| The “Big Lie” About the U.S. Jobs Picture Some 30 million people are either out of work or severely underemployed Get Your FREE Special Report: What You Need to Know NOW About Protecting Yourself from Deflation » The financial media heve been featuring stories with an upbeat outlook for the U.S. economy. For example: The READ MORE |

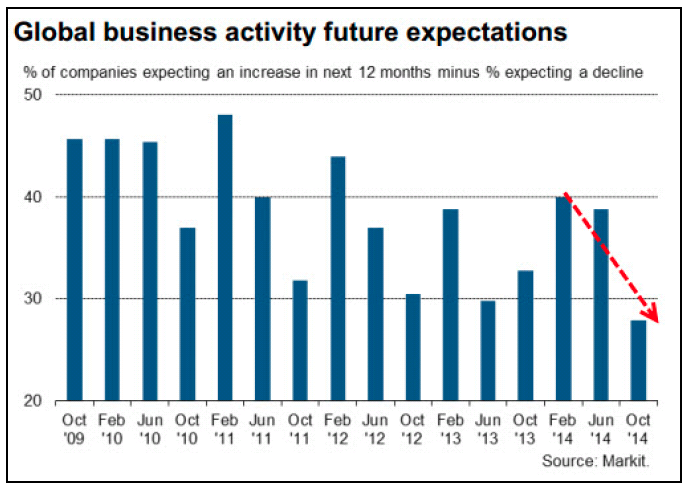

Why Expectations for Business Activity are Plunging

| Editor’s note: This article is excerpted from “The State of the Global Markets 2015 Edition,” a comprehensive report by Elliott Wave International, the world’s largest independent market-forecasting firm (data through December 2014). You can download the full, 53-page report here — 100% free. In its November issue, published on Oct. 31, EWI’s European Financial Forecast READ MORE |

3 Ways To Identify Support and Resistence

| We will consider three ways to identify price support and resistance in the markets you trade. Previous highs and lows Trendline support Fibonacci Ratios These examples are adapted from Jeffrey Kennedy’s time tested Trader’s Classroom service. 1) Uptrends terminate at resistance while downtrends terminate at support. Previous highs and lows often act as resistance and support. In READ MORE |

From Faith to Failure: Abenomics

| After decades of deflation in Japan, we thought there was hope and the deflating money supply and falling prices were gone. But during the last two quarters we once again witnessed relentless deflationary pressure in Japan despite record stimulus that promised inflation. Well, inflation is missing in action. Deflation still rocks the nation! Surprised? Why READ MORE |

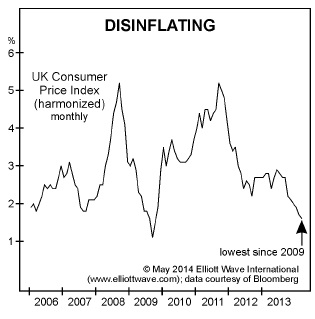

Can Europe’s Deflation Be Like Japan?

| While the stock market has recently seen all time highs in the the United States, despite Federal Reserve’s quantitative easing runs, inflation has been mute. In fact there is talk that FED may just keep printing money if deflation continues to be a concern! Across the ocean, money printing has continued for some years as READ MORE |

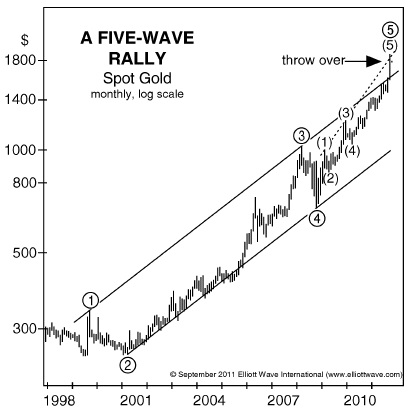

Gold Price Direction

| Where is the gold price heading? Will gold keep crashing? Since hitting a record high of $1921.50 per ounce in September 2011, gold prices have erased 30% in value. By the end of day on October 3, 2014, gold prices were circling the drain of a 15-month low. After such devastation, the global community of READ MORE |

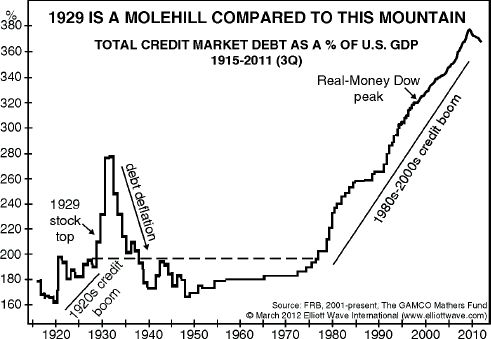

Prepare for the Stock Market Crash

| How to Prepare for the Coming Crash and Preserve Your Wealth Bob Prechter first released Conquer the Crash: You Can Survive and Prosper in a Deflationary Depression during a stock-market high in 2002, and it quickly became a New York Times–bestseller. Now he has updated the book with 188 new pages for a second edition, READ MORE |

How to be safe in an economic crash

| People worry. Sometimes it helps, sometimes there is nothing we can do. I came across some research on the subject of worry. Here’s how it was presented: Things People Worry About: things that never happen – 40% things which did happen that worrying can’t undo – 30% needless health worries – 12% petty, miscellaneous worries READ MORE |

Why Do Traders Fail?

| The following is an excerpt from Jeffrey Kennedy’s Trader’s Classroom Collection. Now through February 6, Elliott Wave International is offering a special 45-page Best Of Traders Classroom eBook, free. I think that, as a general rule, traders fail 95% of the time, regardless of age, race, gender or nationality. The task at hand could be READ MORE |

Jaguar Inflation

| FED rate is at 0% and some people are worried about inflation that may come as the recovery takes hold. Some other people believe deflation is the problem and FED rate should stay at 0%. So, is it really the FED who sets the interest rates in an economy? Utimately, FED does not control the READ MORE |

News and Earnings Are Not What Moves Stocks

| Sometimes you know that a company earnings will be good. You buy the stock and you wait for the earnings announcement. Stock goes up until the good news are out. And then it sells off and you are frustrated. Sometimes you see the market crashing in the morning, the media says “home builders are in READ MORE |

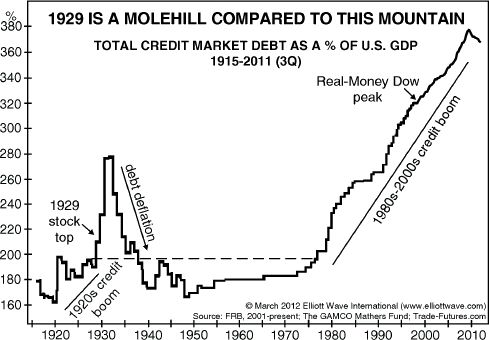

DOW Jones Index Priced in Gold

| DOW Priced in Gold: What Does It Mean for the Long-Term Trend? Of the many forward-looking market indicators we at EWI employ, one of the most interesting tools (and least discussed in the financial media) is the DJIA priced in gold — “the real money,” as EWI’s president Robert Prechter calls it. What implications might READ MORE |

What Can Movies Tell About the Stock Market

| What Can Movies Tell You About the Stock Market? The following article is adapted from a special report on “Popular Culture and the Stock Market” published by Robert Prechter, founder and CEO of the technical analysis and research firm Elliott Wave International. Although originally published in 1985, “Popular Culture and the Stock Market” is so READ MORE |

Extreme Sentiments Threaten European Union

| The similarities between Greece and pre-WWII Germany are striking Extreme sentiments threaten Europe. Nazi salutes. Praise for Adolf Hitler. Swastika-like banners. Now, before you write off this warning as a run-of-the-mill, Nazi-name-dropping scare tactic, consider this recent report from the Socionomics Institute, a U.S.-based think tank that studies global trends in social mood. Here’s an READ MORE |

Deflation in Europe

| History shows that the U.S. should pay attention to economies in Europe The economy has been sluggish for five years. There’s no shortage of chatter about “why,” yet few observers mention deflation. One exception is a hedge fund manager who spoke up at the recent Milken Institute Global Conference. The presentation by Dan Arbess, a READ MORE |