| Stock Market’s Character Has Changed — Here’s How We’re watching the VIX or “fear index” to see what’s next Stock market investors naturally want to know the closing numbers for the main stock indexes at the end of each trading day. Yet, it’s also good to dig deeper. Let me show you some examples of READ MORE |

Category: Stock Market

Discussion about the stock market, trading and investment, market timing.

Seasonal Tendencies

| Stocks: Keep This in Mind About Seasonal Tendencies “In 1987 and 2000, the month of August presented a great chance to sell stocks” Many investors know that some time periods of the year tend to be more bullish for stocks, like the holiday season. Other times tend to be more bearish, like September and October. READ MORE |

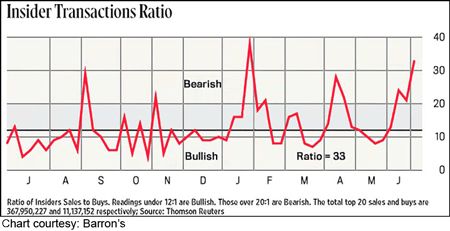

Insiders Selling

| Pay Attention to This Group of Investors (They Know More) The stock market actions of corporate insiders is revealing It stands to reason that executives of a corporation know more about the goings-on of their business than outsiders. So, it’s wise to pay attention to their stock market actions regarding their own shares. Yes, the READ MORE |

Platinum Selloff

| Platinum’s May-June Selloff: When the “Fundamental” Chips Fall In May, a “record supply deficit” should’ve sent platinum prices soaring. So much for the best laid “fundamental” plans. If I had a nickel for every time someone asked me what value “fundamentals” serve in navigating financial markets, well… let’s just say I could’ve retired to the READ MORE |

How Major Financial Trends End

| Robert Prechter Interview for the Ages: Quick Takes on Big Financial Trends ‘That’s not even the craziest indicator on this chart. Look at the bottom graph.’ Robert Prechter’s June 23 interview with GoldSeek.com, which is under 15 minutes, covers a variety of financial topics. They include stocks with an emphasis on the technology sector (including READ MORE |

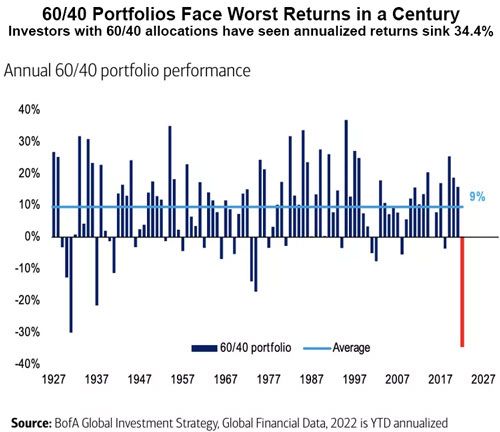

Advisors Take Heat

| Financial Advisors Take Heat for Market Losses (Will Anger Intensify?) Was 2022 an aberration for the 60/40 allocation? Many financial advisors steer clients who are willing to take some risk toward a 60% stocks / 40% bonds portfolio. Alas, investors who followed that strategy in 2022 saw the value of their portfolios decrease substantially. In READ MORE |

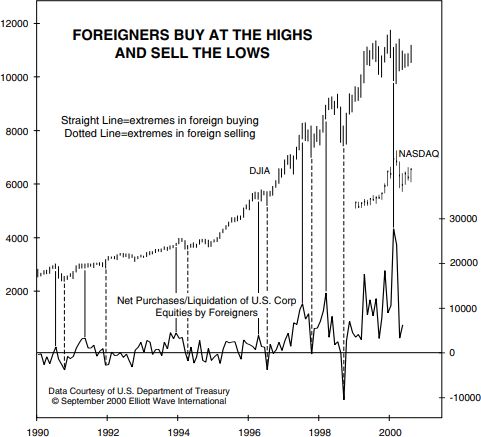

Foreign Buyers Jump Into Stocks

| Overseas Buyers Scoop Up U.S. Shares (Bullish or Bearish)? “No crowd buys stocks of other countries intelligently” The fact that investors from other countries are feverishly buying U.S. stocks might seem like a bullish sign. On the other hand, consider what Robert Prechter said in his book, Prechter’s Perspective: No crowd buys stocks of other READ MORE |

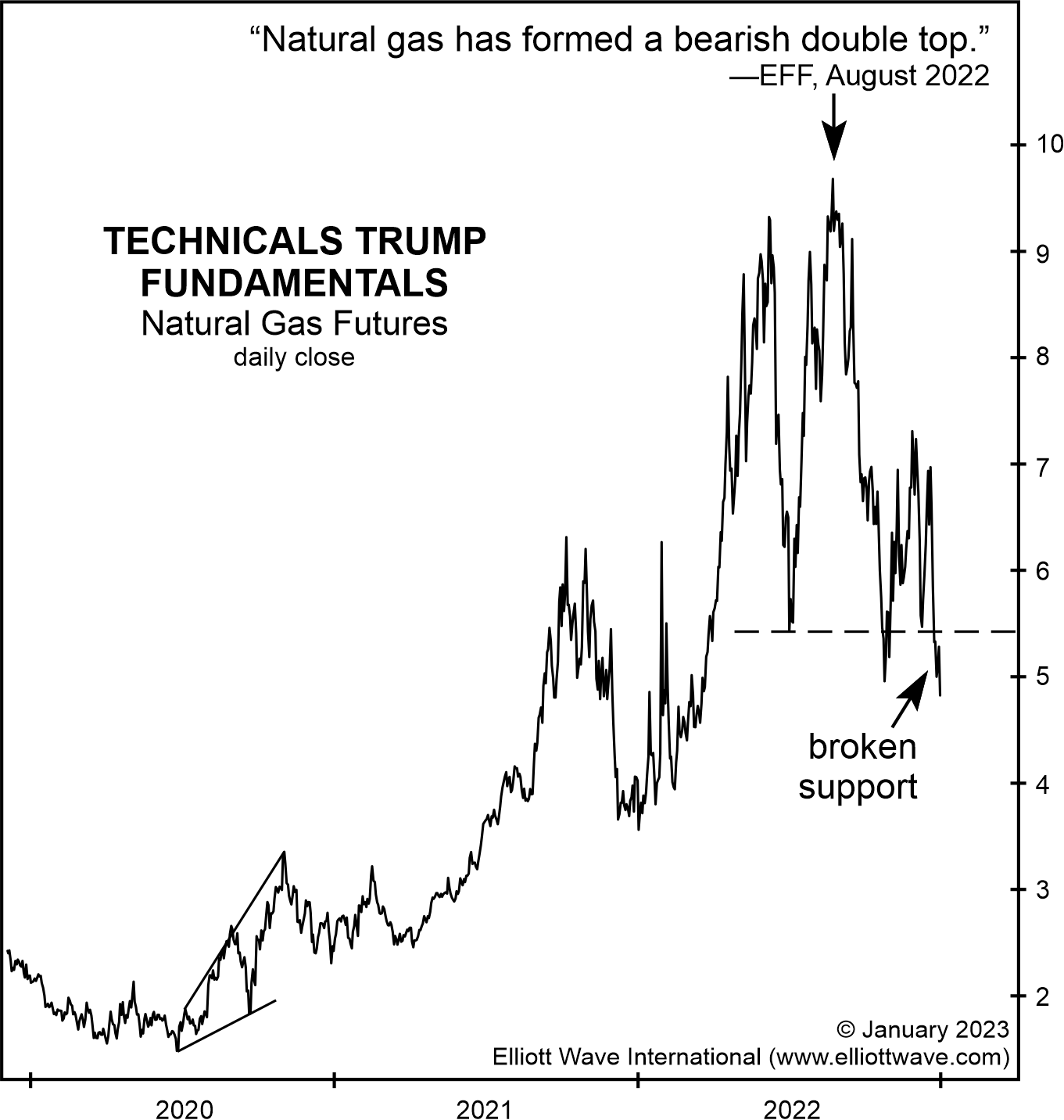

Double Top in Natural Gas

| Natural Gas: Here’s What Happened After a “Double Top” A key technical pattern warns of a reversal It probably won’t be a surprise to you that Elliott Wave International is an advocate of technical analysis. After all, the Elliott wave method is a form of technical analysis. You probably know that the term “technical analysis” READ MORE |

Sentiment Offer Clues About What is Next

| Stocks: How Sentiment Measures Offer Clues About What’s Likely Next Insights into the stock market as a fractal Elliott Wave International’s analysts track dozens of indicators, and our U.S. Short Term Update pays particular attention to those which may offer clues about the near-term. Consider this analysis from the Sept. 26 U.S. Short Term Update, READ MORE |

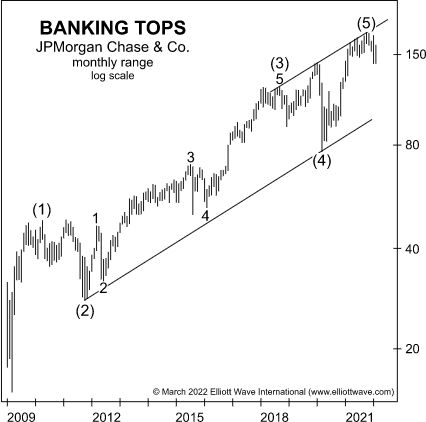

Elliott Waves in Individual Stocks

| Yes, Elliott Waves Work with Individual Stocks — Here’s How “The primary value of the Wave Principle is that it provides a context for market analysis” Elliott waves reflect the repetitive patterns of mass psychology — so they are ideally suited for analyzing the widely traded main stock indexes. On the other hand, thinly traded READ MORE |

Key Insight About Bear Market Rallies

| Bear Market Rallies: Here’s a Key Insight How investors get snookered into the belief of “a further market advance” Nothing raises the hopes of the bullishly inclined like a rapid bear market rally. And there’s been several since the early January top in the Dow Industrials and S&P 500 index. You may be interested in READ MORE |

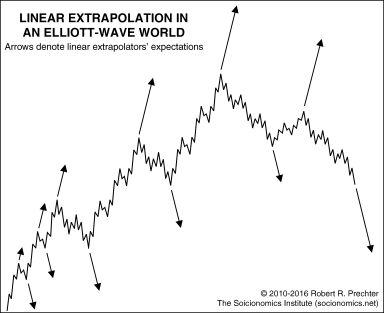

Most Miss Market Turns

| Why Most Investors Are “Doomed” to Miss Major Market Turns “The arrows show how conventional futurists approach forecasting” The reason why most investors miss key turns in financial markets is that they linearly extrapolate a trend into the future. If a market is going down, these investors expect that market to continue to go down READ MORE |

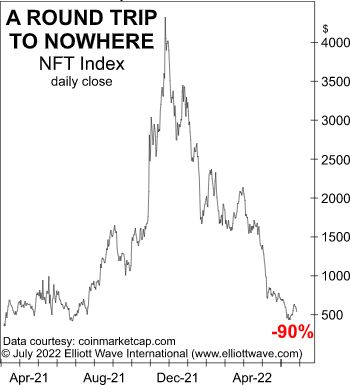

NFT Crash

| Non-Fungible Tokens (NFTs): Another Financial “Fumble” NFTs have taken “a round trip to nowhere” Tampa Bay Buccaneers’ quarterback Tom Brady is a non-fungible token (NFT) enthusiast. However, glory on the football field has not translated to this field of finance (Business Insider, August 8): Tom Brady bought a Bored Ape NFT for $430,000 in April. READ MORE |

IPO will Disappear

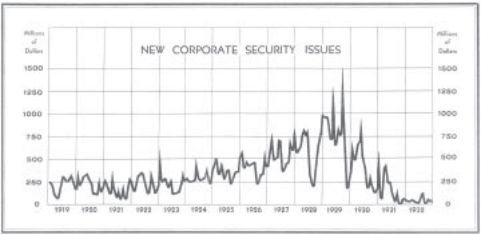

| Here’s Why IPOs Will Likely Dwindle to Near Zero “The IPO market is fizzling” Financial activity is usually abuzz during times of financial optimism, such as the issuance of initial public offerings (IPOs). An IPO means that a company is transitioning from private to public ownership. The process involves selling shares to the public for READ MORE |

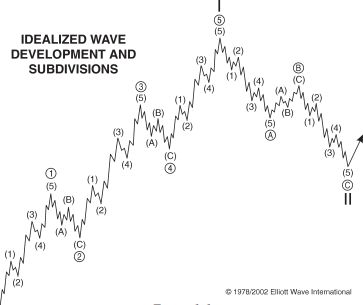

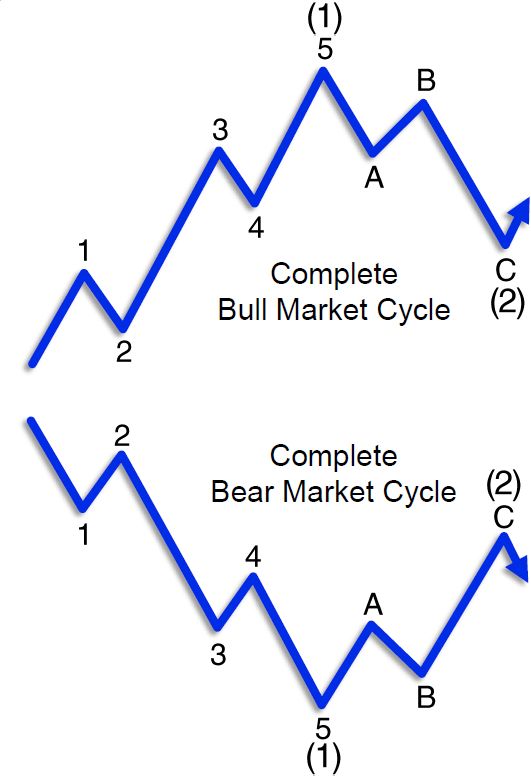

Dow Industrials 8 Wave Cycle

| The Dow Industrials’ Big 8-Wave Cycle is Incomplete “We finally understand our full Elliott wave position” The Wave Principle’s basic pattern includes five waves in the direction of the larger trend, followed by three corrective waves, as illustrated in both bull and bear markets below: Keep in mind that the stock market is a fractal, READ MORE |