Silicon Valley Bank, Silvergate and “The Everything Bust”

“The pressure on banks will rise”

The phrase “Everything Bust” means a bust in just about every financial risk-asset of which you can think, as well as the economy and, I dare say, the financial system itself.

Indeed, in a section titled “The Everything Bust Is on The Way,” the December Global Market Perspective, a monthly Elliott Wave International publication which covers 50-plus financial markets, noted:

The pressure on banks will rise as the economy heads south.

And, now, we have these headlines:

- Silicon Valley Bank Fails After Run on Deposits (The New York Times, March 10)

- Crypto-focused bank Silvergate is shutting operations and liquidating after market meltdown (CNBC, March 8)

Silicon Valley’s collapse was the biggest bank failure since Washington Mutual in 2008 and the second largest bank failure in U.S. history.

Many of those on Wall Street blamed the bank failures for triple-digit declines in the Dow Industrials on the day the news came out. However, the real “bust” in the Dow Industrials and S&P 500 began a year earlier, in January 2022. It reflected a downturn in a social mood; today’s bank failures have the same roots that stretch back months and months. And since social mood is showing no signs of improvement, it’s likely not over.

The “Everything Bust” is on — in stocks, real estate, bonds, the world of crypto, SPACs (a.k.a. special purpose acquisition companies) and elsewhere in the world of finance, including the subprime auto market.

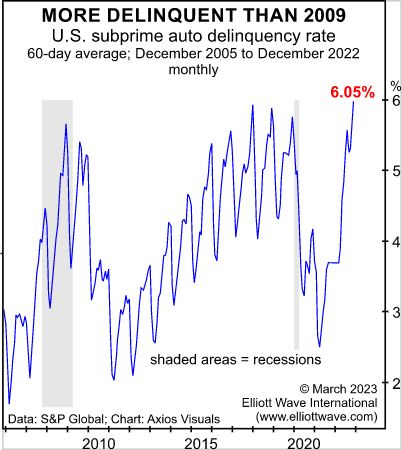

This chart and commentary are from the March Global Market Perspective:

The percentage of subprime auto borrowers who are at least 60 days late on payments surged to 6.05% in December, more than double the seven-year low of 2.58% recorded in April 2021, and eclipsing the peak reading of 5.7% during the Great Recession of December 2007 to June 2009.

As a March 10 New York Post headline said:

Silicon Valley Bank meltdown sparks contagion fears: ‘We found our Enron’

Whether you want to call it “contagion fears” or the manifestation of an increasingly fearful mood, don’t be surprised if more bank failures appear on the horizon sooner rather than later.

Also, don’t be surprised if more triple-digit declines occur with the Dow Industrials.

The Elliott wave pattern of this senior U.S. index is revealing what very well may be next for U.S. stocks.

If you’re unfamiliar with Elliott wave analysis, or simply need a refresher, read Frost and Prechter’s Elliott Wave Principle: Key to Market Behavior. Here’s a quote from the book:

Although it is the best forecasting tool in existence, the Wave Principle is not primarily a forecasting tool; it is a detailed description of how markets behave. Nevertheless, that description does impart an immense amount of knowledge about the market’s position within the behavioral continuum and therefore about its probable ensuing path. The primary value of the Wave Principle is that it provides a context for market analysis. This context provides both a basis for disciplined thinking and a perspective on the market’s general position and outlook. At times, its accuracy in identifying, and even anticipating, changes in direction is almost unbelievable. Many areas of mass human activity display the Wave Principle, but it is most popularly used in the stock market.

If you’d like to read the entire online version of this Wall Street classic, you may do so for free once you become a member of Club EWI, the world’s largest Elliott wave educational community (around 500,000 worldwide members).

A Club EWI membership is also free and members enjoy complimentary access to a range of Elliott wave resources on investing and trading.

Join Club EWI now by following this link: Elliott Wave Principle: Key to Market Behavior — get free and instant access.