Signs Of Deflation

By Elliott Wave International

As the biggest credit bubble in history continues to shrink, consumer prices have stayed flat over the past several months, meaning there is no sign of inflation to come, despite growing commitments from the U.S. government.

So what’s keeping inflation at bay, given all the stimulus money promised? The answer: Deflation – an overwhelming urge for consumers to liquidate their assets for cash. And this new economic phase is finally becoming too obvious to ignore, as explained in recent commentary from the world’s largest technical analysis firm.

“The economy is moving into a critical new phase, an outright deflation in which ‘prices fall because people expect falling prices.’ Obviously, this implies an element of recognition, as efforts to protect against indebtedness and falling prices contribute to further declines. We can tell deflation is entering a new stage because of the language and ideas that financial observers now use to describe it.”

— The Elliott Wave Financial Forecast (September 2010)

Read the FREE Deflation Survivor Guide to get an independent look at the future of the U.S. economy. Newly updated for 2010, Prechter’s 90-page ebook on deflation reveals the biggest threat to your money right now. You’ll learn not only how to prepare for deflation and adapt during it; you’ll also learn how to survive it and — most important — prosper during it, so you’ll be ready for the buying opportunity of a lifetime at its end. Download Your Free 90-Page Deflation eBook Now.

Here are a few recent comments about the new economic reality:

- “[New Jersey Governor] Christie spelled out the details of his proposal Tuesday. They include: repealing an increase in benefits approved years ago; eliminating automatic cost-of-living adjustments; raising the retirement age to 65 from 60 in many cases; reducing pension payouts for many future retirees; and requiring some employees to contribute more to their pensions.” — Associated Press (Sept. 15)

- “U.S. Home Prices Face Three-Year Drop as Inventory Surge Looms” — Bloomberg (Sept. 15)

- “Atlanta Awash in Empty Offices Struggles to Recover From Building Binge” — Bloomberg (Sept. 14)

- “The world economy faces a long, hard slog toward recovery and could slide into deflation and financial instability if leaders fail to deliver on promises of reform.” — Reuters (Sept. 10)

- “Deflation seems to have the upper hand lately in the debate among investors about inflation versus deflation.” – Marketwatch (Sept. 8)

- “With the release of the August sales figures, one thing is clear for car shoppers — it’s a buyer’s market.” — Edmunds (Sept. 2)

- “20 Funds to Guard Against Deflation” — Smartmoney (Aug. 29)

- “Dividend-Yield Signal Screams Deflation” — Forbes (Aug. 25)

The word deflation also started appearing more in the financial media around 2002, but Robert Prechter, president of technical analysis firm Elliott Wave International and author of the 2002 New York Times best-seller Conquer the Crash, added in the updated 2009 edition of his book that the deflation references back then were in an entirely different context:

“The rarely used word deflation has become fashionable in financial discussion. It is fashionable, however, not to predict its occurrence but primarily to dismiss the idea that it has any serious likelihood of occurring. The president of the Federal Reserve Bank of Dallas said in May [2004] that there is ‘maybe one chance out of four’ that deflation will occur.” Conquer the Crash, 2nd edition (2009)

And Prechter says the opinion from the Federal Reserve Bank of Dallas was not an isolated outlook at the time. Here’s another quote from around the same time:

“Not one economist [of 67 surveyed] said it was ‘very likely’ the economy would slip into deflation, and only 6% said it was ‘somewhat likely.’ About 95% said deflation was ‘not very likely’ to happen.” Barron’s (2003)

In hindsight, we know that economists, in the aggregate, were dead wrong about their deflation predictions.

As we saw above, references to “deflation” are increasing now — because it’s obvious.

So if economists were unable — or worse, unwilling — to warn you in advance about the threat of deflation a few years ago, what are they not warning you about now?

Get an independent look at the future of the U.S. economy by reading Robert Prechter’s FREE Deflation Survival Guide now. Newly updated for 2010, Prechter’s 90-page ebook on deflation reveals the biggest threat to your money right now. You’ll learn not only how to prepare for deflation and adapt during it; you’ll also learn how to survive it and — most important — prosper during it, so you’ll be ready for the buying opportunity of a lifetime at its end. Download Your Free 90-Page Deflation eBook Now.

Deflation is coming

Yes, You Heard Us Right

May 14, 2010

Everywhere you look, the mainstream financial experts are pinning on their “WIN 2” buttons in a show of solidarity against what they see as the number one threat to the U.S. economy: Whip Inflation Now.

There’s just one problem: They’re primed to fight the wrong enemy. Fact is, despite ten rate cuts by the Federal Reserve Board to record low levels plus $13 trillion (and counting) in government bailout money over the past three years — the Demand For and Availability Of credit is plunging. Without a borrower or lender, the massive supply of debt LOSES value, bringing down every exposed investment like one long, toppling row of dominoes.

This is the condition known as Deflation.

The following market analysis is courtesy of Bob Prechter’s Elliott Wave International. Elliott Wave International is currently offering Bob’s recent Elliott Wave Theorist, free. Bob Prechter uncovered more than a dozen “value depreciating” developments underway in the U.S. economy as the two main engines of credit expansion sputter: Banks and Consumers. Off the top of the Theorist’s watch list are these “Continuing and Looming Deflationary Forces”:

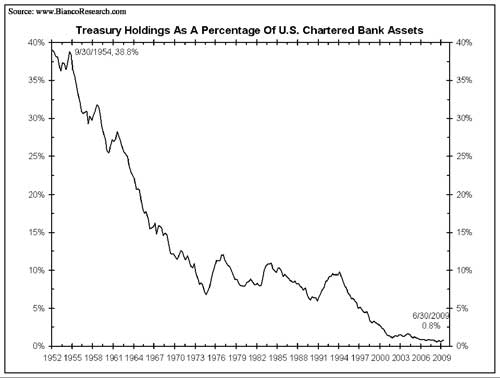

- A riveting chart of Treasury Holdings as a Percentage of US Chartered Bank Assets since 1952 shows how “safe” bank deposits really are. In short: today’s banks are about 95% invested in mortgages via the purchase of federal agency securities. Unlike Treasuries, IOU’s with homes as collateral have “tremendous potential” to fall in dollar value.

- Loan Availability to Small Businesses has fallen to the lowest level since the interest rate crises of 1980. In Bob Prechter’s own words: “The means of debt repayment [via business growth] are evaporating, which implies further deflationary pressure within the banking system.”

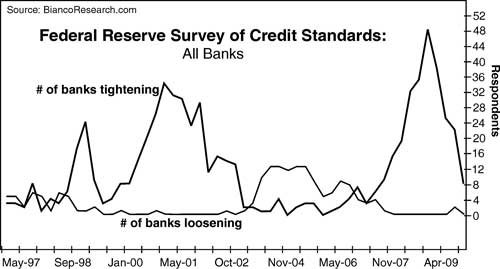

- An all-inclusive close-up of the Number Of Banks Tightening Their Lending Standards since 1997 has this message to impart: Since peaking in October 2008, lending restrictions have soared, thereby significantly reducing the overall credit supply.

- Both residential and commercial mortgages are plummeting as home/business owners walk away from their leases at an increasing rate.

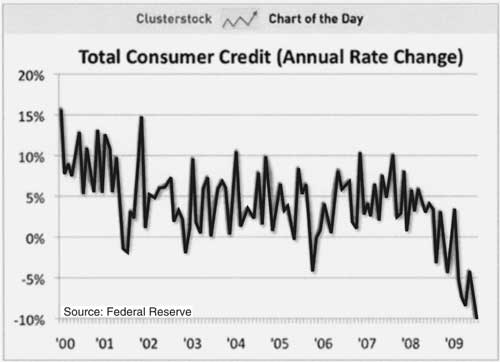

- The major sources of bank revenue — consumer credit and state taxes — are plunging as more people opt to pay DOWN their debt. Also, a compelling chart of leveraged buyouts since 1995 shows a third catalyst for the credit binge — private equity — on the decline.

All that is just the beginning. Bob Prechter’s 13 pages of commentary, riveting charts, and unparalleled insight that make it impossible to ignore the deflationary shift underway in the financial landscape. For that reason, we have compiled the most “the most important investment report you’ll read in 2010.”

Elliott Wave International’s latest free report puts 2010 into perspective like no other. The Most Important Investment Report You’ll Read in 2010is a must-read for all independent-minded investors. The 13-page report is available for free download now. Learn more.

Continuing—and Looming—Deflationary Forces

The Fed and the government quite effectively advertise their efforts to inflate the supply of money and credit. But deflationary forces, to most eyes, are invisible. I thought I would point some of them out.

1. Banks Are about 95 Percent Invested in Mortgages

|

Figure 4, courtesy of Bianco Research, shows that U.S. banks used to be fairly conservative, holding 40 percent of their assets in Treasury securities. This large investment in federal government debt, the basis of our “monetary” “system”, served as a stop-gap against deflation. In 1950, even if mortgages had been wiped out by a factor of 80 percent, banks still would have been 50% solvent and 40% liquid. Today, banks hold federal agency securities (backed mostly by mortgages), mortgage-backed securities (meaning complicated packages of mortgages), plain old mortgages that they financed themselves, and a few business loan contracts. If these mortgages become wiped out by a factor of 80 percent, which in turn would cause many of the business loans to go into default, the banks will be only about 22% solvent and 1% liquid. I believe the coming wipeout will be bigger than that, but let’s be conservative for now. The point is that, unlike Treasuries, IOUs with homes as collateral can fall in dollar value, and such IOUs are pretty much the only paper backing U.S. bank deposits. The potential for deflation here is tremendous.

2. More Mortgages Are Going Under

It has been well publicized recently that commercial real estate has been plunging in value as business tenants walk away from their leases, leaving properties empty. Zisler Capital Partners reports, “Returns were negative for the past five quarters, the longest streak since 1992. Property prices have fallen by 30 percent to 50 percent from their peaks. Much of the debt is likely worth about 50 percent of par, or less.” (Bloomberg, 11/11) Needless to say, the fact that commercial mortgages are plunging in value is stressing banks even further, which in turn restricts their lending. This trend is deflationary.

3. People Are Walking away from Their Homes and Mortgages

Great numbers of people are ceasing to pay their mortgages, even if they have the money to pay them. When people walk away from their mortgages, they are reneging on a promise to pay the interest on the loan. … Refusal to pay interest is deflationary. When banks can’t collect fully on their loan principal, as is the case by law in the above-named states, it is deflationary. Even in states where banks can go after other assets held by borrowers, default is still deflationary if the borrowers are broke. The reason is that, in all these cases, the value of the loan contract falls to the marketable value of the collateral, and a contraction in the value of debt is deflation.

Some people who walk away from their mortgages purposely damage the homes when they leave. New businesses have sprung up to take on the job of cleaning up the houses that former occupants trashed as they left. Angry defaulters are stripping coils out of stoves, pulling electrical wiring out of walls, ripping fixtures out of bathrooms, yanking seats off of toilets, punching holes in walls and leaving rotting food in the fridge. (AP, 8/9) Such actions, and the threat of more such actions, lower the value of the collateral behind mortgage debts, thereby lowering the value of mortgages, which is deflationary.

4. Bank Lending Standards Have Stayed Restrictive

|

As people default on mortgages, banks are tightening lending standards. Figure 7 shows that banks loosened credit standards from late 2003 through the summer of 2007. By the end of that time, you could borrow money if you were breathing and could operate a ball-point pen. Banks have been tightening credit standards ever since. The rate of tightening peaked in October 2008, but the graph shows that over the past year various banks have either left their new, tighter standards in place or continued to tighten their standards further. Across the board, it is harder to get a loan, and it’s staying that way. Lending restrictions reduce the credit supply. This condition is deflationary.

5. Banks Are Cashing Out of the Credit-Card Business

|

Articles have revealed that banks are doing everything they can to get credit-card debtors to pay off their cards. They are raising penalties and rates, lowering ceilings and otherwise bugging their clients to pay up, one way or another: Transfer your debt to another bank’s card; default; pay us off; we don’t care which. And it’s working. Through September, consumers have paid down credit card balances for 12 months in a row. Figure 8 shows the new trend. The credit-card business was another formerly humming engine of credit that is sputtering. You might call the new program “cash from clunkers,” and it is deflationary.

For more information from Robert Prechter, download a FREE 10-page issue of The Elliott Wave Theorist. It challenges current recovery hype with hard facts, independent analysis, and insightful charts. You’ll find out why the worst is NOT over and what you can do to safeguard your financial future.

This article was syndicated by Elliott Wave International. EWI is the world’s largest market forecasting firm. Its staff of full-time analysts lead by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.