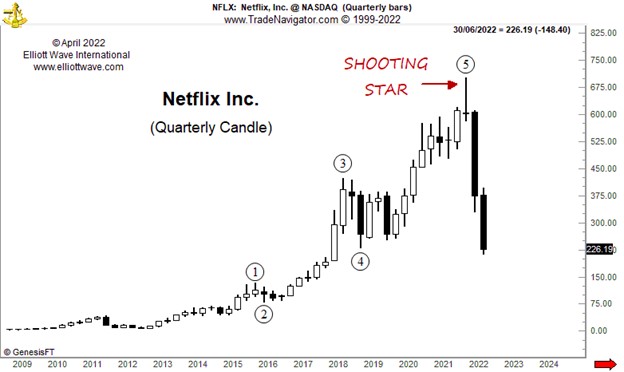

| Another One Bites the Dust – The Deflation of Netflix Bubbles are popping, one by one. The share price of Netflix plummeted last week, coinciding with news that it is losing subscribers, a big change after years of growth. The media and conventional analysts will, of course, link the cause of the share price decline READ MORE |

Category: Stock Market

Discussion about the stock market, trading and investment, market timing.

Sign of a Major Top: M&A

| M&As: Beware of This Major Sign of a Stock Market Top Here’s what often precedes “prolonged and devastating bear markets” Inside the three publications that comprise Elliott Wave International’s flagship Financial Forecast Service, Elliott Wave International recently documented the many expressions of “financial optimism.” Things like crypto mania. Or meme stocks. Or just buying any READ MORE |

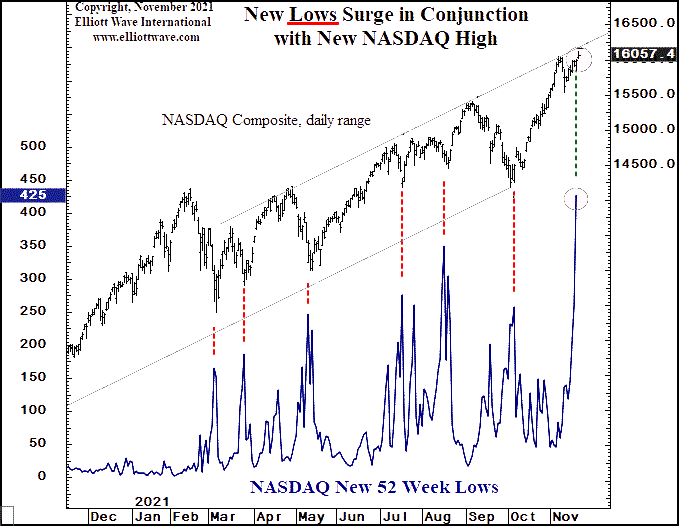

Nasdaq New Lows?

| Insights into a “Remarkable” NASDAQ Development Here’s what usually happens in the stock market when “the troops abandon the generals” You’ve probably heard the phrase: “Appearances can be deceiving.” In other words, it’s usually wise to “take a closer look” because the truth may not be obvious. This applies to various circumstances of life — READ MORE |

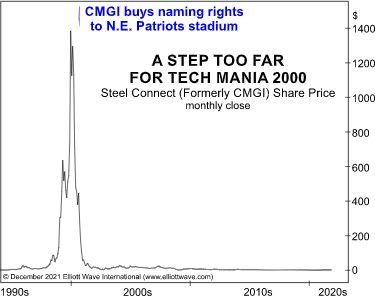

Did the Crypto Bubble Pop?

| Has Crypto-Mania Finally Run Its Course? Here’s a high-profile parallel between tech- and crypto-mania When a company that’s part of a major financial trend buys the naming rights to a professional sports stadium or arena, watch out! History suggests that such a prominent move might be a sign that the fortunes of that company are READ MORE |

Junk Bonds Signal Trouble

| Junk Bonds Are Sending a Signal to Stock Investors Something happened just before the historic 2007 stock market top — and it’s happening again. It’s generally known that stocks are risky. It all hinges on how “hungry” investors are. So, if investors’ appetite for risk starts to diminish, it stands to reason that this is READ MORE |

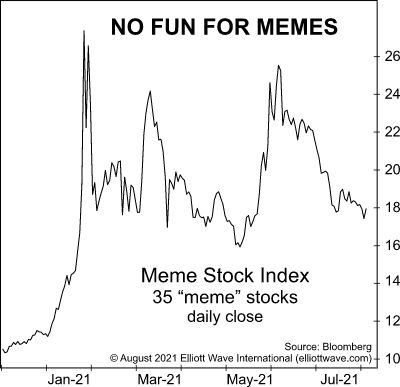

Meme Stocks Decline

| How “Hot” Stock Market Ideas Can Burn Investors The Meme Stock Index sees a 36% decline since January. On July 30, this headline appeared on a well-known investment website: It’s Definitely Possible to Make a Fortune Off Meme Stocks And, it’s definitely true that many investors, especially newbies, have tried. As you probably know, “meme” READ MORE |

Fear of Missing Out – FOMO

| “Everybody’s Getting Rich (and Having Fun) Except Me” The idea of “missing out” on stock market gains “literally generates fear in many people” Hardly anyone wants to miss the party — whether on Wall Street or elsewhere. Thus, the acronym FOMO — which stands for the “fear of missing out” — is in vogue. After READ MORE |

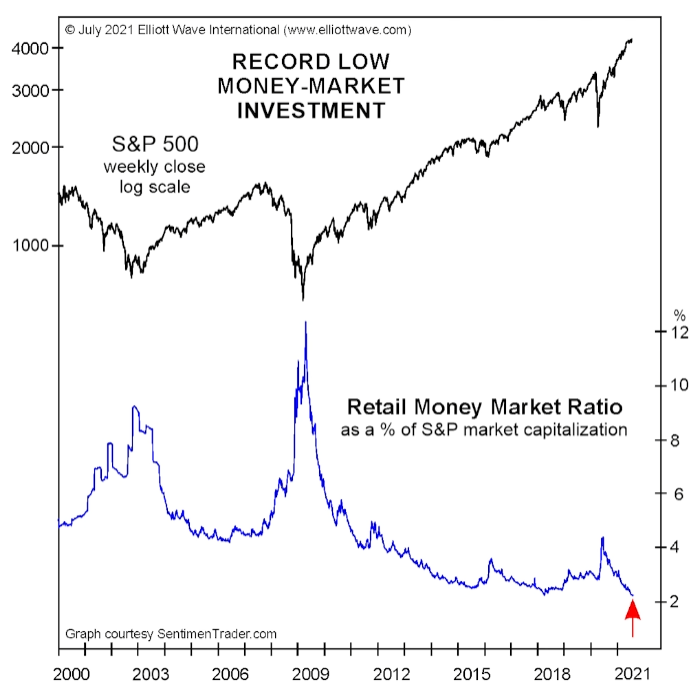

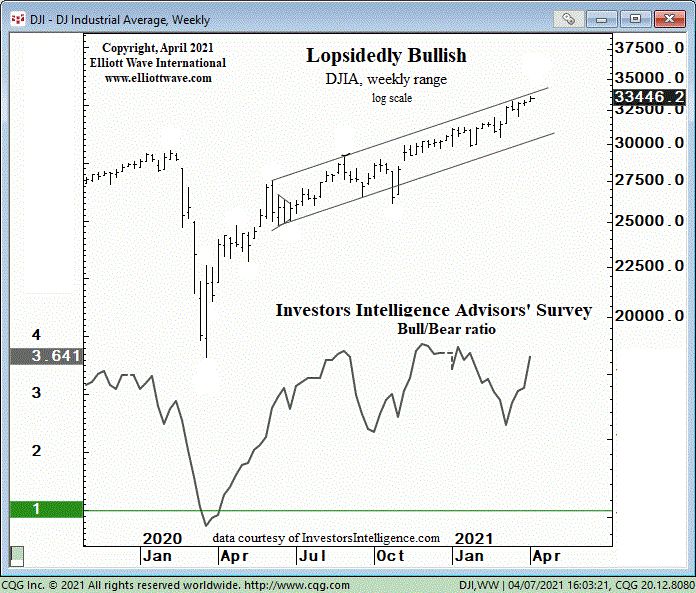

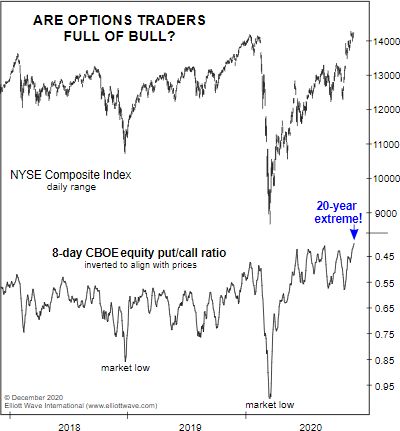

Extreme Bullish Sentiment

| This “Lopsided” Stock Market Ratio Is Sending a Clear Signal. Investors always find ways to “rationalize” bearish or bullish stances. For a stock market investor who understands that markets are not random or chaotic but instead patterned, the most important information to know is the price pattern of the market in question. For an Elliott READ MORE |

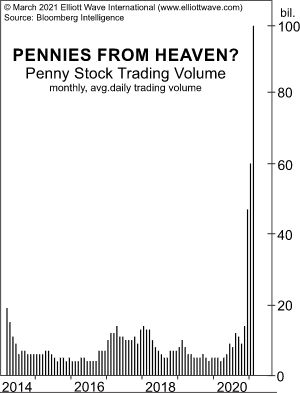

Unprecedented Acceptance of Risk At Peak

| U.S. Stocks: Here’s Evidence of a “Nearly Unprecedented Acceptance of Risk” Penny stocks fever has reached “the highest level since the first three months of 2000” Penny stocks tend to be highly illiquid. In other words, it’s difficult to buy and sell them at favorable prices. Even so, the lure of low-priced shares is hard READ MORE |

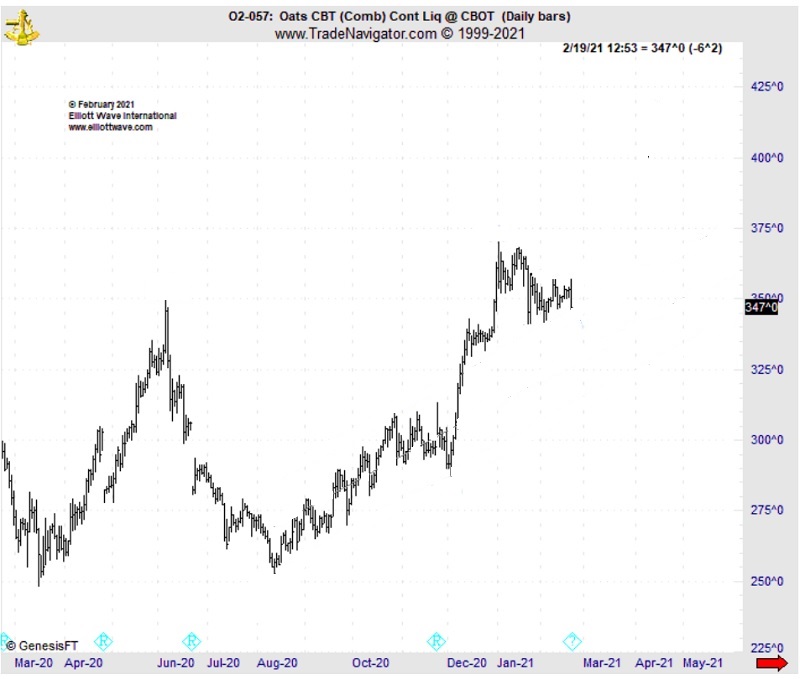

Oat Milk Craze

| Oat Prices AND the Truth Behind the “White Gold” Rush Oat futures’ recent surge to 7-year highs wasn’t caused by the oat milk craze; think “market psychology” instead. Generally speaking, the idea of oats is about as exciting as, well, a bowl of steel cut oatmeal. But this chart of oat futures shows why this READ MORE |

Spike in Volatility Soon

| Stock Market: Why You Should Prepare for a Jump in Volatility This volatility indicator “has made a series of higher lows” — and it’s not a good sign. Stock market volatility is like a roller-coaster ride — extreme ups and downs. However, unlike thrill-seeking roller-coaster riders who often rise from their seats after the ride READ MORE |

Most Investors Miss Major Stock Market Turns

| Will the Dow Industrials hit 100,000 in the next decade? Well, the answer posed by the question in the title is a resounding “yes!” — according to the British financial magazine, MoneyWeek. The cover of the Dec. 4 issue of the magazine is titled “The Roaring 2020s, Prepare Your Portfolio for a Boom.” An image READ MORE |

Borrowed Money, Borrowed Time?

| Margin: How Stock Market Investors Are “Reaching for the Stars” This is the highest ratio in the 20-year history of the data. One of the historic ways that stock market investors exhibit conviction about the direction of prices is to use leverage or participate in the market with borrowed money. Yet another way of putting READ MORE |

Is it Covid that Drives Stocks?

| Do These Explanations Make Sense for This Intraday Stock Market Turn? The market “is not propelled by … external causality” On Oct. 19, the DJIA had been trading higher for much of the morning, but by the last hour of trading, the index was more than 400 points in the red. During that last hour READ MORE |

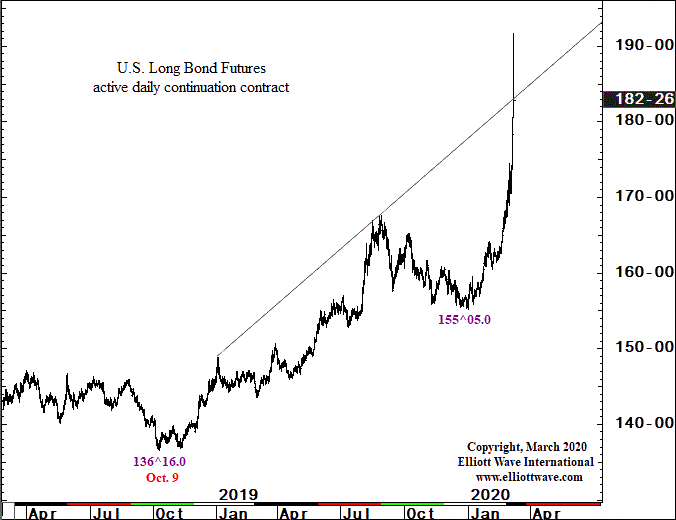

Extreme Sentiment Indicates a Peak in Bonds

| U.S. Long Bond: Let’s Review the “Upward Point of Exhaustion” Here’s an update on the trend of 30-year U.S. Treasuries since the historic early March price moves. Back in early March, the behavior of the bond market was reminiscent of what unfolded during the depths of the 2007-2009 financial crisis. Prices and yields were making READ MORE |