| Do These Explanations Make Sense for This Intraday Stock Market Turn? The market “is not propelled by … external causality” On Oct. 19, the DJIA had been trading higher for much of the morning, but by the last hour of trading, the index was more than 400 points in the red. During that last hour READ MORE |

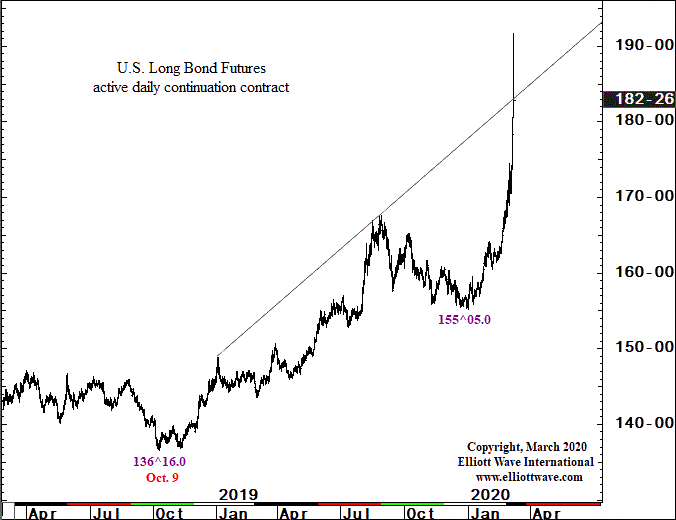

Extreme Sentiment Indicates a Peak in Bonds

| U.S. Long Bond: Let’s Review the “Upward Point of Exhaustion” Here’s an update on the trend of 30-year U.S. Treasuries since the historic early March price moves. Back in early March, the behavior of the bond market was reminiscent of what unfolded during the depths of the 2007-2009 financial crisis. Prices and yields were making READ MORE |

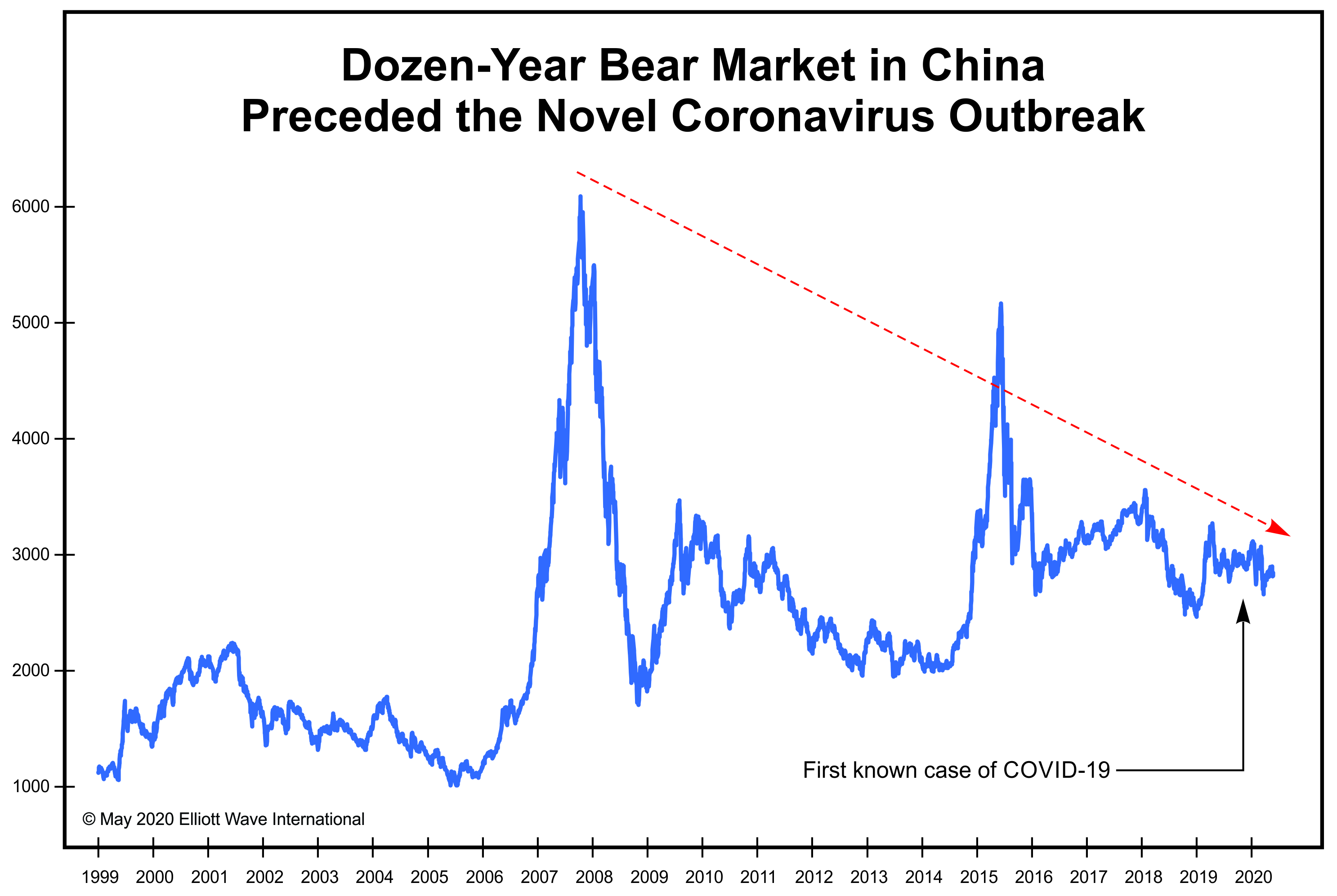

Did Covid19 Cause the Stock Market Crash?

| Think Coronavirus Caused the Crash? These Two Charts Beg to Differ Just about everyone thinks the coronavirus pandemic slammed global stock prices in February and March. Entire countries shut down; businesses closed up shop; unemployment soared. People stopped spending money beyond the essentials, so conventional wisdom would indeed expect stocks to slide as a result. READ MORE |

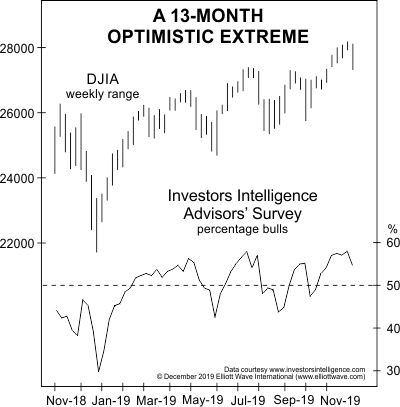

Optimism Reigns at a Market Top

| Many stock market investors believe that prices have already bottomed. Numerous banks, brokers and financial firms have issued statements saying as much. Indeed, the May Elliott Wave Theorist, a monthly publication which has offered analysis of financial and social trends since 1979, noted: On April 28, Bloomberg interviewed four money managers to answer the question READ MORE |

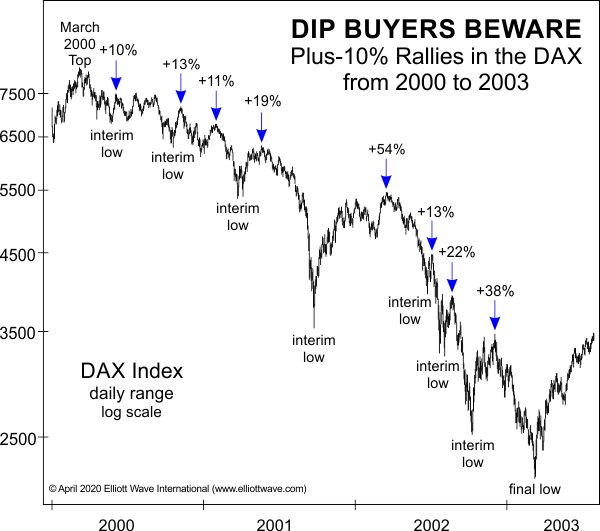

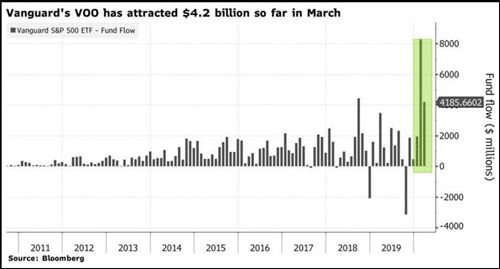

Buying the Dip Can Backfire

| “Buying the dip” might work in a rip-roaring bull market, but it can cost you your shirt in a severe downturn. Even so, this March 23 Wall Street Journal quote represents the mindset of many global investors: I’m Scared. That’s a Reason to Buy. The true contrarian only buys when it makes him feel physically READ MORE |

Price and Volume in a Bear Market

| A question was posed to Elliott Wave International President Robert Prechter for a classic Elliott Wave Theorist (Prechter’s monthly publication about financial markets and social trends since 1979): Under the Wave Principle, what is the most important thing to watch other than price? Prechter answered: Volume. You see, high trading volume means that traders are READ MORE |

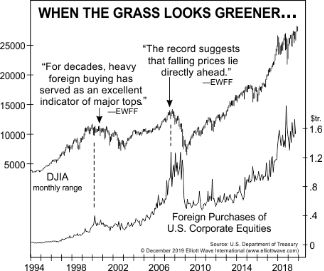

Foreign Buyers Indicate Stock Market Top?

| Let’s start by establishing that the stock market is not driven by the news. Aggregate stock prices are driven by waves of optimism and pessimism — which go from one extreme to another — as reflected by the Elliott wave model. That’s what makes the stock market predictable. Hence, Elliott wave analysis is at the READ MORE |

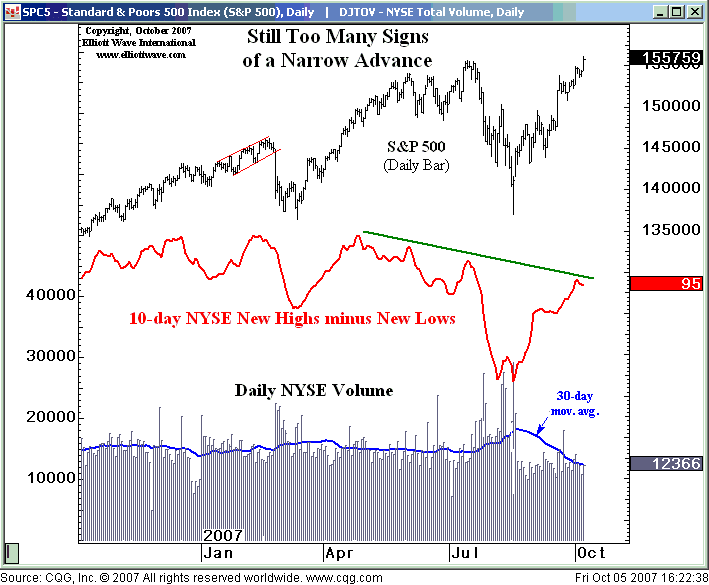

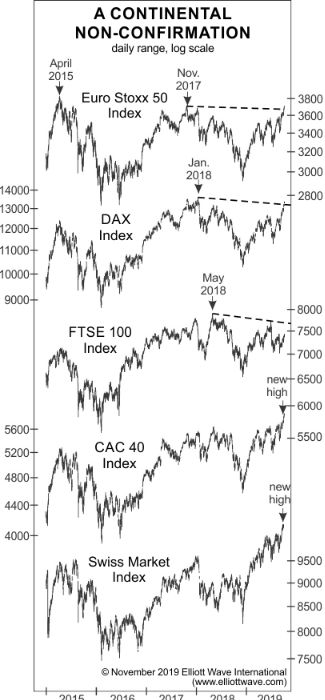

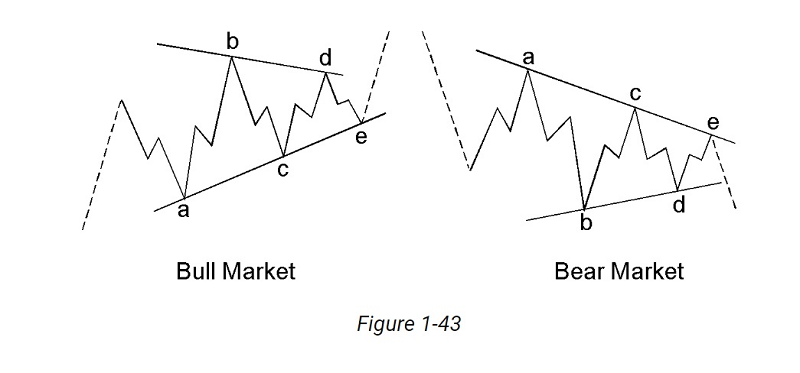

Recognize a Weakening Trend

| Pay Attention to “Non-Confirmations” When a trend is strong, related markets tend to move in unison. However, when a trend is near exhaustion — a bullish or bearish trend, “non-confirmations” often occur. A non-confirmation occurs when one market makes a new high (or low), but a related market does not. As cases in point, our READ MORE |

Bear Market Half Way?

| This Will Signal the Bear Market’s Halfway Point On March 12, the date the DJIA closed lower more than 2350 points, the U.S. chief equity strategist for a major financial firm appeared on Bloomberg after the market close and opined that “90% of the damage has been done.” He went on to affirm that if READ MORE |

Is a Dovish FED Bullish for the Stock Market?

| Is an Accommodative Fed Bullish for the Stock Market? “In 2007-2008, the Fed cut rates 10 times, but the S&P 500 still declined 58%” Many investors heed every utterance from the Federal Reserve, hoping they hear a clue about interest rates. They assume that a fall in interest rates means higher stock prices, while rising READ MORE |

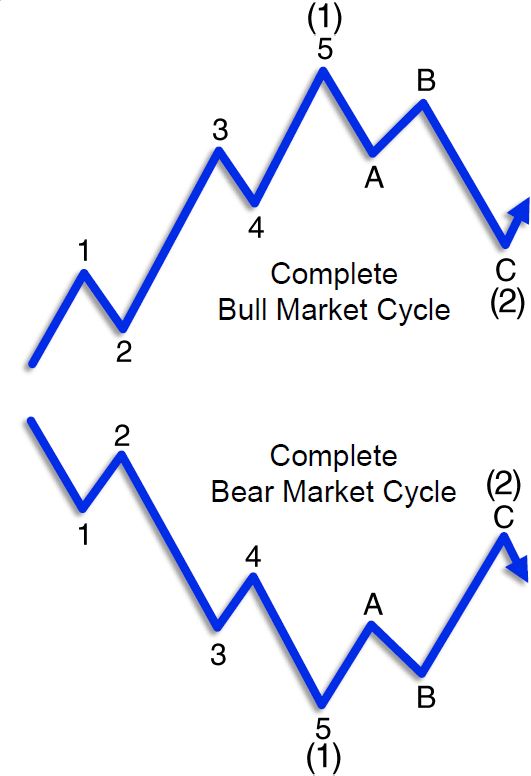

Elliott Wave Principle a Marvel of Technical Analysis

| Just when you thought there’d been every possible adaptation of the Marvel comics movie franchise, we’ve thought of one more: A Marvel installment based on financial market analysis. At one end of this Marvel market universe is Technipede: Like the insect he’s named for, Technipede uses hundreds of technical disciplines to stand on for evaluating READ MORE |

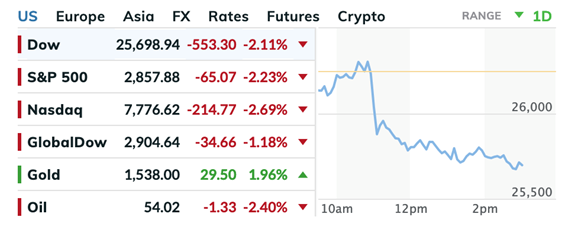

Stocks are red, why?

| Just Thursday — or even on Friday morning — it seemed that stocks were finally out of the woods. But as I’m typing this… Our friends at Elliott Wave International had a hunch this would happen. Here’s what their Short Term Update wrote Wednesday night: “The harmony of the major averages is out of whack, which is READ MORE |

Gold From Boring to Six Year High

| As mainstream experts struggled to see the direction in gold, Elliott wave analysis saw a clear, bullish triangle. Then, gold prices rocketed to six-year highs! A common misconception of trading is that the best opportunities come near market highs and lows, when a change-in-trend is on the launchpad with 10 seconds to liftoff. The problem READ MORE |

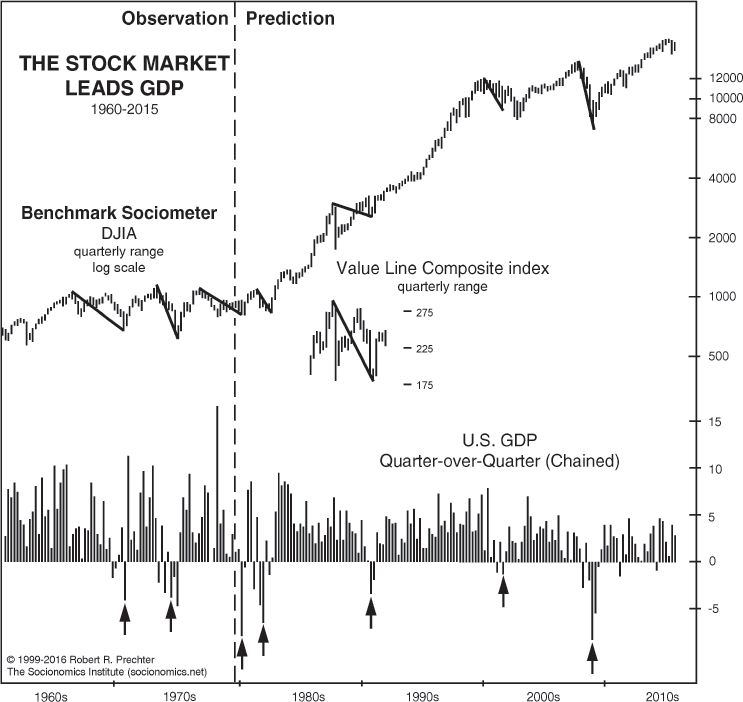

What’s next for the economy?

| There IS a way to forecast the general health of the economy. This method has repeatedly proven itself. Yes, you can anticipate the likelihood of a recession, even a depression — or, conversely, when major economic measures — like jobs — will be robust. That surefire way is the performance of the stock market. That’s READ MORE |

How to Capitalize on Market Corrections

| 90% of traders throw in the towel. One of the main reasons is because they don’t have a method. Elliott Wave Principle is one of the most popular investment method books ever published. Now, we’re working with Elliott Wave International to celebrate the book’s 40th anniversary by giving you free access to Bob Prechter’s bestseller. READ MORE |