| Are the Birds to Blame? Egg prices have skyrocketed. Is there another force at work besides the Avian flu? Read this analysis from Elliott Wave International’s Global Rates & Money Flows that you likely won’t find in the mainstream media: Commodity indices have a bullish tilt to them from a higher-degree Elliott wave perspective and READ MORE |

Category: Economy

Discussion about the state of the economy, social mood, economic signals and their relation to market tops and bottoms.

Fireside Chat With Robert Prechter and Avi Gilburt

| “This is Going to Shock People!”: Avi Gilburt and Bob Prechter Chat “It’s going to make 2008 look like child’s play,” says ElliottWave Trader’s Avi Gilburt when discussing the precarious balance sheets of U.S. banks with Elliott Wave International’s Robert Prechter. In the just-released webinar “A Fireside Market Chat with Robert Prechter & Avi Gilburt,” READ MORE |

Gold Prices: The Calm Before a Record Run

| The basis for analysis and forecasting at Elliott Wave International is fundamentally different from everyone else’s. Here’s a prime example in gold. This excerpt is from the March Elliott Wave Financial Forecast, when gold was trading below $2,050/oz. Gold’s three-month implied volatility has declined to its lowest level in over four years. While low volatility READ MORE |

Place Your Bets

| Are You a “Betting Man”? Then Take a Look — and Make Your Bet. I have spent much of my career among professional traders. By nature, traders are a betting crowd; if they can’t bet on the markets, they’ll bet on something else. A monthly highlight on trading floors was always the ‘NFP Sweepstake,’ where READ MORE |

Commercial Real Estate

| Commercial Property Prices: Why the Decline May Have Just Started This index has already retreated 20% since May 2022 The major bust in property prices 15 to 20 years ago started with the residential real estate market. This time, the commercial real estate market may have taken the lead. Here are some recent headlines: [“Shark READ MORE |

Earnings Season

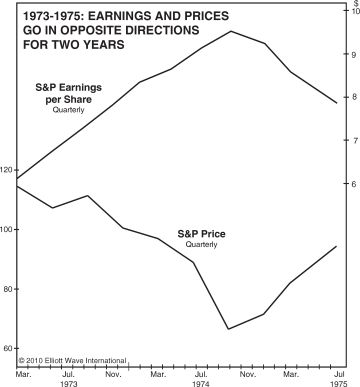

| Here’s What You Need to Know About Earnings Season Investing based on earnings “is akin to driving down the highway looking only in the rearview mirror” Many investors and financial journalists believe that corporate earnings play a substantial role in driving stock market prices. This headline from a few months ago captures the traditional thinking READ MORE |

100x Increase in Interest Rates

| This Trend Is Up a Whopping 10,240% Since March 2021 How millionaires are handling financial uncertainty On March 1, 2021, the 6 Month Treasury Bill Rate was a measly 0.05%. The March 2021 Elliott Wave Theorist, a monthly Elliott Wave International publication which covers major financial and social trends, said: If the rise in interest READ MORE |

Intimidating Bond Market

| Want to “Intimidate Everybody”? Be a Bond Market Back in October 2021, we showed subscribers a chart of the “Bond Universe” — ALL bonds, from around the world, in ONE chart. Since then, as yields spiked and prices fell, the bond market has indeed been “intimidating everybody.” Watch our monthly Global Market Perspective contributor, Murray READ MORE |

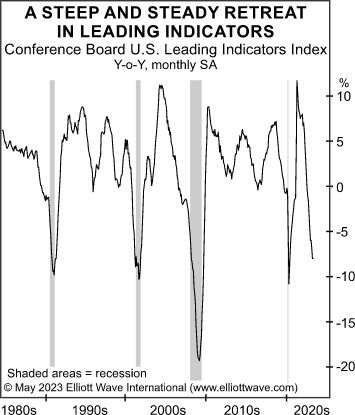

Recession May Foil Expectations

| Why a U.S. Recession May Foil Economists’ Expectations “Many classic indicators of a recession are exactly where they were at the…” You may have heard that Germany has slipped into a recession. What you may not have heard is, the German government anticipated an economic uptick in Q1, not a slide. Reality failing to meet READ MORE |

Pension Fund Crisis

| Is a Pension Fund Crisis Next? “U.S. pension funds are on the brink of implosion” Did you get a heads-up from the financial media that the U.S. banking system was vulnerable before the failures of Silicon Valley, Signature and First Republic banks? There may have been outlier articles here and there but no real warnings. READ MORE |

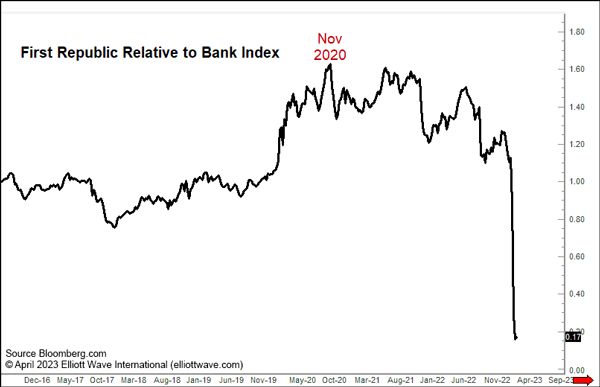

Your Bank: Early Warning

| Your Bank: “Use This as an Early Warning Signal” First Republic Bank “customers had pulled $100 billion in deposits in the first quarter” More dramatic news on the banking front. On April 25, investors in the shares of First Republic Bank were hit hard (The New York Times): First Republic Bank Enters New Free Fall READ MORE |

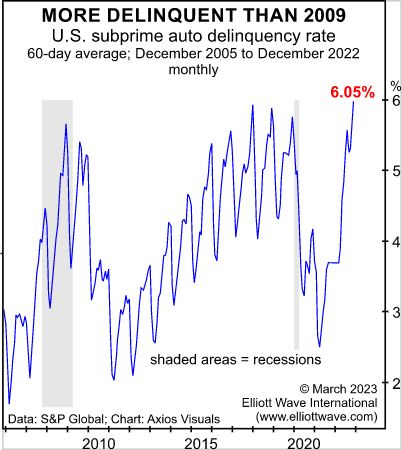

Pressure on Banks will Rise

| Silicon Valley Bank, Silvergate and “The Everything Bust” “The pressure on banks will rise” The phrase “Everything Bust” means a bust in just about every financial risk-asset of which you can think, as well as the economy and, I dare say, the financial system itself. Indeed, in a section titled “The Everything Bust Is on READ MORE |

FDIC and Your Bank Deposits

| The Shocking Truth About the FDIC and Your Bank Deposits Why you can’t rely on the FDIC if your bank goes under Editor’s note: The failures of Silicon Valley Bank and Silvergate Bank have many observers of the banking system discussing the possibility of contagion. Even so, many depositors feel safe because their deposits are READ MORE |

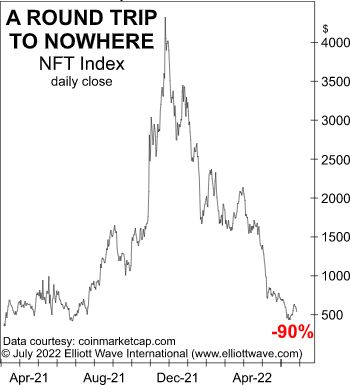

NFT Crash

| Non-Fungible Tokens (NFTs): Another Financial “Fumble” NFTs have taken “a round trip to nowhere” Tampa Bay Buccaneers’ quarterback Tom Brady is a non-fungible token (NFT) enthusiast. However, glory on the football field has not translated to this field of finance (Business Insider, August 8): Tom Brady bought a Bored Ape NFT for $430,000 in April. READ MORE |

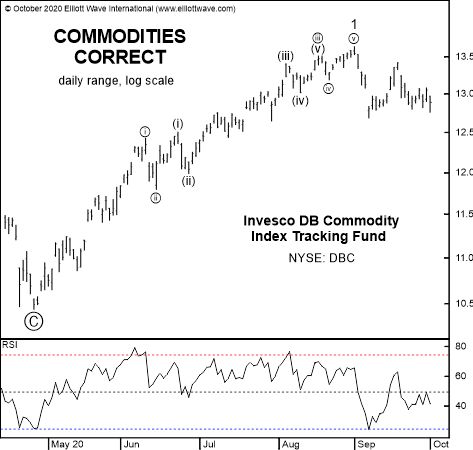

Food and Gas Prices to Increase Even Faster

| Food and Gas Prices: Is the Rising Trend (Finally) Ending? The Elliott wave structure of a key commodity ETF provides a clue. Consumers around the globe are wondering when they will finally see some relief from rising prices at the gas pump and grocery store. It’s difficult for these consumers to get a handle on READ MORE |