| Are you paying attention to commodities? You should be. Major moves in oil, gold and other commodities have offered up huge opportunities for traders in 2017. Our friends at Elliott Wave International have kept our subscribers ahead of many big commodity moves. And now, they want to prepare YOU for what’s next — free. Free Instant READ MORE |

Category: Stock Market

Discussion about the stock market, trading and investment, market timing.

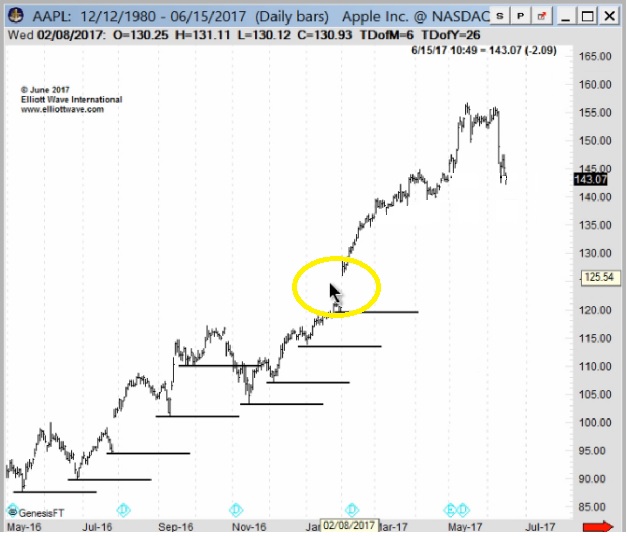

Has Apple Stock Topped?

| Does AAPL’s 6% June slide indicate that a top is already in? On June 29, the Apple iPhone turned 10 years old. But, for many, the mood surrounding the milestone was less than celebratory. Reason being, in June alone, Apple Inc. (AAPL) plunged 6% to two-month lows amidst a broad-scale bruising of the global tech READ MORE |

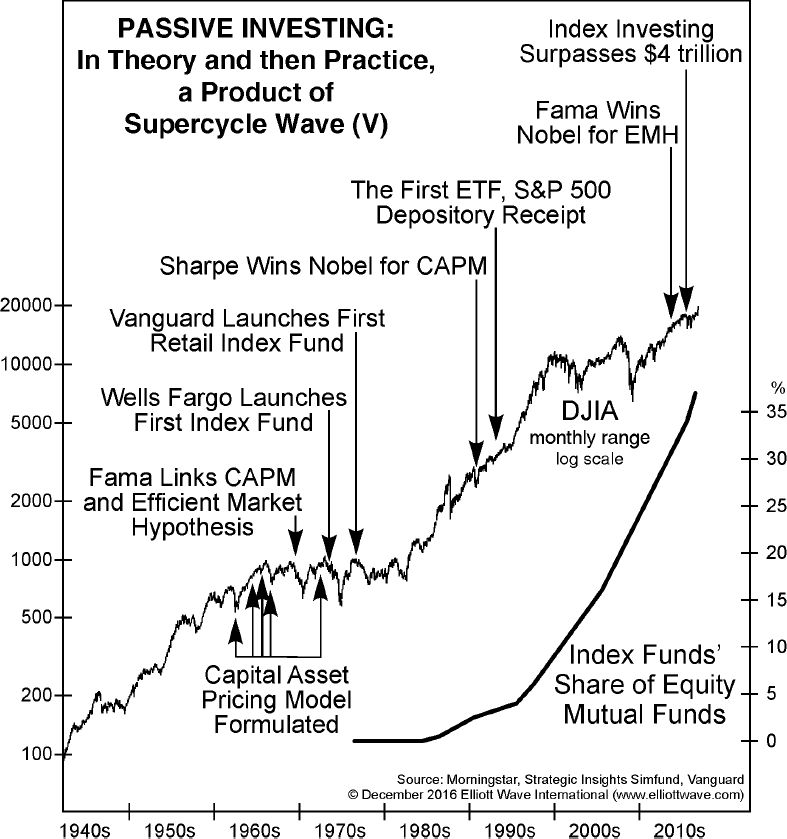

Passive Investing Push Signals End of Bull Run

| What the New Passive Investing Push Tells You The popularity of exchange-traded funds fits with the market’s Elliott wave structure Stock picking is losing favor. On the other hand, passive investing is growing in popularity. This fits with the stock market’s Elliott wave pattern. The mania is not over, but the end might be closer READ MORE |

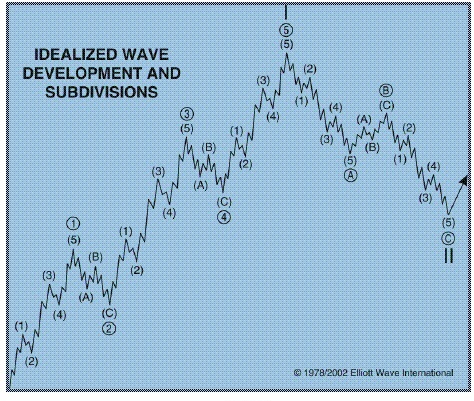

Bull Markets Move in 5 Waves

| How One Forecasting Tool Defied the Bull Market Naysayers Three compelling Elliott wave charts lay it all out. The Elliott wave model often indicates a stock market outlook that’s at odds with the sentiment of the crowd. But, that’s okay. The crowd is usually wrong at major market turns. For example, two years ago on READ MORE |

Trump Card was the Market’s Destiny

| The “Trump Bump” Was in the Cards LONG Before Trump How to breach limitations of conventional market forecasting Get the Free Elliott Wave Tutorial Learn how you can apply the Wave Principle to improve your trading and investing in this free 10-lesson tutorial. You’ll learn: What the basic Elliott wave progression looks like Difference between READ MORE |

Elliott Waves in India’s Bull Market

| India’s Stock Market: Nothing “Random” About It Back in 2009 we made a bull market prediction for India’s stock market, and SENSEX. So far the bull market is still on track. See how beautifully India’s 8-year long bull market follows a clear Elliott wave fractal pattern Every day, the mainstream financial experts attempt to explain READ MORE |

Charts and Politics

| 3 Killer Charts, 2 Fast Looks at Politics Global Market Perspective is Your Roadmap to Global Investment Opportunity Covering more than 40 markets on 50-plus pages each month, Global Market Perspective prepares subscribers for opportunities around the world. Get the latest forecasts for U.S., Asian-Pacific and European stocks and economies, global currencies, bonds, crude oil READ MORE |

The Trend is Set

| What You Should Pay Attention to Next Steve Hochberg and Pete Kendall, co-editors of our monthly Financial Forecast, sat down with ElliottWaveTV to discuss the volatility that followed Thursday’s Brexit vote. Learn what the Brexit vote represents — and its implications for the world markets and economies. Volatility is Raging — Prepare for what’s next, READ MORE |

Global Markets Report for 2016

| Where is the Stock Market headed? State of the Global Markets Report — 2016 edition, one of the most anticipated annual reports for investors and technical analysts, has just been released, and the first 10,000 copies can be reserved right now 100% free. After that, it goes to $99 per download, where it will stay READ MORE |

Can the Money Disappear in Stocks?

| Can Stock Values Simply “Disappear”? Yes. And it’s happened before, too — just think back to the 2007-2009 financial crisis. You see, the money was never there to begin with. When your stock portfolio shows you have a million dollars worth of stocks, it simply means you can get million dollars if you can sell READ MORE |

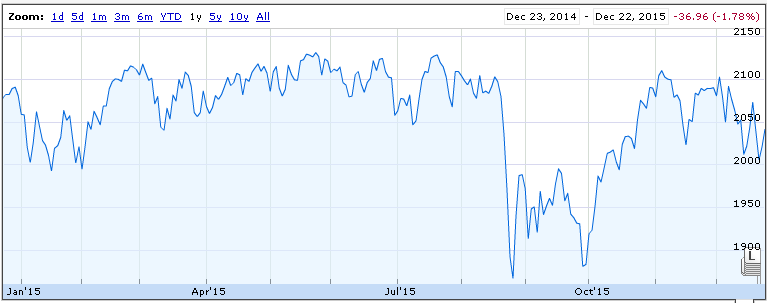

Risk On, Risk OFF?

| Stocks got no-where in 2015. Gold topped back in 2011, oil bounce topped 2014. Various commodities resumed their decline during the last few years. Where is the stock market headed? Risk On? Risk Off? Find Out Where Your Money Lies A peek at the new free report from the editors of our Financial Forecast Service READ MORE |

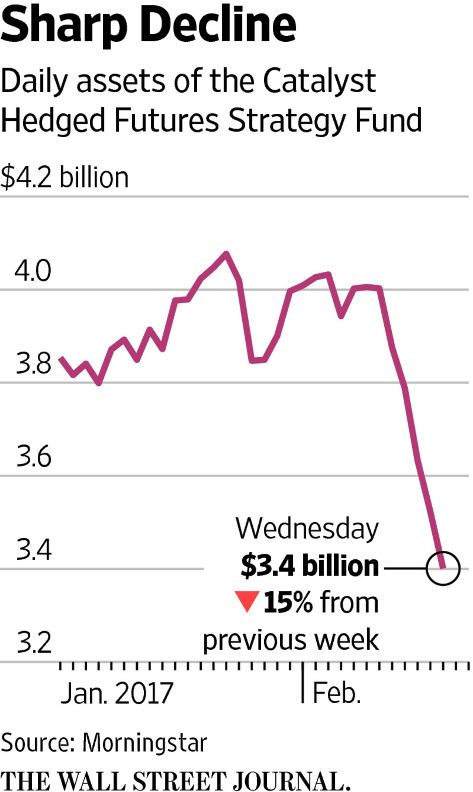

It is a Mistake to Follow the Crowd

| We’ve seen it time and again: The investment crowd often hops aboard a financial trend just as it’s about to end. Government itself is actually a case in point. Here’s what the August 2007 Elliott Wave Financial Forecast said: [In July], The Elliott Wave Financial Forecast discussed governments’ knack for committing to a trend when READ MORE |

DOW Falls 1000 Points in a week

| Markets are crashing around the world. US is no exception. After a long bull run, 50 and 200 day averages are breached by the sharp decline in S&P 500. 50 day average may soon cross below 200 day for the first time after a many years in many of the market indices. This week’s stunning sell-off READ MORE |

The World is Awash in Oil

| …But does that mean that oil prices will only go down from here? In this new interview with Elliott Wave International’s Chief Energy Analyst, Steve Craig, you’ll learn where he sees prices going next. *Editor’s note: this interview was recorded on August 12; the price low cited in the video was broken on August 13. READ MORE |

NASDAQ Leads the Stock Market Bubble

| Another bubble is about to pop. In March 2015, we covered the return to a popular fascination with technology. The striking resemblance to 2000’s technology mania is not going unnoticed. How can it? With the NASDAQ’s much heralded return to 5000 and magazine covers proclaiming “Google Wants You To Live Forever,” concern about an “asset READ MORE |