| DOW Priced in Gold: What Does It Mean for the Long-Term Trend? Of the many forward-looking market indicators we at EWI employ, one of the most interesting tools (and least discussed in the financial media) is the DJIA priced in gold — “the real money,” as EWI’s president Robert Prechter calls it. What implications might READ MORE |

Category: Stock Market

Discussion about the stock market, trading and investment, market timing.

Extreme Sentiment Signal Stock Market Top

| EXTREME SENTIMENT SIGNALS TREND CHANGE In March 2009, stock prices were at a 12-year low, and the Dow Industrials were down 54% from the 2007 peak. You’d have needed to search far and wide to find someone calling for a rebound. Most investors feared that more of the same was ahead for stocks. But on READ MORE |

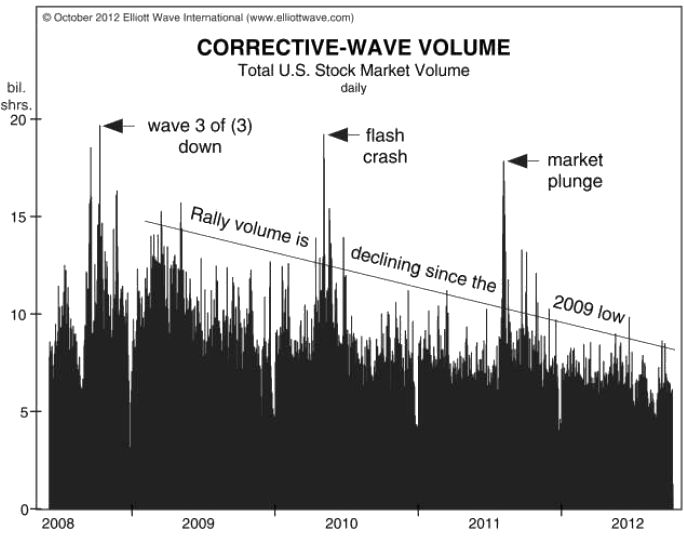

Declining Volume Spells Trouble

| Declining Volume Signals Market Trouble The three-and-a-half-year rally has occurred on declining volume What a comeback for the Dow Industrials! From a March 9, 2009, close of 6,547, the senior index climbed to 13,610 on Oct. 5, 2012. Moreover, the Dow achieved this feat in the face of a weak-kneed economy, and it has grinded READ MORE |

Stock Market Crash – How Low Can it Go?

| The stock market had ups and downs but over all we did fairly well. Unemployment remains stubbornly high but bonds and equities and recently housing had price gains. At least that has been the story of the last two years even though Asia and European markets have topped and have been declining since 2010 and READ MORE |

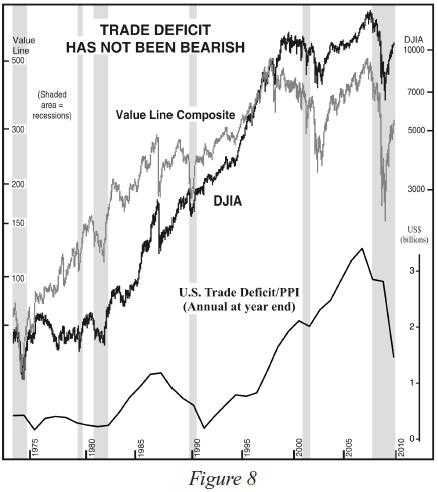

Is Lower Trade Deficit Bullish for the Market

| US trade deficit is lower for the past year and the government is trying hard to further lower it. Deficit cannot be maintained forever so we have to do something about it and the government is motivated. It makes sense to have a balanced trade for the overall economy. But is that something to celebrate READ MORE |

Does Diversification Work?

| Why Diversification Does Not Work in Today’s Market Prechter and Kendall’s “All the Same Market” Analysis Shows how Diversification Can’t Protect You from Correlated Risk A dear friend of mine wants to celebrate an important health milestone by going skydiving with friends. She feels happy and healthy and excited. She wants to do something very READ MORE |

Investors Jump Into The Fire – Junk Bonds

| I spent my childhood discussing the stock market at the dinner table. My dad was a stock broker, and he loved to “tell the story” of the stocks he recommended to the customers – a story that included critical information about macro economics, the industry, the products, earnings, and the outlook for the future. Most READ MORE |

Efficient Market Hypothesis

| Efficient Market Hypothesis: Is the Market Efficient at all? In finance, the efficient-market hypothesis (EMH) asserts that financial markets are “informationally efficient”. That is, one cannot consistently achieve returns in excess of average market returns on a risk-adjusted basis, given the information publicly available at the time the investment is made. The validity of the READ MORE |

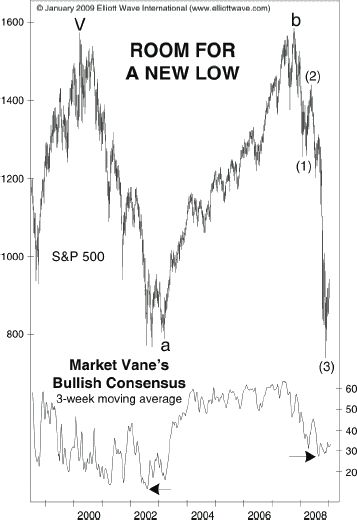

Stock Market Bottom

| Have We Seen The Stock Market Bottom? Stock market has rallied from the March lows as predicted, but is it a new bull market, or is it a bear market rally? Elliott Wave International has made intensive research to identify the economic and technical indicators that signal a market bottom. And no, we have not READ MORE |

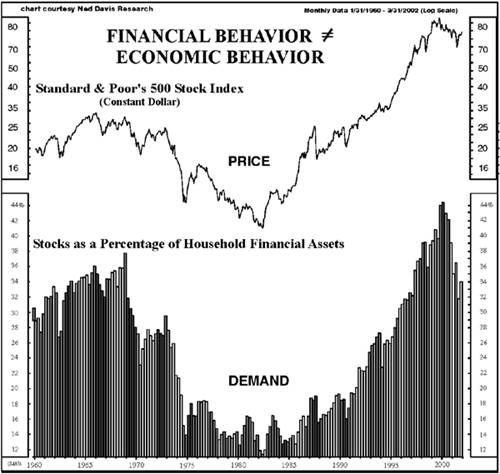

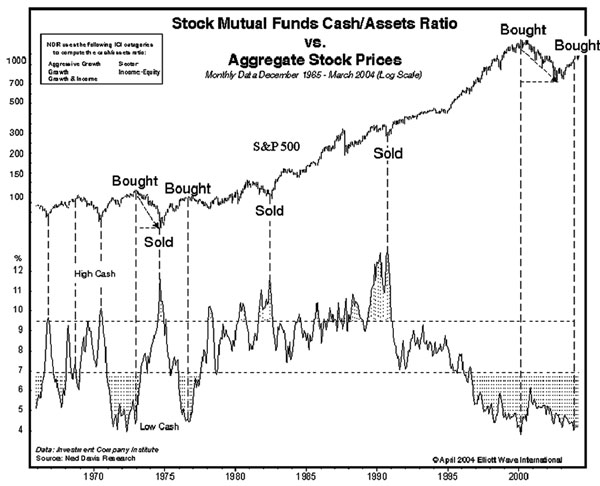

Herding and Markets

| Robert Prechter on Herding and Markets’ “Irony and Paradox” To anyone new to socionomics, the stock market is saturated with paradox. The following is an excerpt from a classic issue of Robert Prechter’s Elliott Wave Theorist. For a limited time, you can visit Elliott Wave International to download the rest of the 10-page issue free. READ MORE |

Fatal Flaws of Traders

| Paper Trading Is NOT What Will Teach You To Trade Paper trading is only useful for the testing of your methodology. By Editorial Staff This is an excerpt from Elliott Wave International’s free Club EWI resource, “What a Trader Really Needs to be Successful” — a classic Special Report by EWI’s president Robert Prechter. … READ MORE |

The Lost Decade of Stock Market

| If You Think the Past Decade Was Bad For Stocks, Wait Till You See This The major stock indexes are the wrong place to look By Robert Folsom A well-known business magazine recently published a story with this headline: Stocks: The “Loss” Decade A disastrous ten years for the stock market ends in just a READ MORE |

The Black Monday

| Black Monday: Ancient History Or Imminent Future? By Nico Isaac The following article includes analysis from Robert Prechter’s Elliott Wave Theorist. For more insights from Robert Prechter, download the 75-page eBook Independent Investor eBook. It’s a compilation of some of the New York Times bestselling author’s writings that challenge conventional financial market assumptions. Visit Elliott READ MORE |

Germany’s DAX: Insight into Europe’s Leading Economy

| Germany’s DAX: FREE Insight Into Europe’s Leading Economy By Elliott Wave International It’s one of the first rules in the book of mainstream economic wisdom: a country’s economy is the thermometer which “reads” its stock market’s temperature. If financial conditions are heating up, stocks rise; if they are cooling down, stocks fall. Were it so READ MORE |

Will SENSEX Reach 100,000?

| A Road Map To SENSEX 100,000 By Mark Galasiewski This article was originally published as a special Interim Report of EWI’s Asian-Pacific Financial Forecast on March 23, 2009. Since then the SENSEX has risen as much as 65%. For a limited time, Elliott Wave International is offering a full 10-page issue of the Asian Pacific READ MORE |