| Stock Market’s Character Has Changed — Here’s How We’re watching the VIX or “fear index” to see what’s next Stock market investors naturally want to know the closing numbers for the main stock indexes at the end of each trading day. Yet, it’s also good to dig deeper. Let me show you some examples of READ MORE |

Seasonal Tendencies

| Stocks: Keep This in Mind About Seasonal Tendencies “In 1987 and 2000, the month of August presented a great chance to sell stocks” Many investors know that some time periods of the year tend to be more bullish for stocks, like the holiday season. Other times tend to be more bearish, like September and October. READ MORE |

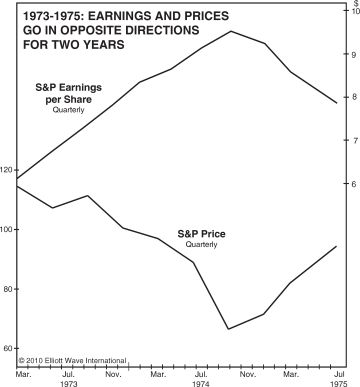

Earnings Season

| Here’s What You Need to Know About Earnings Season Investing based on earnings “is akin to driving down the highway looking only in the rearview mirror” Many investors and financial journalists believe that corporate earnings play a substantial role in driving stock market prices. This headline from a few months ago captures the traditional thinking READ MORE |

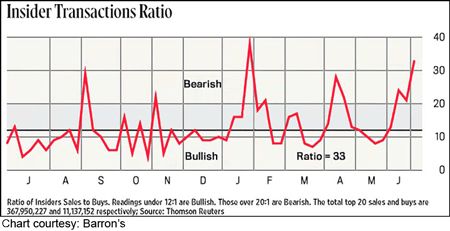

Insiders Selling

| Pay Attention to This Group of Investors (They Know More) The stock market actions of corporate insiders is revealing It stands to reason that executives of a corporation know more about the goings-on of their business than outsiders. So, it’s wise to pay attention to their stock market actions regarding their own shares. Yes, the READ MORE |

Platinum Selloff

| Platinum’s May-June Selloff: When the “Fundamental” Chips Fall In May, a “record supply deficit” should’ve sent platinum prices soaring. So much for the best laid “fundamental” plans. If I had a nickel for every time someone asked me what value “fundamentals” serve in navigating financial markets, well… let’s just say I could’ve retired to the READ MORE |

How Major Financial Trends End

| Robert Prechter Interview for the Ages: Quick Takes on Big Financial Trends ‘That’s not even the craziest indicator on this chart. Look at the bottom graph.’ Robert Prechter’s June 23 interview with GoldSeek.com, which is under 15 minutes, covers a variety of financial topics. They include stocks with an emphasis on the technology sector (including READ MORE |

100x Increase in Interest Rates

| This Trend Is Up a Whopping 10,240% Since March 2021 How millionaires are handling financial uncertainty On March 1, 2021, the 6 Month Treasury Bill Rate was a measly 0.05%. The March 2021 Elliott Wave Theorist, a monthly Elliott Wave International publication which covers major financial and social trends, said: If the rise in interest READ MORE |

Intimidating Bond Market

| Want to “Intimidate Everybody”? Be a Bond Market Back in October 2021, we showed subscribers a chart of the “Bond Universe” — ALL bonds, from around the world, in ONE chart. Since then, as yields spiked and prices fell, the bond market has indeed been “intimidating everybody.” Watch our monthly Global Market Perspective contributor, Murray READ MORE |

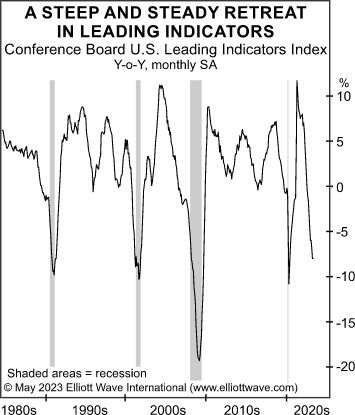

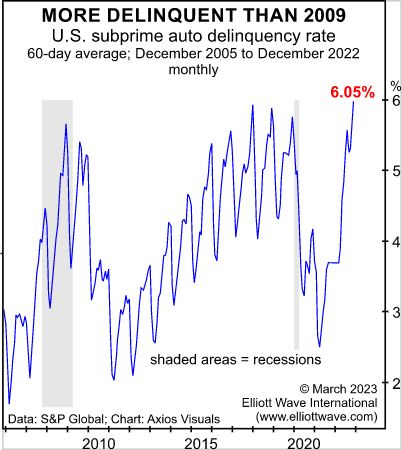

Recession May Foil Expectations

| Why a U.S. Recession May Foil Economists’ Expectations “Many classic indicators of a recession are exactly where they were at the…” You may have heard that Germany has slipped into a recession. What you may not have heard is, the German government anticipated an economic uptick in Q1, not a slide. Reality failing to meet READ MORE |

Pension Fund Crisis

| Is a Pension Fund Crisis Next? “U.S. pension funds are on the brink of implosion” Did you get a heads-up from the financial media that the U.S. banking system was vulnerable before the failures of Silicon Valley, Signature and First Republic banks? There may have been outlier articles here and there but no real warnings. READ MORE |

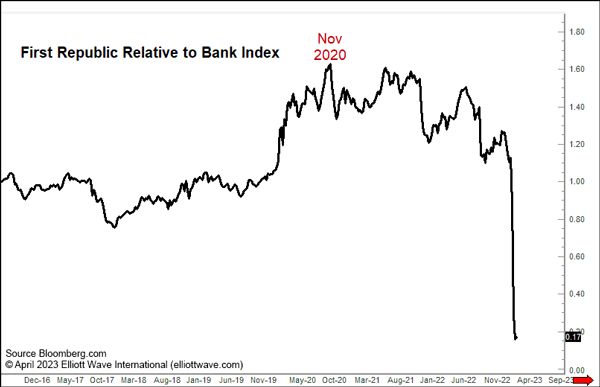

Your Bank: Early Warning

| Your Bank: “Use This as an Early Warning Signal” First Republic Bank “customers had pulled $100 billion in deposits in the first quarter” More dramatic news on the banking front. On April 25, investors in the shares of First Republic Bank were hit hard (The New York Times): First Republic Bank Enters New Free Fall READ MORE |

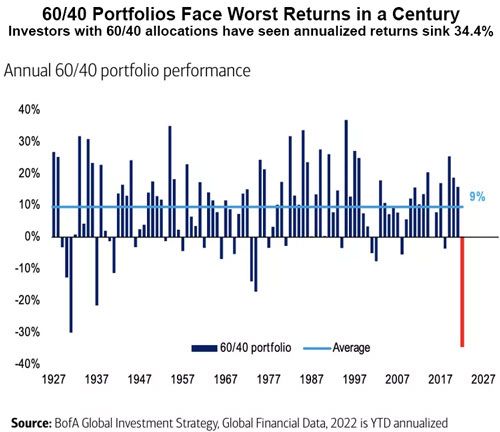

Advisors Take Heat

| Financial Advisors Take Heat for Market Losses (Will Anger Intensify?) Was 2022 an aberration for the 60/40 allocation? Many financial advisors steer clients who are willing to take some risk toward a 60% stocks / 40% bonds portfolio. Alas, investors who followed that strategy in 2022 saw the value of their portfolios decrease substantially. In READ MORE |

Pressure on Banks will Rise

| Silicon Valley Bank, Silvergate and “The Everything Bust” “The pressure on banks will rise” The phrase “Everything Bust” means a bust in just about every financial risk-asset of which you can think, as well as the economy and, I dare say, the financial system itself. Indeed, in a section titled “The Everything Bust Is on READ MORE |

FDIC and Your Bank Deposits

| The Shocking Truth About the FDIC and Your Bank Deposits Why you can’t rely on the FDIC if your bank goes under Editor’s note: The failures of Silicon Valley Bank and Silvergate Bank have many observers of the banking system discussing the possibility of contagion. Even so, many depositors feel safe because their deposits are READ MORE |

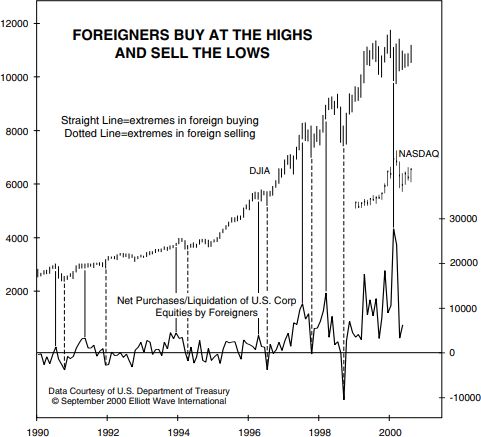

Foreign Buyers Jump Into Stocks

| Overseas Buyers Scoop Up U.S. Shares (Bullish or Bearish)? “No crowd buys stocks of other countries intelligently” The fact that investors from other countries are feverishly buying U.S. stocks might seem like a bullish sign. On the other hand, consider what Robert Prechter said in his book, Prechter’s Perspective: No crowd buys stocks of other READ MORE |