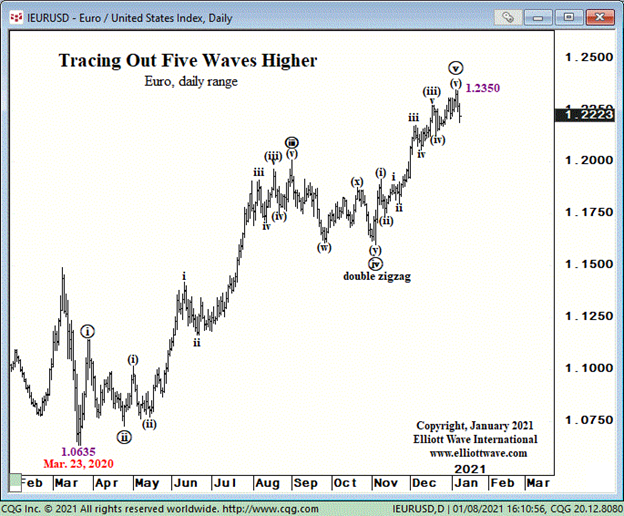

Just 19 months ago, EURUSD was at $1.2350. It’s quietly dropped 20%+ since.

Quietly? Yeah, because of all the other fireworks in the market drowned out the news.

What would you have done with this knowledge a year and a half ago?

For one thing, you’d have put off that European vacation until now!

Who could have known? EWI subscribers. Check out this forecast from EWI back on January 8, 2021:

It appears that currencies are delivering the early New Year trend reversal that often occurs. The [Euro]’s high at 1.2350 on Wednesday, January 6, completes the five-wave rally from at least November 4, 2020 (1.1604) and likely from March 23, 2020 (1.0635)…Greater bearish potential exists…

Every student of Elliott knows that when five waves finish, you should anticipate a reversal of equal degree.

Here’s what happened since:

Mmmm, I love a good chart.

And a great tweet. Tip of the hat to Mr_Cuddlez!

So, are you ready to catch the next big euro move?

EWI’s Chief Market Analyst Steven Hochberg guides our Financial Forecast Service subscribers 3X/week through the twist and turns in the euro (and dollar) — plus, U.S. stock indexes, bonds, gold and silver — inside his Short Term Update.

Right now, read our forecasts for all of the markets listed above (and more) inside our Financial Forecast Service Test Drive — just $17 for a full week’s access.

Join the Financial Forecast Service Test Drive now.

Hurry: Your one-time Test Drive opportunity ends Thursday, July 28th.