Financial Advisors Take Heat for Market Losses (Will Anger Intensify?)

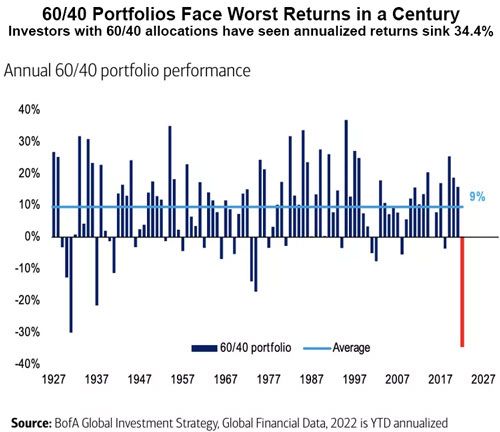

Was 2022 an aberration for the 60/40 allocation?

Many financial advisors steer clients who are willing to take some risk toward a 60% stocks / 40% bonds portfolio.

Alas, investors who followed that strategy in 2022 saw the value of their portfolios decrease substantially.

In November, The Elliott Wave Theorist, a monthly publication which provides analysis of major financial and cultural trends, said:

Our long term bearish stance on stocks and bonds for 2022 is certainly panning out. In mid-October, [this] headline and chart, from Bank of America, made the rounds in the media:

The bond market was a big contributor to investors’ losses. The September 2020 issue of EWT depicted a 78-year cycle in 10-year U.S. Treasury note yields and concluded that after 39 years of rise and 39 years of fall, interest rates had just registered a historic bottom.

Since then, as you know, interest rates have risen substantially, which means bond prices have fallen.

Even today, many clients of financial advisors are still fuming (Marketwatch, April 4):

Investors are mad as hell at advisers …

With the S&P 500 down 18% in 2022 and bonds off, too, investor sentiment toward full-service investment firms dropped significantly from last year

Yet, there are some who suggest the 60/40 allocation is still worth considering, along with perhaps a few tweaks (Forbes, March 9):

The 60/40 Portfolio Is Not Dead; It’s Just Not Well-Balanced

As I write, the 60/40 strategy has performed better so far in 2023, but the remainder of the year is another matter.

Elliott wave analysis can be useful in helping you get a handle on what the remainder of 2023 holds for stocks and bonds.

If you’d like to learn how the Elliott wave method can help you analyze financial markets, read Frost & Prechter’s Wall Street best seller, Elliott Wave Principle: Key to Market Behavior. Here’s a quote from the book:

In markets, progress ultimately takes the form of five waves of a specific structure. Three of these waves, which are labeled 1, 3 and 5, actually effect the directional movement. They are separated by two countertrend interruptions, which are labeled 2 and 4. The two interruptions are apparently a requisite for overall directional movement to occur.

[R.N.] Elliott noted three consistent aspects of the five-wave form. They are: Wave 2 never moves beyond the start of wave 1; wave 3 is never the shortest wave; wave 4 never enters the price territory of wave 1.

… Elliott did not specifically say that there is only one overriding form, the “five-wave” pattern, but that is undeniably the case. At any time, the market may be identified as being somewhere in the basic five-wave pattern at the largest degree of trend. Because the five-wave pattern is the overriding form of market progress, all other patterns are subsumed by it.

Here’s some good news: You can read the entire online version of Elliott Wave Principle: Key to Market Behavior for free once you become a member of Club EWI, the world’s largest Elliott wave educational community (approximately 500,000 worldwide members).

A Club EWI membership is also free and allows for complimentary access to a wealth of Elliott wave resources (videos and articles) on investing and trading.

Join Club EWI now by following this link: Elliott Wave Principle: Key to Market Behavior.