| Let’s start by establishing that the stock market is not driven by the news. Aggregate stock prices are driven by waves of optimism and pessimism — which go from one extreme to another — as reflected by the Elliott wave model. That’s what makes the stock market predictable. Hence, Elliott wave analysis is at the READ MORE |

Category: Stock Market

Discussion about the stock market, trading and investment, market timing.

Recognize a Weakening Trend

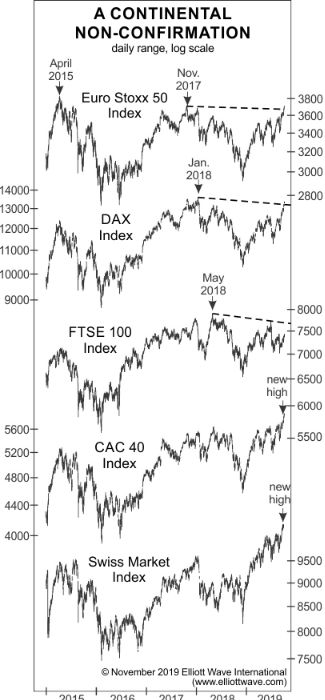

| Pay Attention to “Non-Confirmations” When a trend is strong, related markets tend to move in unison. However, when a trend is near exhaustion — a bullish or bearish trend, “non-confirmations” often occur. A non-confirmation occurs when one market makes a new high (or low), but a related market does not. As cases in point, our READ MORE |

Bear Market Half Way?

| This Will Signal the Bear Market’s Halfway Point On March 12, the date the DJIA closed lower more than 2350 points, the U.S. chief equity strategist for a major financial firm appeared on Bloomberg after the market close and opined that “90% of the damage has been done.” He went on to affirm that if READ MORE |

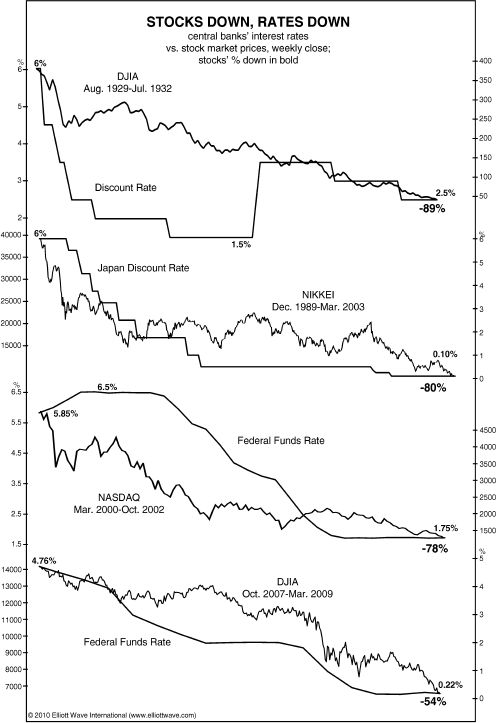

Is a Dovish FED Bullish for the Stock Market?

| Is an Accommodative Fed Bullish for the Stock Market? “In 2007-2008, the Fed cut rates 10 times, but the S&P 500 still declined 58%” Many investors heed every utterance from the Federal Reserve, hoping they hear a clue about interest rates. They assume that a fall in interest rates means higher stock prices, while rising READ MORE |

Elliott Wave Principle a Marvel of Technical Analysis

| Just when you thought there’d been every possible adaptation of the Marvel comics movie franchise, we’ve thought of one more: A Marvel installment based on financial market analysis. At one end of this Marvel market universe is Technipede: Like the insect he’s named for, Technipede uses hundreds of technical disciplines to stand on for evaluating READ MORE |

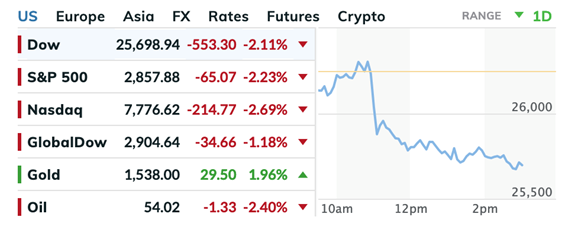

Stocks are red, why?

| Just Thursday — or even on Friday morning — it seemed that stocks were finally out of the woods. But as I’m typing this… Our friends at Elliott Wave International had a hunch this would happen. Here’s what their Short Term Update wrote Wednesday night: “The harmony of the major averages is out of whack, which is READ MORE |

How to Capitalize on Market Corrections

| 90% of traders throw in the towel. One of the main reasons is because they don’t have a method. Elliott Wave Principle is one of the most popular investment method books ever published. Now, we’re working with Elliott Wave International to celebrate the book’s 40th anniversary by giving you free access to Bob Prechter’s bestseller. READ MORE |

Will the Feds Rate Hikes Choke the Stock Market Rally

| Fact: The direction of interest rates does not determine the stock market’s trend. Investing is hard. You, like many others, probably watch financial TV networks, read analysis, listen to talk shows and talk to fellow investors, trying to understand what’s next. One popular stock market “indicator” is interest rates. Analysts parse every word from the READ MORE |

Most Traders Lose Money

| 90% of Traders Lose Money. Some Don’t… See how Elliott wave pattern analysis helped “craft a rock-solid trade” in ROKU in late November 2017 Fact: 90% of traders lose money. Also a fact: 80% of all day traders quit within the first two years. And, according to a July 16, 2017 Forbes article titled “Day READ MORE |

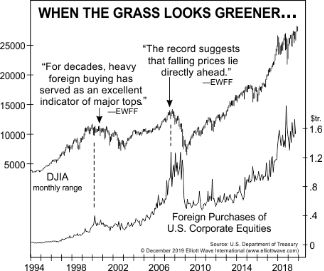

Indicator’s 30-Year Track Record is Flashing Red for Stocks

| 3 Videos + 8 Charts = Opportunities You Need to See. Join this free event hosted by Elliott Wave International and you’ll get a clear picture of what’s next in a variety of U.S. markets. After seeing these videos and charts you will be ready to jump on opportunities and sidestep risks in some READ MORE |

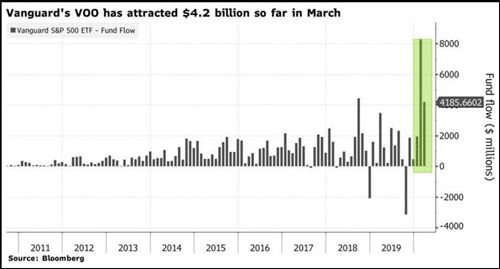

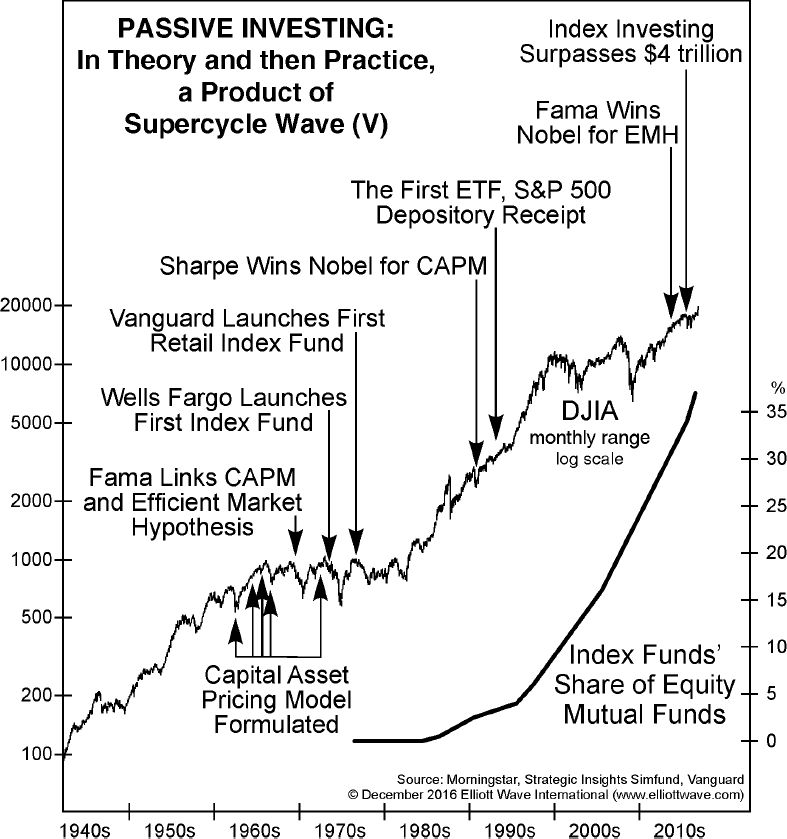

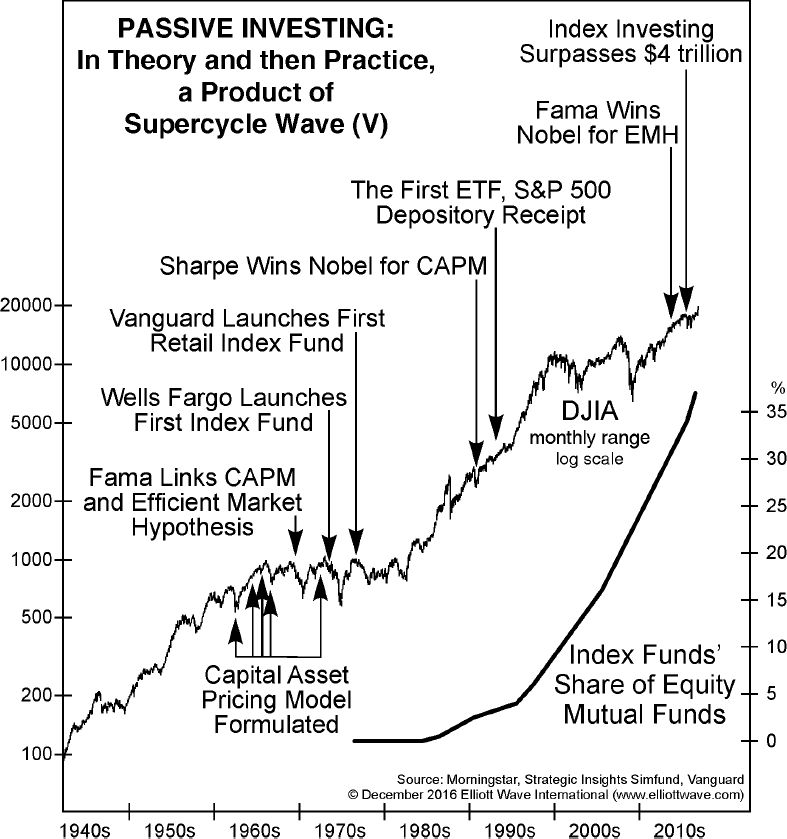

Passive Investing Push Reaching Peak

| What the New Passive Investing Push Tells You The popularity of exchange-traded funds fits with the market’s Elliott wave structure Stock picking is losing favor. On the other hand, passive investing is growing in popularity. This fits with the stock market’s Elliott wave pattern. The mania is not over, but the end might be closer READ MORE |

Gold, Oil and Other Commodity Forecast

| Are you paying attention to commodities? You should be. Major moves in oil, gold and other commodities have offered up huge opportunities for traders in 2017. Our friends at Elliott Wave International have kept our subscribers ahead of many big commodity moves. And now, they want to prepare YOU for what’s next — free. Free Instant READ MORE |

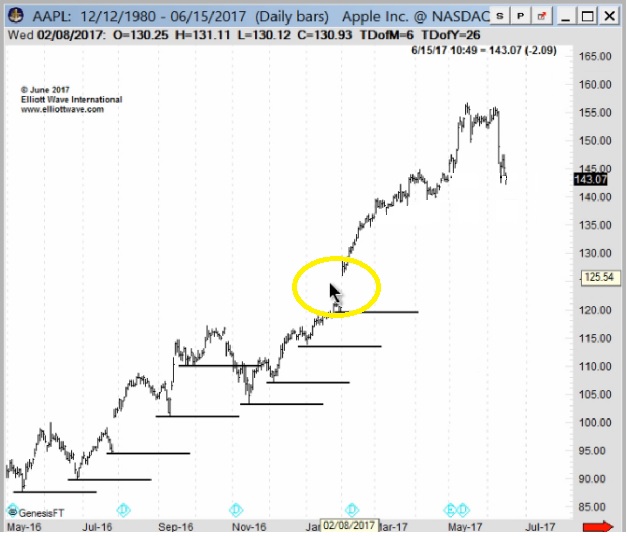

Has Apple Stock Topped?

| Does AAPL’s 6% June slide indicate that a top is already in? On June 29, the Apple iPhone turned 10 years old. But, for many, the mood surrounding the milestone was less than celebratory. Reason being, in June alone, Apple Inc. (AAPL) plunged 6% to two-month lows amidst a broad-scale bruising of the global tech READ MORE |

Passive Investing Push Signals End of Bull Run

| What the New Passive Investing Push Tells You The popularity of exchange-traded funds fits with the market’s Elliott wave structure Stock picking is losing favor. On the other hand, passive investing is growing in popularity. This fits with the stock market’s Elliott wave pattern. The mania is not over, but the end might be closer READ MORE |

Bull Markets Move in 5 Waves

| How One Forecasting Tool Defied the Bull Market Naysayers Three compelling Elliott wave charts lay it all out. The Elliott wave model often indicates a stock market outlook that’s at odds with the sentiment of the crowd. But, that’s okay. The crowd is usually wrong at major market turns. For example, two years ago on READ MORE |