| Why Diversification Does Not Work in Today’s Market Prechter and Kendall’s “All the Same Market” Analysis Shows how Diversification Can’t Protect You from Correlated Risk A dear friend of mine wants to celebrate an important health milestone by going skydiving with friends. She feels happy and healthy and excited. She wants to do something very READ MORE |

Investors Jump Into The Fire – Junk Bonds

| I spent my childhood discussing the stock market at the dinner table. My dad was a stock broker, and he loved to “tell the story” of the stocks he recommended to the customers – a story that included critical information about macro economics, the industry, the products, earnings, and the outlook for the future. Most READ MORE |

Using Elliott Wave Analysis for Forex

| Analyzing Forex with Elliott Wave Can Help You Catch Rallies and Declines Free Week of Elliott Wave International’s Currency Specialty Service is here until Nov. 18, 2010 On November 1, the EUR/USD — the euro-dollar exchange rate and the most actively-traded forex pair — was trading the $1.38 range, near the level it is today. READ MORE |

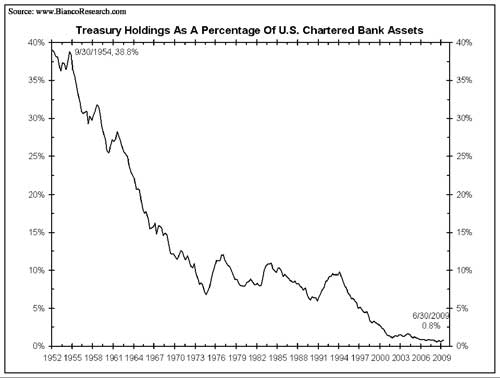

Signs of Deflation

| Signs Of Deflation By Elliott Wave International As the biggest credit bubble in history continues to shrink, consumer prices have stayed flat over the past several months, meaning there is no sign of inflation to come, despite growing commitments from the U.S. government. So what’s keeping inflation at bay, given all the stimulus money promised? READ MORE |

Efficient Market Hypothesis

| Efficient Market Hypothesis: Is the Market Efficient at all? In finance, the efficient-market hypothesis (EMH) asserts that financial markets are “informationally efficient”. That is, one cannot consistently achieve returns in excess of average market returns on a risk-adjusted basis, given the information publicly available at the time the investment is made. The validity of the READ MORE |

Does Gold Always Go Up in Recessions?

| Gold: Best Supporting Role In Economic Downturns? Think Again Gold’s safe-haven status is based on hype, not history By Nico Isaac As I sat down to watch the Oscar pre-show on Sunday night, March 7, one word was repeatedly used to describe the celebrity starlets and their designer duds: GOLD. Gold bustiers and gold lame READ MORE |

Stock Market Bottom

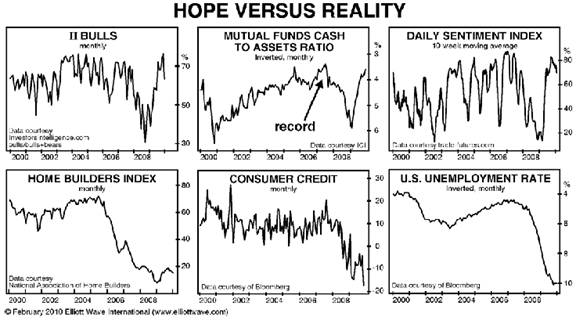

| Have We Seen The Stock Market Bottom? Stock market has rallied from the March lows as predicted, but is it a new bull market, or is it a bear market rally? Elliott Wave International has made intensive research to identify the economic and technical indicators that signal a market bottom. And no, we have not READ MORE |

Herding and Markets

| Robert Prechter on Herding and Markets’ “Irony and Paradox” To anyone new to socionomics, the stock market is saturated with paradox. The following is an excerpt from a classic issue of Robert Prechter’s Elliott Wave Theorist. For a limited time, you can visit Elliott Wave International to download the rest of the 10-page issue free. READ MORE |

Goldman Sachs Charged With Fraud

| Goldmand Sachs is charged by SEC and the financial stocks were hit by the news. But Elliott Wave International has warned investors long time ago that Goldman Sachs may not survive this bear market. Goldman Sachs Charged With Fraud: Who Could Have Guessed? The firm’s history suggests its vulnerability in periods of negative social mood. READ MORE |

What To Do With Your Pension Plan

| What are the long term risks in investing in pension plans, IRAs, 401ks? Immediately obvious risk is higher tax rates we are likely to face in the future. This is a risk for tax deferred investments. But Roth IRAs, Roth 401k are immune. But could there be other problems? What would you do if the READ MORE |

Fatal Flaws of Traders

| Paper Trading Is NOT What Will Teach You To Trade Paper trading is only useful for the testing of your methodology. By Editorial Staff This is an excerpt from Elliott Wave International’s free Club EWI resource, “What a Trader Really Needs to be Successful” — a classic Special Report by EWI’s president Robert Prechter. … READ MORE |

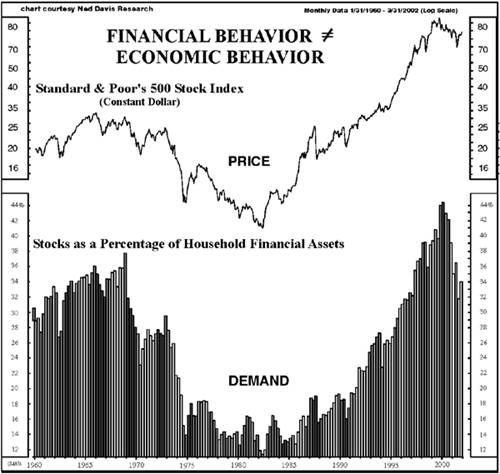

Europe’s Return to Risky Investment

| As the markets go higher, people who buy stocks tend to feel more secure. Finance is one area where normal economic theories do not work. When you go to a shoe store, you look for cheap prices. If the prices appear high, you may wait for the sale. However, in financial markets, as the prices READ MORE |

Credit Default Swaps Indicate Trouble For Europe

| Debt crisis in the headlines of the mainstream media again. Why do we care about the debt of Greece? Portugal? Spain? Why is high levels of debt deflationary? How can this excessive debt effect global recovery? We got help from Elliott Wave International to answer these questions. Credit Default Swaps Indicate Trouble for European Debt READ MORE |

Empty Malls in China

| Mainstream media has been beeting the drums and announcing that recession is over. According to the experts recovery is well in progress. 3% GDP growth is expected in the near future. Virtually nobody sees going back to the March lows in the stock market. Let us put some cold water on this heated enthusiasm and READ MORE |

The Lost Decade of Stock Market

| If You Think the Past Decade Was Bad For Stocks, Wait Till You See This The major stock indexes are the wrong place to look By Robert Folsom A well-known business magazine recently published a story with this headline: Stocks: The “Loss” Decade A disastrous ten years for the stock market ends in just a READ MORE |