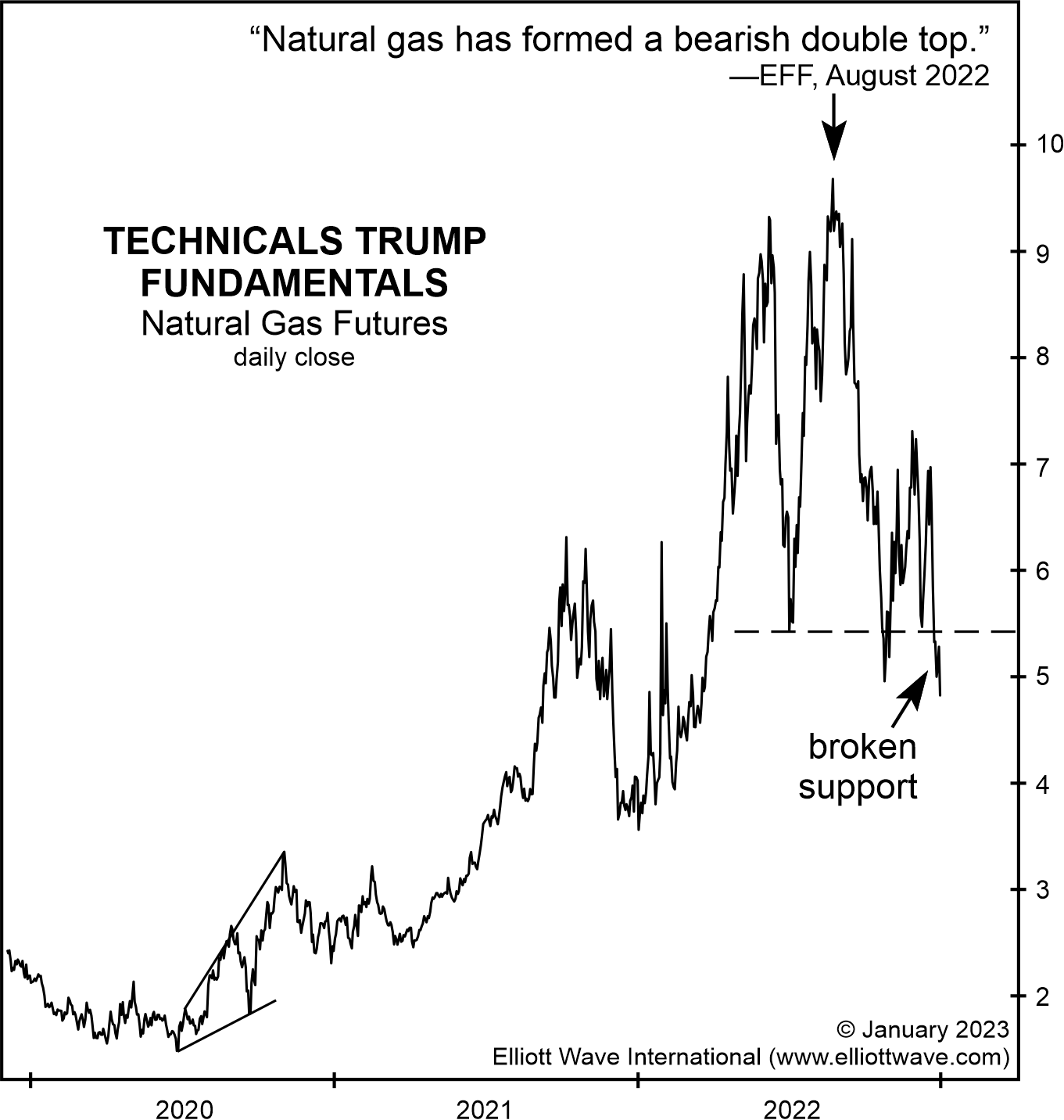

| Natural Gas: Here’s What Happened After a “Double Top” A key technical pattern warns of a reversal It probably won’t be a surprise to you that Elliott Wave International is an advocate of technical analysis. After all, the Elliott wave method is a form of technical analysis. You probably know that the term “technical analysis” READ MORE |

Sentiment Offer Clues About What is Next

| Stocks: How Sentiment Measures Offer Clues About What’s Likely Next Insights into the stock market as a fractal Elliott Wave International’s analysts track dozens of indicators, and our U.S. Short Term Update pays particular attention to those which may offer clues about the near-term. Consider this analysis from the Sept. 26 U.S. Short Term Update, READ MORE |

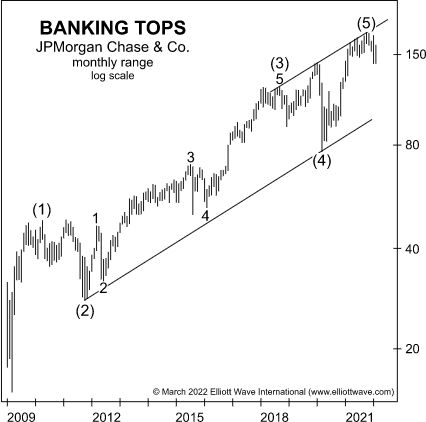

Elliott Waves in Individual Stocks

| Yes, Elliott Waves Work with Individual Stocks — Here’s How “The primary value of the Wave Principle is that it provides a context for market analysis” Elliott waves reflect the repetitive patterns of mass psychology — so they are ideally suited for analyzing the widely traded main stock indexes. On the other hand, thinly traded READ MORE |

Key Insight About Bear Market Rallies

| Bear Market Rallies: Here’s a Key Insight How investors get snookered into the belief of “a further market advance” Nothing raises the hopes of the bullishly inclined like a rapid bear market rally. And there’s been several since the early January top in the Dow Industrials and S&P 500 index. You may be interested in READ MORE |

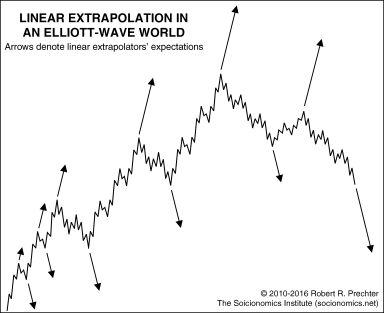

Most Miss Market Turns

| Why Most Investors Are “Doomed” to Miss Major Market Turns “The arrows show how conventional futurists approach forecasting” The reason why most investors miss key turns in financial markets is that they linearly extrapolate a trend into the future. If a market is going down, these investors expect that market to continue to go down READ MORE |

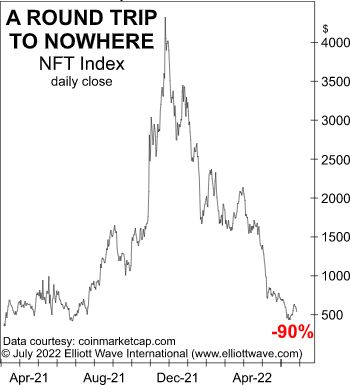

NFT Crash

| Non-Fungible Tokens (NFTs): Another Financial “Fumble” NFTs have taken “a round trip to nowhere” Tampa Bay Buccaneers’ quarterback Tom Brady is a non-fungible token (NFT) enthusiast. However, glory on the football field has not translated to this field of finance (Business Insider, August 8): Tom Brady bought a Bored Ape NFT for $430,000 in April. READ MORE |

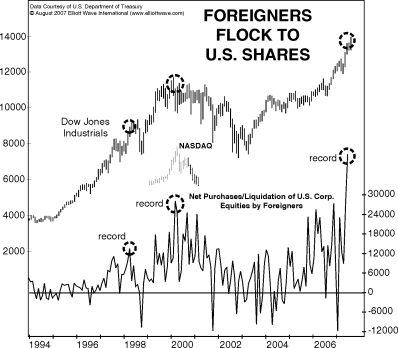

Foreign Interest Peaks in Housing

| The Final Act BEFORE a Housing Bubble Bursts Here’s a time-tested indicator of trend turns in financial markets Financial history shows that feverish foreign buying of a financial asset usually marks the end of that asset’s upward trend. The reason why is that foreign buyers tend to enthusiastically jump on a trend after it’s already READ MORE |

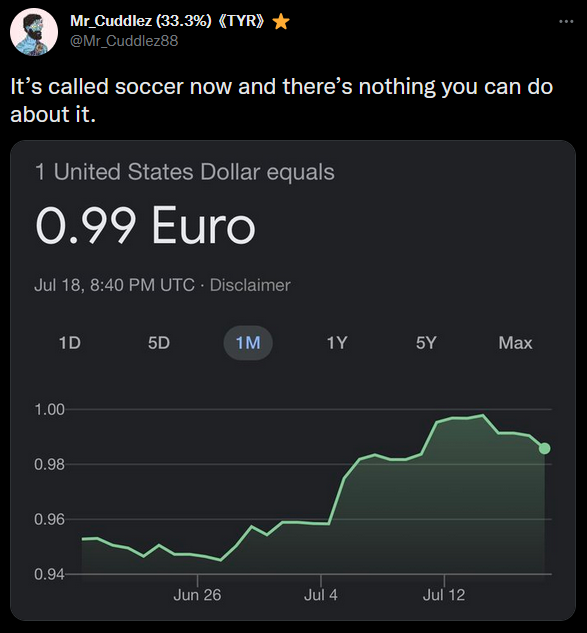

Euro is on Sale

| Europe On Sale: Get It While U Can On July 13 and 14, the euro and the U.S. dollar briefly traded at parity — for the first time in 20 years. Just 19 months ago, EURUSD was at $1.2350. It’s quietly dropped 20%+ since. Quietly? Yeah, because of all the other fireworks in the market READ MORE |

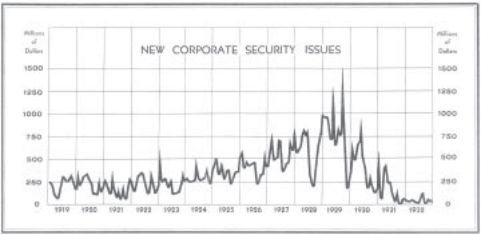

IPO will Disappear

| Here’s Why IPOs Will Likely Dwindle to Near Zero “The IPO market is fizzling” Financial activity is usually abuzz during times of financial optimism, such as the issuance of initial public offerings (IPOs). An IPO means that a company is transitioning from private to public ownership. The process involves selling shares to the public for READ MORE |

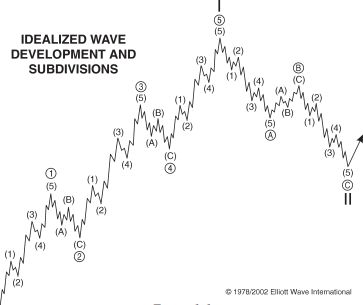

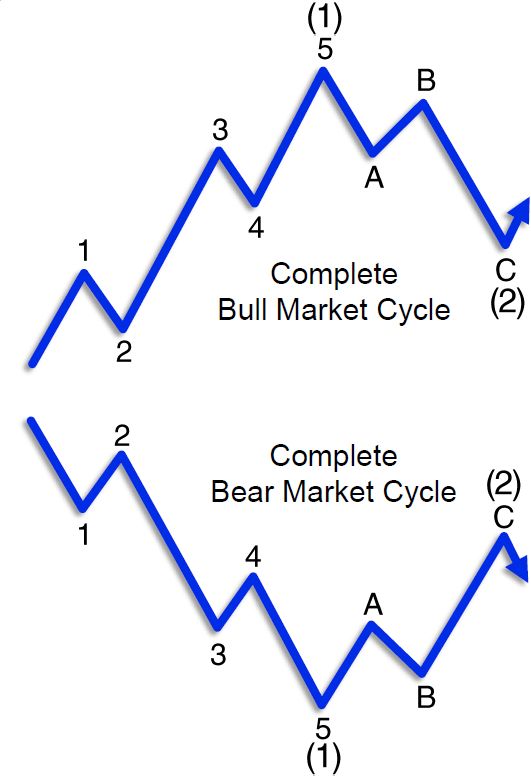

Dow Industrials 8 Wave Cycle

| The Dow Industrials’ Big 8-Wave Cycle is Incomplete “We finally understand our full Elliott wave position” The Wave Principle’s basic pattern includes five waves in the direction of the larger trend, followed by three corrective waves, as illustrated in both bull and bear markets below: Keep in mind that the stock market is a fractal, READ MORE |

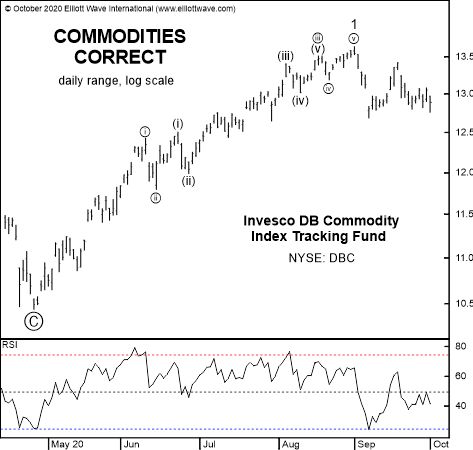

Food and Gas Prices to Increase Even Faster

| Food and Gas Prices: Is the Rising Trend (Finally) Ending? The Elliott wave structure of a key commodity ETF provides a clue. Consumers around the globe are wondering when they will finally see some relief from rising prices at the gas pump and grocery store. It’s difficult for these consumers to get a handle on READ MORE |

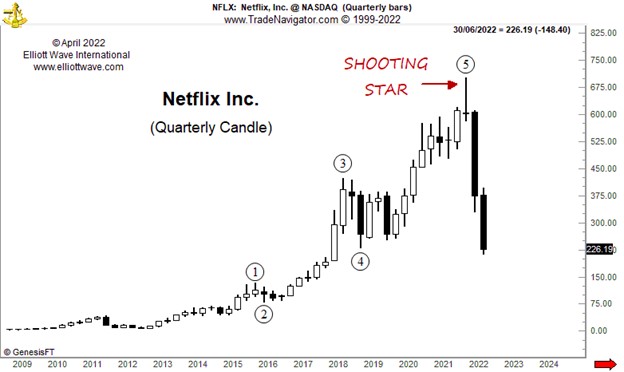

Netflix Crash

| Another One Bites the Dust – The Deflation of Netflix Bubbles are popping, one by one. The share price of Netflix plummeted last week, coinciding with news that it is losing subscribers, a big change after years of growth. The media and conventional analysts will, of course, link the cause of the share price decline READ MORE |

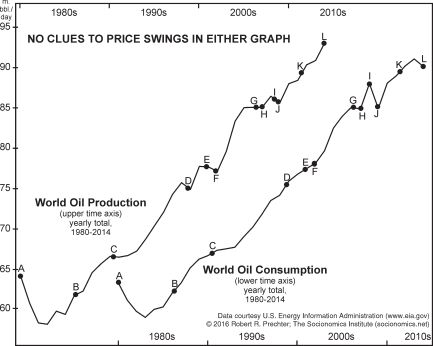

Does Supply and Demand Dictate Oil Price?

| Oil at $130: Look Beyond Supply and Demand “War” is the answer that only gets you so far Most everyone knows that oil and gasoline prices have been soaring, and this steady climb started well before the Russia-Ukraine conflict. The upward trend began in April 2020, when oil prices briefly went negative, and it’s continued READ MORE |

FDIC Guarantee?

| The Stunning Truth About the FDIC and Your Bank Deposits Why you can’t rely on the FDIC if another financial crisis hits and your bank goes under. Millions of U.S. bank depositors feel safe in the knowledge that the Federal Deposit Insurance Corporation will protect their accounts, even if their bank goes under. Yes, it’s READ MORE |

Sign of a Major Top: M&A

| M&As: Beware of This Major Sign of a Stock Market Top Here’s what often precedes “prolonged and devastating bear markets” Inside the three publications that comprise Elliott Wave International’s flagship Financial Forecast Service, Elliott Wave International recently documented the many expressions of “financial optimism.” Things like crypto mania. Or meme stocks. Or just buying any READ MORE |