| FED rate is at 0% and some people are worried about inflation that may come as the recovery takes hold. Some other people believe deflation is the problem and FED rate should stay at 0%. So, is it really the FED who sets the interest rates in an economy? Utimately, FED does not control the READ MORE |

Category: Economy

Discussion about the state of the economy, social mood, economic signals and their relation to market tops and bottoms.

What Can Movies Tell About the Stock Market

| What Can Movies Tell You About the Stock Market? The following article is adapted from a special report on “Popular Culture and the Stock Market” published by Robert Prechter, founder and CEO of the technical analysis and research firm Elliott Wave International. Although originally published in 1985, “Popular Culture and the Stock Market” is so READ MORE |

Extreme Sentiments Threaten European Union

| The similarities between Greece and pre-WWII Germany are striking Extreme sentiments threaten Europe. Nazi salutes. Praise for Adolf Hitler. Swastika-like banners. Now, before you write off this warning as a run-of-the-mill, Nazi-name-dropping scare tactic, consider this recent report from the Socionomics Institute, a U.S.-based think tank that studies global trends in social mood. Here’s an READ MORE |

Deflation in Europe

| History shows that the U.S. should pay attention to economies in Europe The economy has been sluggish for five years. There’s no shortage of chatter about “why,” yet few observers mention deflation. One exception is a hedge fund manager who spoke up at the recent Milken Institute Global Conference. The presentation by Dan Arbess, a READ MORE |

How Deep Will the Cuts in Government Services Go?

| “Localities have chopped 535,000 positions since September 2008…” USA Today (10/18) Cuts in government services became conspicuous after the 2007-2009 financial crisis. The first edition of Robert Prechter’s Conquer the Crash saw this coming, even though the book published nearly a decade ago: “Don’t expect government services to remain at their current levels…The tax receipts READ MORE |

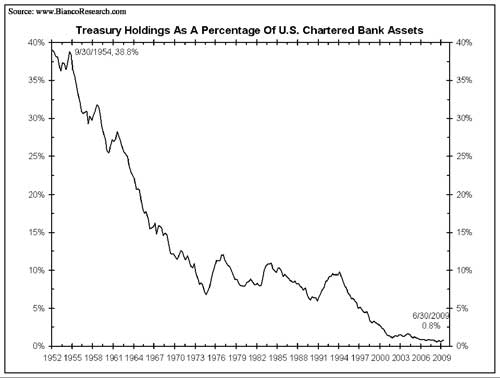

Is Your Bank Safe?

| Bank failures continue to increase every year since the recession begun. FDIC guarantee is still 250,000 dollars. But if dominos start falling, will FDIC be able to guarantee your bank accounts? Or should you consider looking into the safety of your own bank? World’s 15 Biggest Banks Get Downgraded Another one of Robert Prechter’s Conquer READ MORE |

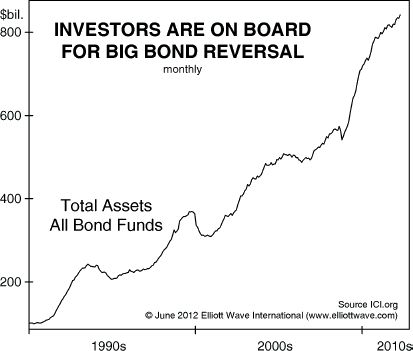

The Bond Market Bubble is About to Pop

| Why risk in the rebalanced portfolio is getting bigger Surprisingly, after the great stock market run of 1980s and 1990s, a decade of ups and downs in stocks left bonds ahead. Yes, bonds have outperformed stocks for the last 30 years. But how long can the bond miracle last? Bonds are deemed to be stable READ MORE |

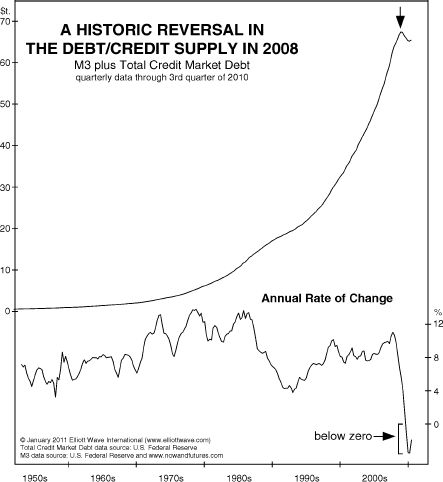

How Does Money Disappear?

| In 2008, after a day of major crash George Bush went on TV and said a trillion dollars of wealth has just disappeared. Is that really true? Is it really the case that people had a combined trillion dollars that just evaporated when the market crashed? How Does Money Disappear? The bursting of the “debt READ MORE |

Does Deflation Remain a Threat?

| A 90-Page “Deflation Survival Guide” Gives the Answer “Every excess causes a defect; every defect an excess. Every sweet hath its sour…The waves of the sea do not more speedily seek a level from their loftiest tossing, than the varieties of condition tend to equalize themselves.” This quote comes from Ralph Waldo Emerson’s essay, “Compensation.” READ MORE |

Money, Credit and the Federal Reserve Bank

| Money, Credit and the Federal Reserve Bank The world’s foremost Elliott wave expert Robert Prechter goes “behind the scenes” on the Federal Reserve The ongoing economic problems have made the central bank’s decisions — interest rates, quantitative easing, monetary stimulus, etc. — a permanent fixture on six-o’clock news. Yet many of us don’t truly understand READ MORE |

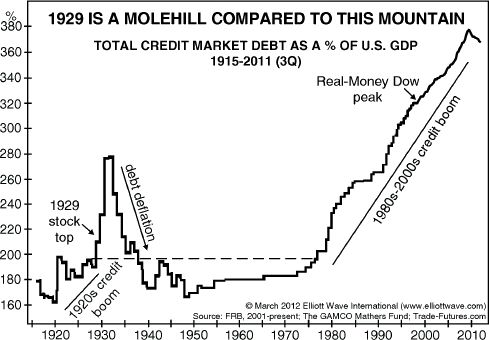

Signs of Deflation

| Signs Of Deflation By Elliott Wave International As the biggest credit bubble in history continues to shrink, consumer prices have stayed flat over the past several months, meaning there is no sign of inflation to come, despite growing commitments from the U.S. government. So what’s keeping inflation at bay, given all the stimulus money promised? READ MORE |

Goldman Sachs Charged With Fraud

| Goldmand Sachs is charged by SEC and the financial stocks were hit by the news. But Elliott Wave International has warned investors long time ago that Goldman Sachs may not survive this bear market. Goldman Sachs Charged With Fraud: Who Could Have Guessed? The firm’s history suggests its vulnerability in periods of negative social mood. READ MORE |

Europe’s Return to Risky Investment

| As the markets go higher, people who buy stocks tend to feel more secure. Finance is one area where normal economic theories do not work. When you go to a shoe store, you look for cheap prices. If the prices appear high, you may wait for the sale. However, in financial markets, as the prices READ MORE |

Credit Default Swaps Indicate Trouble For Europe

| Debt crisis in the headlines of the mainstream media again. Why do we care about the debt of Greece? Portugal? Spain? Why is high levels of debt deflationary? How can this excessive debt effect global recovery? We got help from Elliott Wave International to answer these questions. Credit Default Swaps Indicate Trouble for European Debt READ MORE |

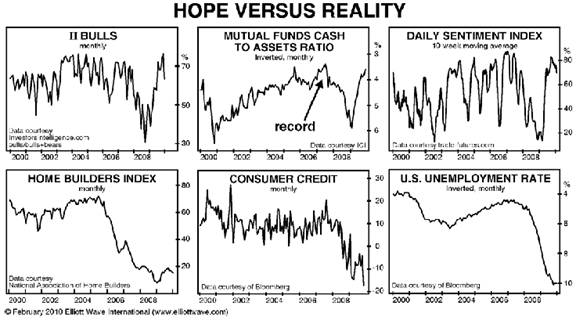

Empty Malls in China

| Mainstream media has been beeting the drums and announcing that recession is over. According to the experts recovery is well in progress. 3% GDP growth is expected in the near future. Virtually nobody sees going back to the March lows in the stock market. Let us put some cold water on this heated enthusiasm and READ MORE |