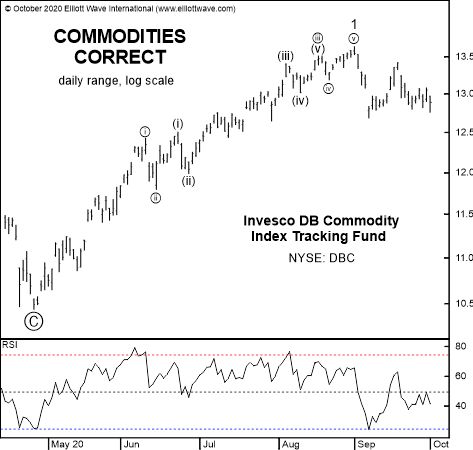

| Food and Gas Prices: Is the Rising Trend (Finally) Ending? The Elliott wave structure of a key commodity ETF provides a clue. Consumers around the globe are wondering when they will finally see some relief from rising prices at the gas pump and grocery store. It’s difficult for these consumers to get a handle on READ MORE |

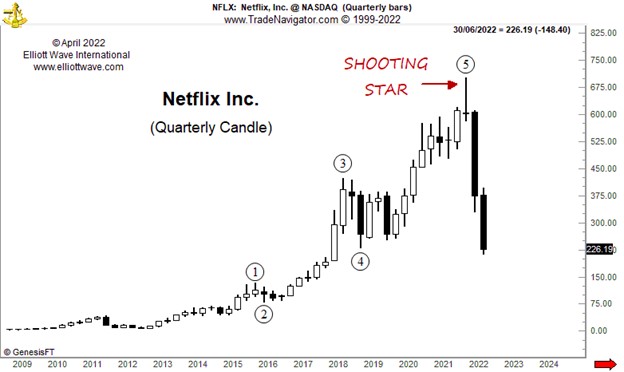

Netflix Crash

| Another One Bites the Dust – The Deflation of Netflix Bubbles are popping, one by one. The share price of Netflix plummeted last week, coinciding with news that it is losing subscribers, a big change after years of growth. The media and conventional analysts will, of course, link the cause of the share price decline READ MORE |

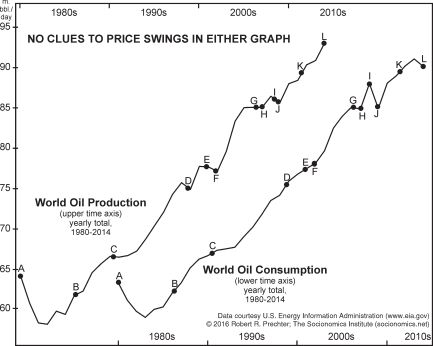

Does Supply and Demand Dictate Oil Price?

| Oil at $130: Look Beyond Supply and Demand “War” is the answer that only gets you so far Most everyone knows that oil and gasoline prices have been soaring, and this steady climb started well before the Russia-Ukraine conflict. The upward trend began in April 2020, when oil prices briefly went negative, and it’s continued READ MORE |

FDIC Guarantee?

| The Stunning Truth About the FDIC and Your Bank Deposits Why you can’t rely on the FDIC if another financial crisis hits and your bank goes under. Millions of U.S. bank depositors feel safe in the knowledge that the Federal Deposit Insurance Corporation will protect their accounts, even if their bank goes under. Yes, it’s READ MORE |

Sign of a Major Top: M&A

| M&As: Beware of This Major Sign of a Stock Market Top Here’s what often precedes “prolonged and devastating bear markets” Inside the three publications that comprise Elliott Wave International’s flagship Financial Forecast Service, Elliott Wave International recently documented the many expressions of “financial optimism.” Things like crypto mania. Or meme stocks. Or just buying any READ MORE |

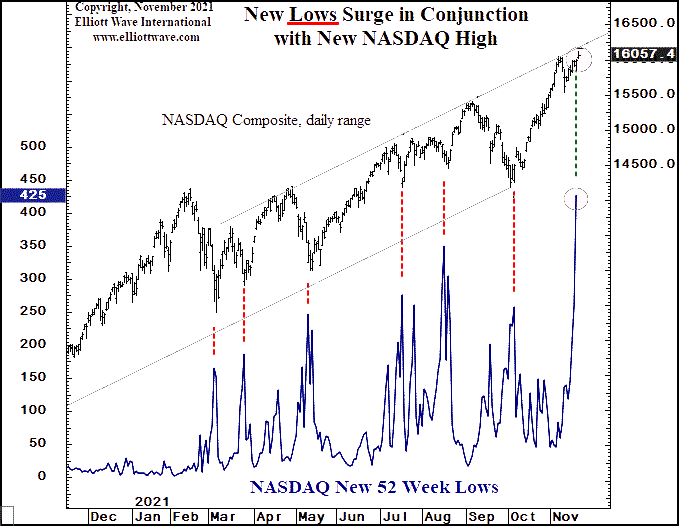

Nasdaq New Lows?

| Insights into a “Remarkable” NASDAQ Development Here’s what usually happens in the stock market when “the troops abandon the generals” You’ve probably heard the phrase: “Appearances can be deceiving.” In other words, it’s usually wise to “take a closer look” because the truth may not be obvious. This applies to various circumstances of life — READ MORE |

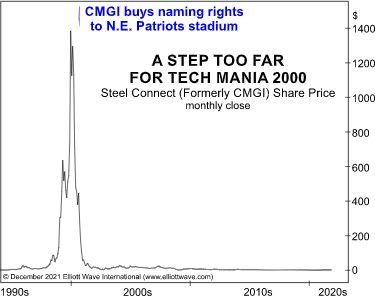

Did the Crypto Bubble Pop?

| Has Crypto-Mania Finally Run Its Course? Here’s a high-profile parallel between tech- and crypto-mania When a company that’s part of a major financial trend buys the naming rights to a professional sports stadium or arena, watch out! History suggests that such a prominent move might be a sign that the fortunes of that company are READ MORE |

Junk Bonds Signal Trouble

| Junk Bonds Are Sending a Signal to Stock Investors Something happened just before the historic 2007 stock market top — and it’s happening again. It’s generally known that stocks are risky. It all hinges on how “hungry” investors are. So, if investors’ appetite for risk starts to diminish, it stands to reason that this is READ MORE |

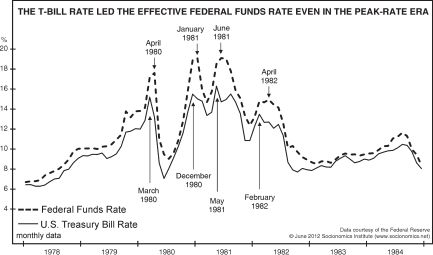

Fed Does Not Set the Interest Rates

| Here’s What Really Sets Interest Rates (Not Central Banks) See “powerful evidence that the Fed is not in control of interest rates” Most everyone is familiar with the phrase: “Keep your eye on the ball,” which of course means — focus on what really matters. Those who seek clues about the direction of interest rates READ MORE |

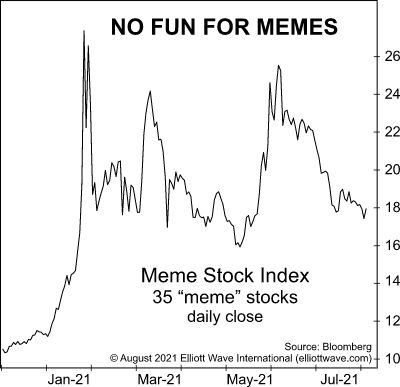

Meme Stocks Decline

| How “Hot” Stock Market Ideas Can Burn Investors The Meme Stock Index sees a 36% decline since January. On July 30, this headline appeared on a well-known investment website: It’s Definitely Possible to Make a Fortune Off Meme Stocks And, it’s definitely true that many investors, especially newbies, have tried. As you probably know, “meme” READ MORE |

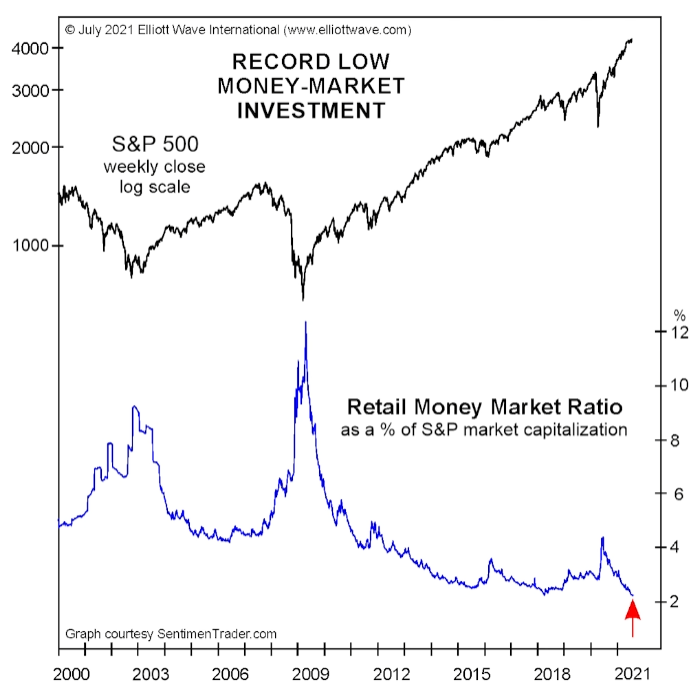

Booming Economy Requires Caution

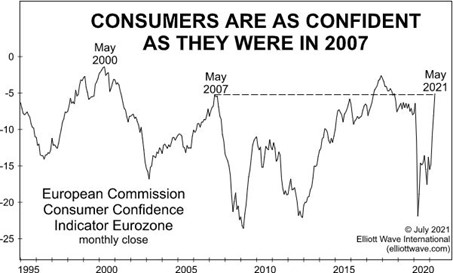

| Global Investing: Here’s the Message of Consumer “Overconfidence” Bear markets tend to follow this particular sentiment. In many global regions, economies are flourishing. For example, here are two headlines about the U.S.: What America’s Startup Boom Could Mean For The Economy (npr.com, June 29) Inflation Rose in June as Economic Recovery Continues (WSJ, July 13) READ MORE |

Fear of Missing Out – FOMO

| “Everybody’s Getting Rich (and Having Fun) Except Me” The idea of “missing out” on stock market gains “literally generates fear in many people” Hardly anyone wants to miss the party — whether on Wall Street or elsewhere. Thus, the acronym FOMO — which stands for the “fear of missing out” — is in vogue. After READ MORE |

Bitcoin: More Volatility Directly Ahead?

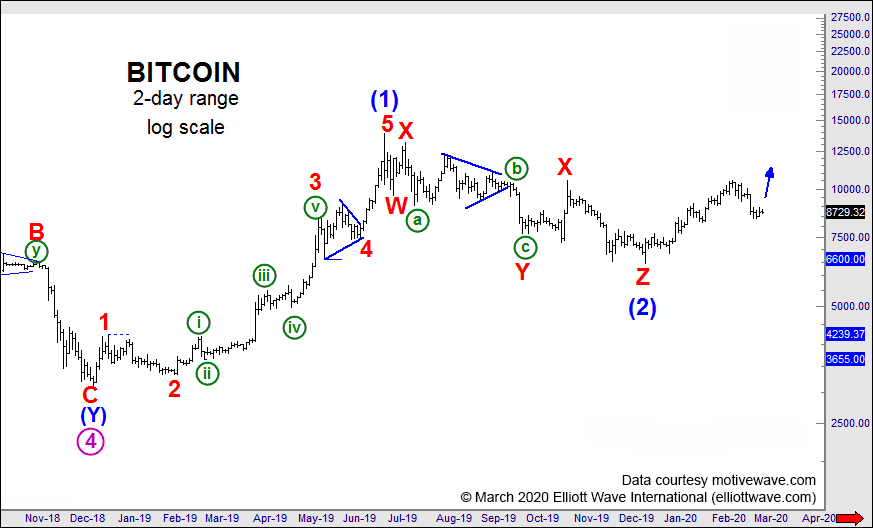

| If there’s a single word to describe bitcoin’s price action, that word is “volatile.” Yet, those who invested roughly a year ago in the cryptocurrency — and stuck with it — have been hugely rewarded. (At least until very recently, as bitcoin traded more than 50% lower from its all-time high on May 19, as READ MORE |

Extreme Bullish Sentiment

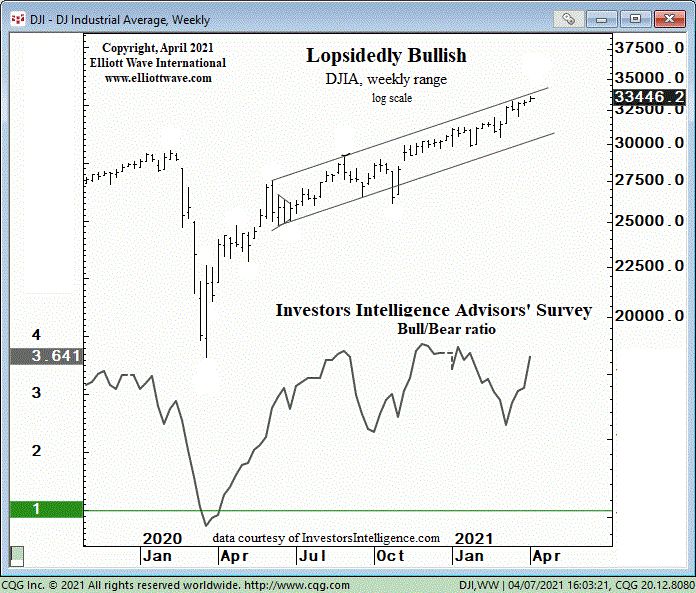

| This “Lopsided” Stock Market Ratio Is Sending a Clear Signal. Investors always find ways to “rationalize” bearish or bullish stances. For a stock market investor who understands that markets are not random or chaotic but instead patterned, the most important information to know is the price pattern of the market in question. For an Elliott READ MORE |

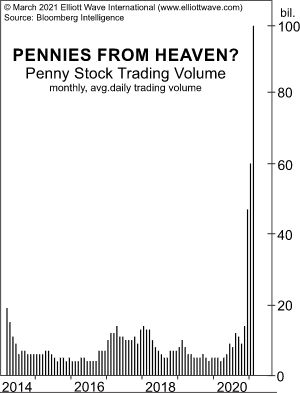

Unprecedented Acceptance of Risk At Peak

| U.S. Stocks: Here’s Evidence of a “Nearly Unprecedented Acceptance of Risk” Penny stocks fever has reached “the highest level since the first three months of 2000” Penny stocks tend to be highly illiquid. In other words, it’s difficult to buy and sell them at favorable prices. Even so, the lure of low-priced shares is hard READ MORE |