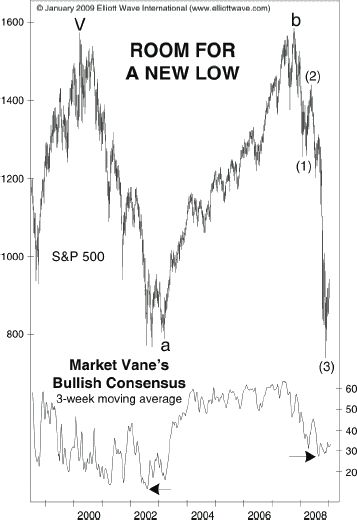

| EXTREME SENTIMENT SIGNALS TREND CHANGE In March 2009, stock prices were at a 12-year low, and the Dow Industrials were down 54% from the 2007 peak. You’d have needed to search far and wide to find someone calling for a rebound. Most investors feared that more of the same was ahead for stocks. But on READ MORE |

How Deep Will the Cuts in Government Services Go?

| “Localities have chopped 535,000 positions since September 2008…” USA Today (10/18) Cuts in government services became conspicuous after the 2007-2009 financial crisis. The first edition of Robert Prechter’s Conquer the Crash saw this coming, even though the book published nearly a decade ago: “Don’t expect government services to remain at their current levels…The tax receipts READ MORE |

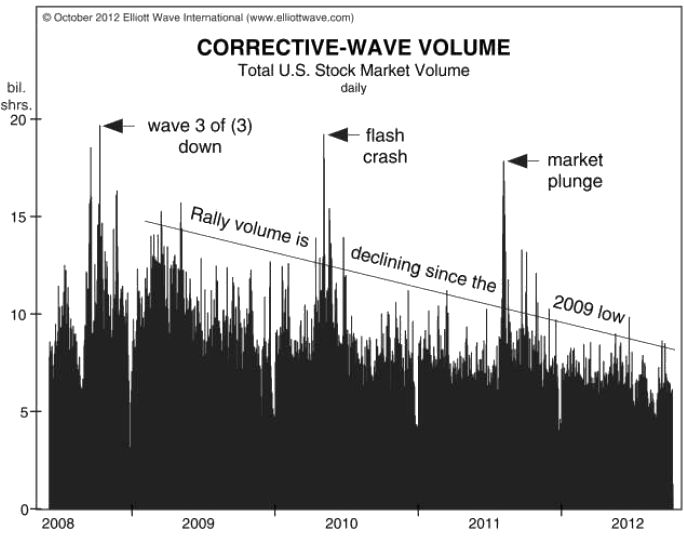

Declining Volume Spells Trouble

| Declining Volume Signals Market Trouble The three-and-a-half-year rally has occurred on declining volume What a comeback for the Dow Industrials! From a March 9, 2009, close of 6,547, the senior index climbed to 13,610 on Oct. 5, 2012. Moreover, the Dow achieved this feat in the face of a weak-kneed economy, and it has grinded READ MORE |

Stock Market Crash – How Low Can it Go?

| The stock market had ups and downs but over all we did fairly well. Unemployment remains stubbornly high but bonds and equities and recently housing had price gains. At least that has been the story of the last two years even though Asia and European markets have topped and have been declining since 2010 and READ MORE |

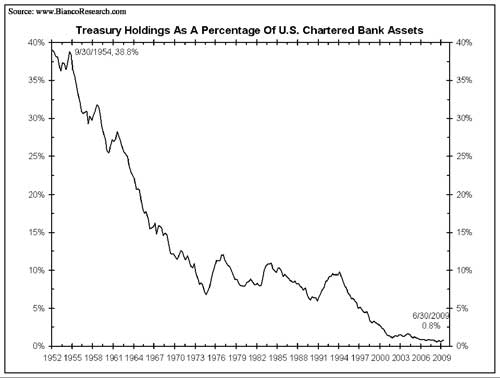

Is Your Bank Safe?

| Bank failures continue to increase every year since the recession begun. FDIC guarantee is still 250,000 dollars. But if dominos start falling, will FDIC be able to guarantee your bank accounts? Or should you consider looking into the safety of your own bank? World’s 15 Biggest Banks Get Downgraded Another one of Robert Prechter’s Conquer READ MORE |

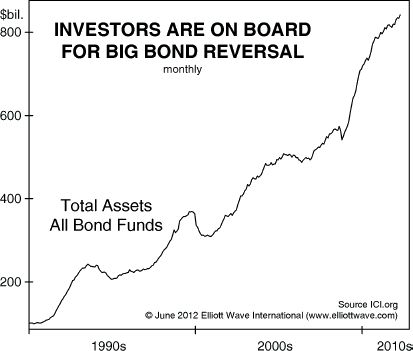

The Bond Market Bubble is About to Pop

| Why risk in the rebalanced portfolio is getting bigger Surprisingly, after the great stock market run of 1980s and 1990s, a decade of ups and downs in stocks left bonds ahead. Yes, bonds have outperformed stocks for the last 30 years. But how long can the bond miracle last? Bonds are deemed to be stable READ MORE |

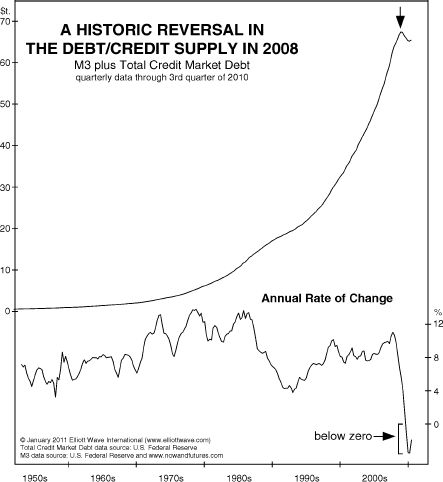

How Does Money Disappear?

| In 2008, after a day of major crash George Bush went on TV and said a trillion dollars of wealth has just disappeared. Is that really true? Is it really the case that people had a combined trillion dollars that just evaporated when the market crashed? How Does Money Disappear? The bursting of the “debt READ MORE |

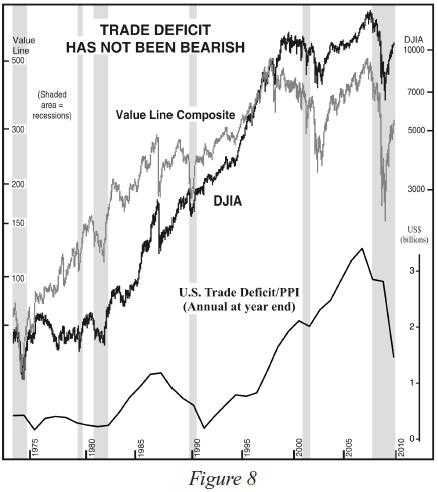

Is Lower Trade Deficit Bullish for the Market

| US trade deficit is lower for the past year and the government is trying hard to further lower it. Deficit cannot be maintained forever so we have to do something about it and the government is motivated. It makes sense to have a balanced trade for the overall economy. But is that something to celebrate READ MORE |

Does Deflation Remain a Threat?

| A 90-Page “Deflation Survival Guide” Gives the Answer “Every excess causes a defect; every defect an excess. Every sweet hath its sour…The waves of the sea do not more speedily seek a level from their loftiest tossing, than the varieties of condition tend to equalize themselves.” This quote comes from Ralph Waldo Emerson’s essay, “Compensation.” READ MORE |

Money, Credit and the Federal Reserve Bank

| Money, Credit and the Federal Reserve Bank The world’s foremost Elliott wave expert Robert Prechter goes “behind the scenes” on the Federal Reserve The ongoing economic problems have made the central bank’s decisions — interest rates, quantitative easing, monetary stimulus, etc. — a permanent fixture on six-o’clock news. Yet many of us don’t truly understand READ MORE |

Does Diversification Work?

| Why Diversification Does Not Work in Today’s Market Prechter and Kendall’s “All the Same Market” Analysis Shows how Diversification Can’t Protect You from Correlated Risk A dear friend of mine wants to celebrate an important health milestone by going skydiving with friends. She feels happy and healthy and excited. She wants to do something very READ MORE |

Investors Jump Into The Fire – Junk Bonds

| I spent my childhood discussing the stock market at the dinner table. My dad was a stock broker, and he loved to “tell the story” of the stocks he recommended to the customers – a story that included critical information about macro economics, the industry, the products, earnings, and the outlook for the future. Most READ MORE |

Using Elliott Wave Analysis for Forex

| Analyzing Forex with Elliott Wave Can Help You Catch Rallies and Declines Free Week of Elliott Wave International’s Currency Specialty Service is here until Nov. 18, 2010 On November 1, the EUR/USD — the euro-dollar exchange rate and the most actively-traded forex pair — was trading the $1.38 range, near the level it is today. READ MORE |

Signs of Deflation

| Signs Of Deflation By Elliott Wave International As the biggest credit bubble in history continues to shrink, consumer prices have stayed flat over the past several months, meaning there is no sign of inflation to come, despite growing commitments from the U.S. government. So what’s keeping inflation at bay, given all the stimulus money promised? READ MORE |

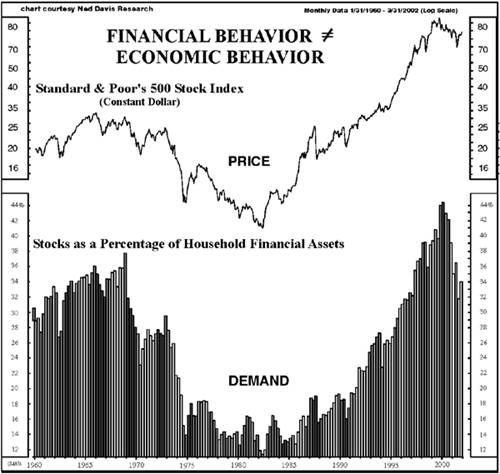

Efficient Market Hypothesis

| Efficient Market Hypothesis: Is the Market Efficient at all? In finance, the efficient-market hypothesis (EMH) asserts that financial markets are “informationally efficient”. That is, one cannot consistently achieve returns in excess of average market returns on a risk-adjusted basis, given the information publicly available at the time the investment is made. The validity of the READ MORE |